Warren Buffett is someone who's really good at investing, and he thinks that regular people like us shouldn't pick which stocks to buy on our own. That's because it's really hard to do and we might make mistakes.

If you want to invest in the stock market but don't know much about it, don't worry. Some investors invented "mutual funds" and "Exchange-Traded Funds (ETFs)" to help you save and increase your money. These things are like big savings jars that many people can put their money into. The experts who know a lot about investing use that money to buy different things like stocks, bonds, and other things that can help your money grow.

These funds let us invest in lots of different stocks all at once, so we don't have to worry about picking the right ones. This is safer and can help us make more money compared to trying to do it all by ourselves.

Mutual funds are like a team where many people put their money together. The team has professional managers who decide where to invest the money in things like stocks, bonds, and other investments. If the investments do well, the team members make more money. But if the investments don't do well, they might lose some money.

Mutual funds are classified into several types. Some invest mostly in stocks, some in bonds, and some in safer things like T-Bills. There are also "target-date" funds that change their investments depending on how close someone is to retiring.

Mutual funds can be managed in different ways. Some managers try to beat the market by picking investments that they think will do better than others. Other managers just try to match the performance of an index like the S&P 500.

ETFs are like a basket of different things you can invest in, like stocks, bonds, and gold. Some people choose the investments in the basket, while others just follow what's already there.

The cool thing about ETFs is that you can buy and sell them during the day, but, you have to pay a small fee to the people who manage and advertise the ETF. This helps them keep everything running smoothly.

Just remember that some ETFs have higher fees because fancy experts choose the investments. So, you need to pick the right one for you.

