Investing is the act of lending your money to a company so that it can improve its business and earn you a return. Companies look to borrow money when they are starting off or looking to expand.

How do companies go about raising funds and how do investors get their money back?

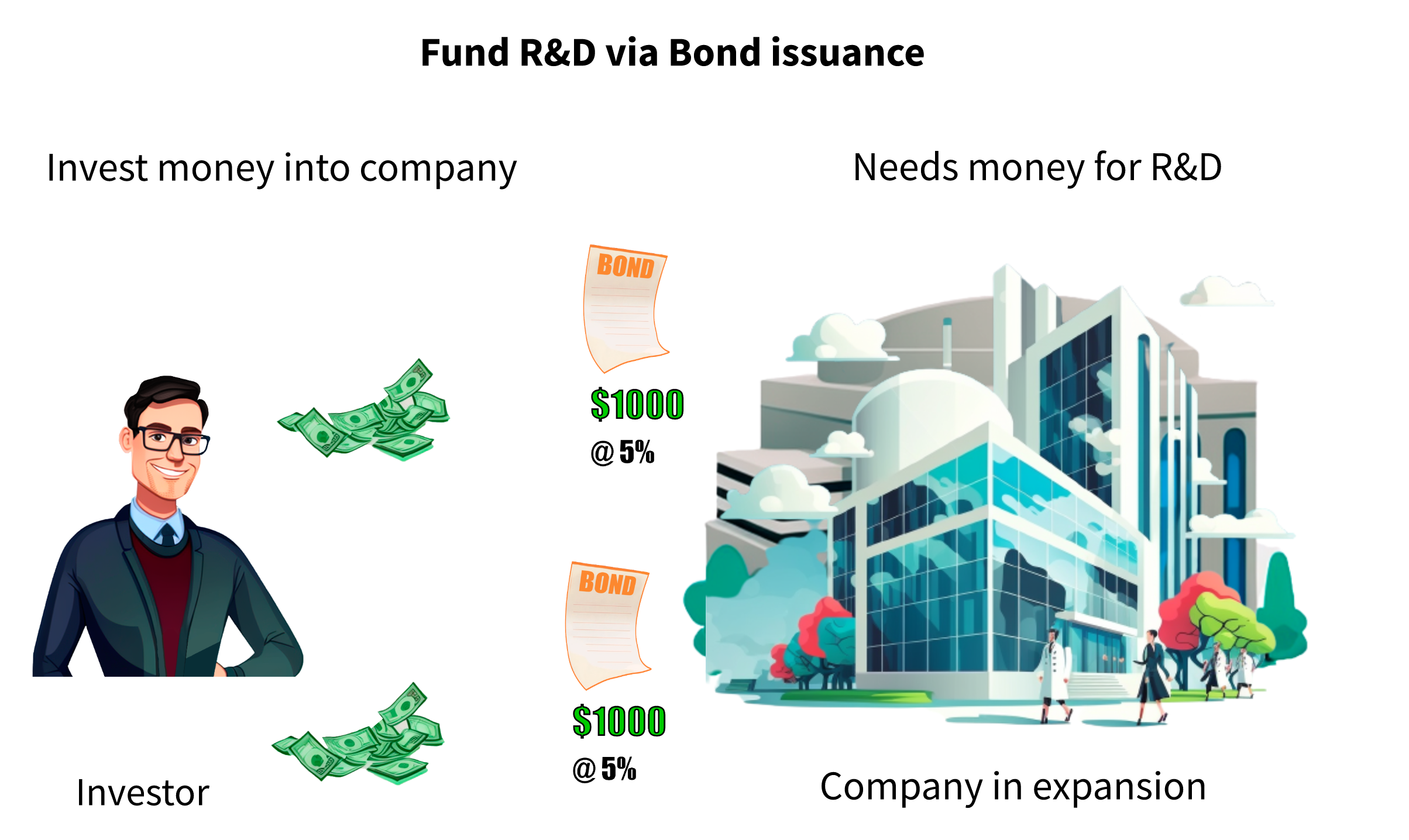

Some people may believe that large companies such as Microsoft and Apple have enough money to do as they please. However, the truth is that they often need extra funding. Maybe they want to start some research and development or pursue a new venture. The cost of such activities is pretty high, so companies look to borrow money from investors.

Borrowing it through Debt

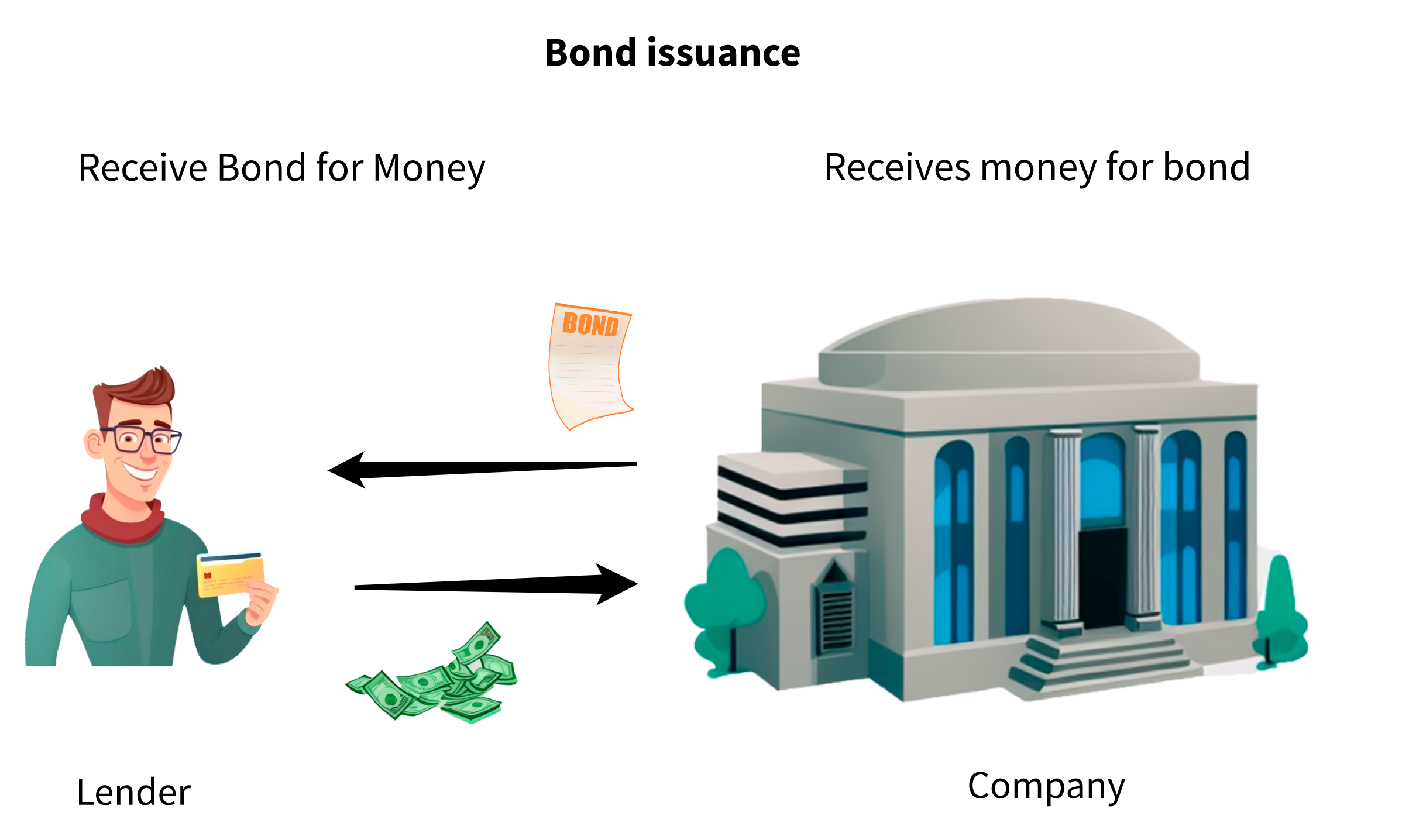

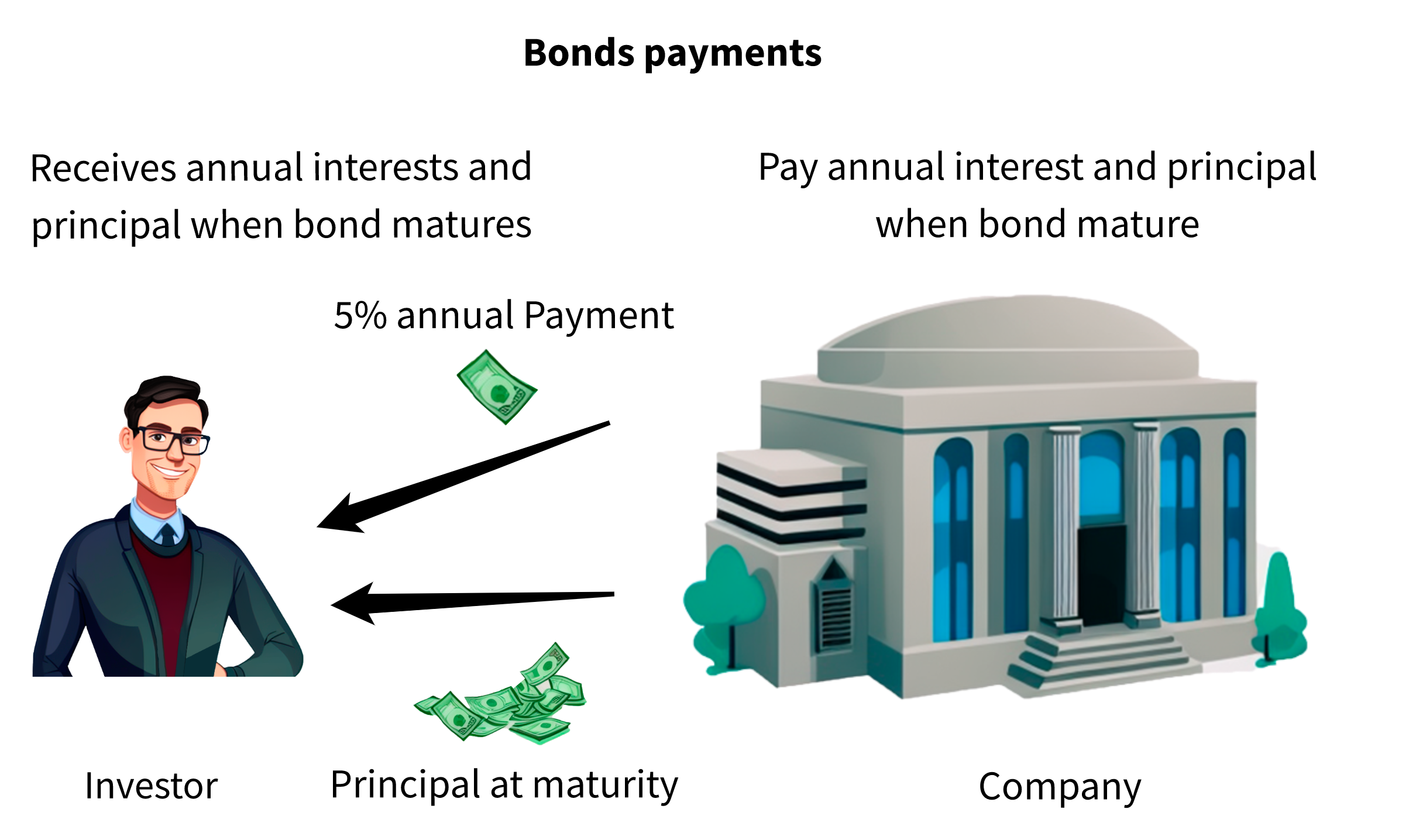

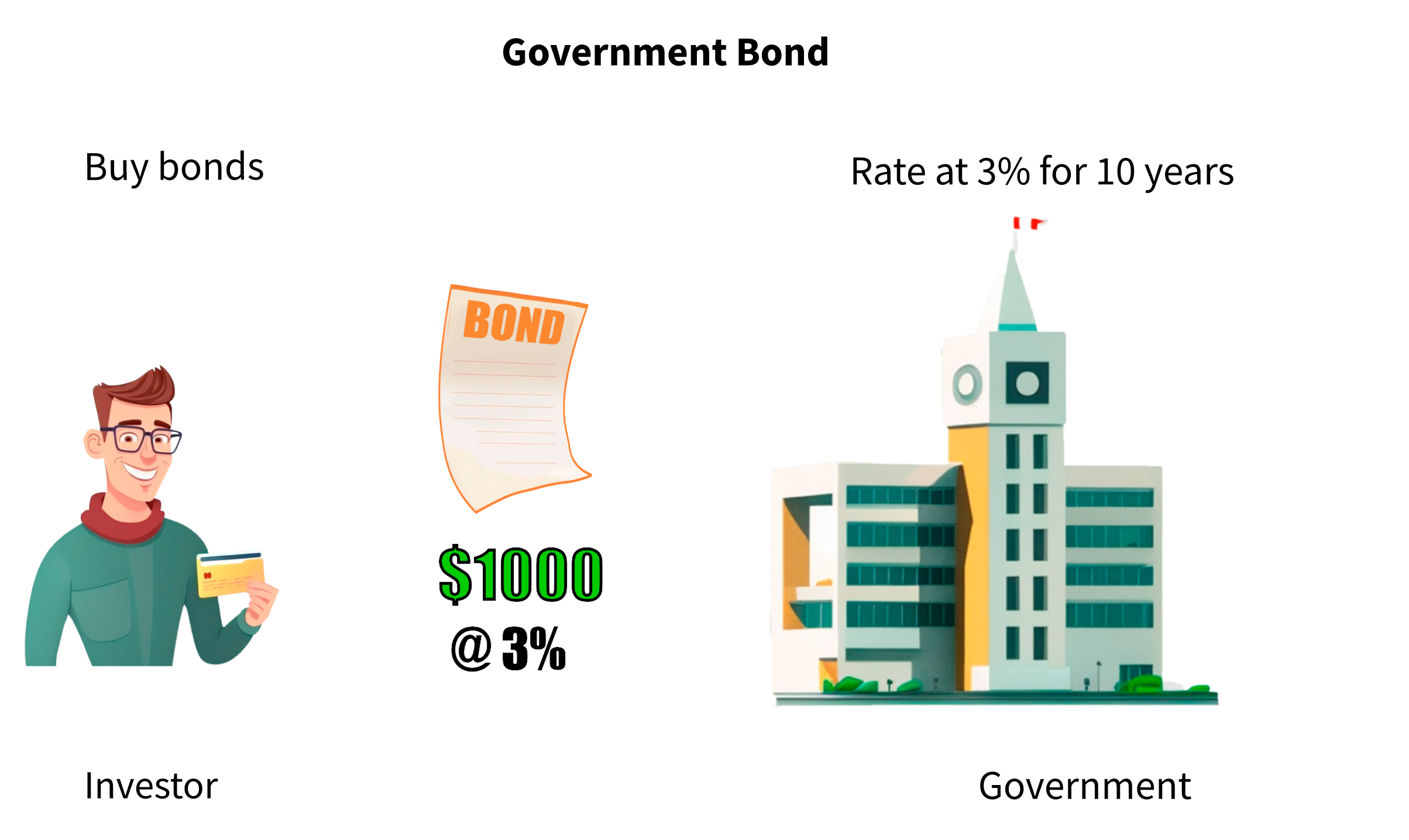

Companies accumulate debt through the sale of bonds, which are agreements between the loaning party, and the company. The company sells you the bond and agrees to pay you an interest rate (a percentage of the principal amount) on a regular basis until the bond matures.

When bond mature you get your principal paid back your principal in full

This means that when the bond matures, the principal amount is due to be paid back, and bonds are typically long-term investments.

They can be outstanding for upwards of 30 years, though they do come in a variety of time lengths now. Before you get too excited about your newfound ability to have large corporations indebted to you, you should note that you won't be getting the 20% interest rate that your credit card balance is currently charging you. A safe investment in bonds is more likely to earn you a return below 5%. It probably seems like a ripoff, but it actually makes sense when you think about it. The interest rate that you're charged is a function of your ability to pay back the debt once it's due.