Trading

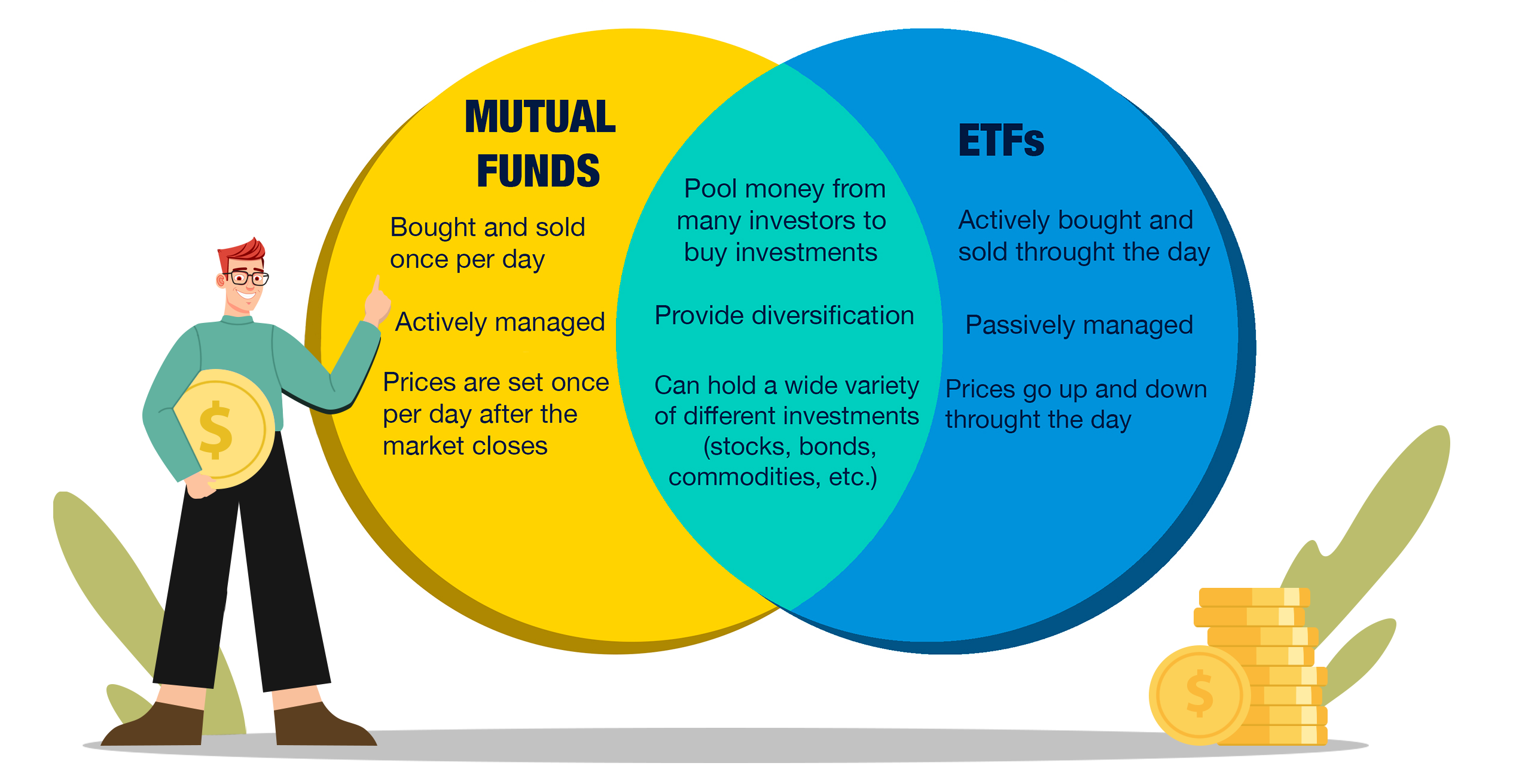

Investing your money can be done in two ways: mutual funds and ETFs. They help you invest in different things like stocks or bonds. Someone can manage these investments by picking which ones to buy and sell or following how groups of investments are doing.

The main difference between mutual funds and ETFs is how they are bought and sold. Mutual funds can only be bought or sold once a day, while ETFs can be bought or sold at any time during the day, just like stocks. This makes ETFs a good choice for new investors who want to make changes quickly.

Fees

When you invest in a mutual fund or ETF, you have to pay a little bit of money to help the people who manage the fund. This money is called an expense ratio, and it's like a fee. It's usually a small part of the money you put in. For example, if you put in $100, you might pay 10 cents for the expense ratio.

ETFs used to be cheaper than mutual funds because they didn't need as much work to manage. But some newer ETFs are now managed by experts who pick and choose which things to invest in. This can make the fees higher. So now, ETFs and mutual funds cost about the same amount.

Minimum investment

Mutual funds are like a team of people who want to buy things together. But sometimes, you need a lot of money to join the team. That can be as much as $5,000! This makes it hard for people who don't have that much money to join. But there's another way to buy things together called ETFs. With ETFs, you don't need to have a lot of money to join the team. You just need to buy at least one thing.

However, some mutual fund teams changed their rules recently. Now, people can join without having to bring any money at all.

Tax efficiency

Mutual funds and ETFs are two different ways to put your money together with other people. Sometimes, at the end of the year, the people in charge of mutual funds have to give some of the money they made to the people who put their money in the fund.

But the problem is that even if you didn't take any of your money out of the fund, the government might take some of the money you got as taxes. This can be frustrating.

With ETFs, though, you don't have to worry about the government taking your extra money as long as you keep your money in the fund. So ETFs are a better way to keep more of your money.

Investing in individual stocks can be challenging, and Warren Buffett advises against it for regular investors. Mutual funds and ETFs provide a solution by pooling money from multiple investors and employing expert managers to invest in various assets. Mutual funds are like teams with professional managers making investment decisions, while ETFs are baskets of investments that can be bought and sold throughout the day. Both have expense ratios and while ETFs used to be cheaper, some now have higher fees. Mutual funds often require a significant minimum investment, but some have eliminated this requirement. ETFs offer potential tax advantages compared to mutual funds. Understanding these key points helps investors make informed decisions about mutual funds and ETFs.

You will receive the information that help to do investments.

Note: Check the spam folder if you don't receive an email.