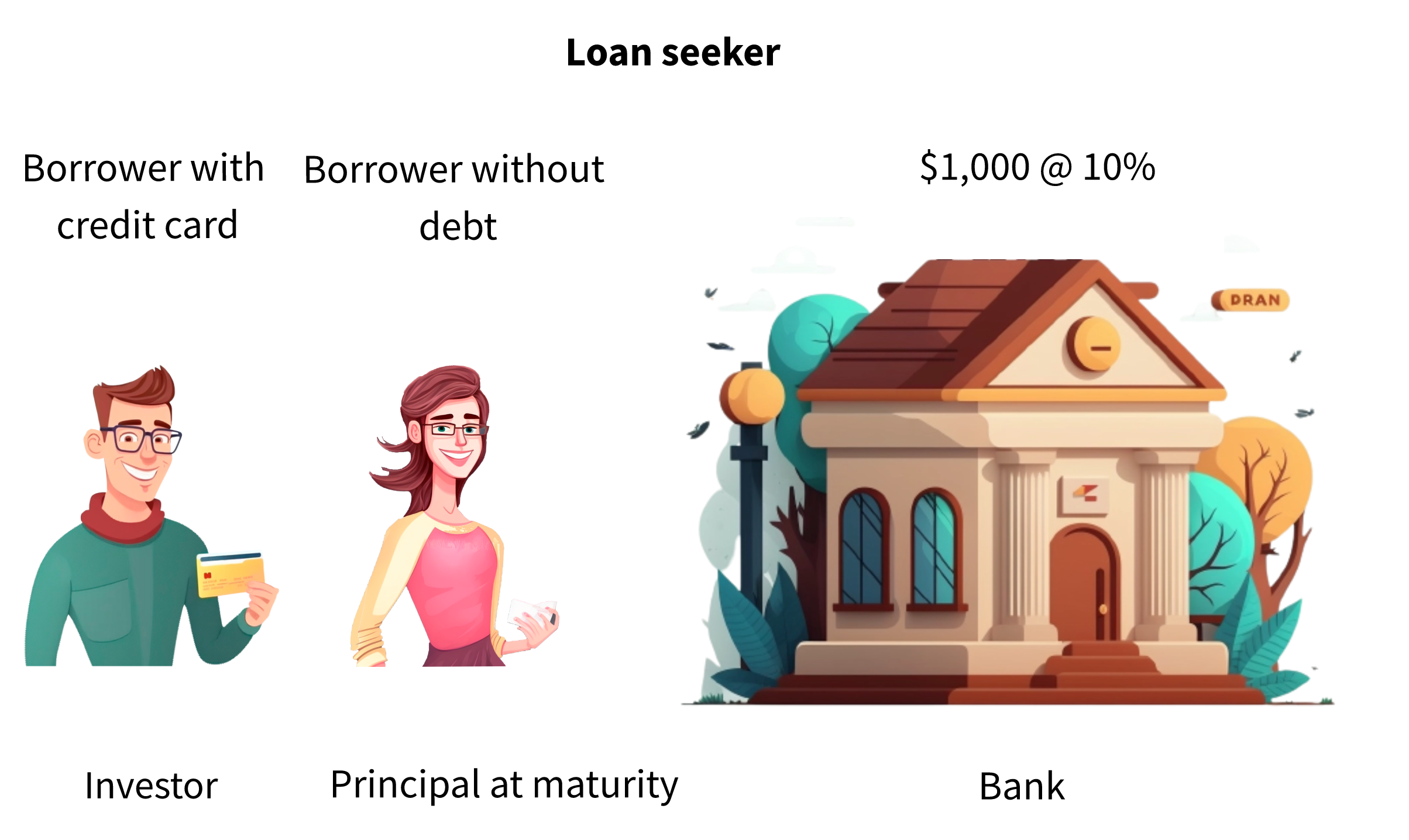

Imagine two people who want to take out a $1,000 loan with a 10 percent interest rate from their local bank, and their financial situations are identical except that one of the individuals currently has a credit card balance outstanding that they need to pay off.

If the bank could only choose one of the people to lend the money to, they would likely choose the person without a credit card balance because they are more capable of paying back the money once it's due.

If the individual with a credit card balance wanted to motivate the bank to give them the loan instead, they would have to offer to pay a higher interest rate to compensate the bank for the risk they pose.

This illustrates the basic risk-return connection

The return on investment should be larger the bigger the risk it entails for the investor. As such, when it comes to bonds, companies are often viewed as posing less default risk than individuals. This allows them, along with other factors, to borrow at a lower interest rate. Despite this, bonds are a pretty popular investment because the borrowing company is legally obligated to always pay its debts. If they don't, they could face legal action and bankruptcy.

It is critical to understand that not all bonds are created equal. When a bond is sold, it's given a seniority ranking. In the event that a company does go bankrupt, the more senior bonds are able to recover their losses first, before the less senior bonds can try and regain any lost value to compensate for this.

In addition to seniority, less senior bonds are paid a higher interest rate, and the risk-return characteristic of a bond is influenced by the issuing organization. Government bonds are indeed the least risky bonds available. They are bonds sold to fund government activities and these bonds are thought to be virtually risk-free and pay low-interest rates. In theory, the government could simply charge its citizens more taxes to make up the difference if it was unable to make its debt payments.

Corporate Bonds

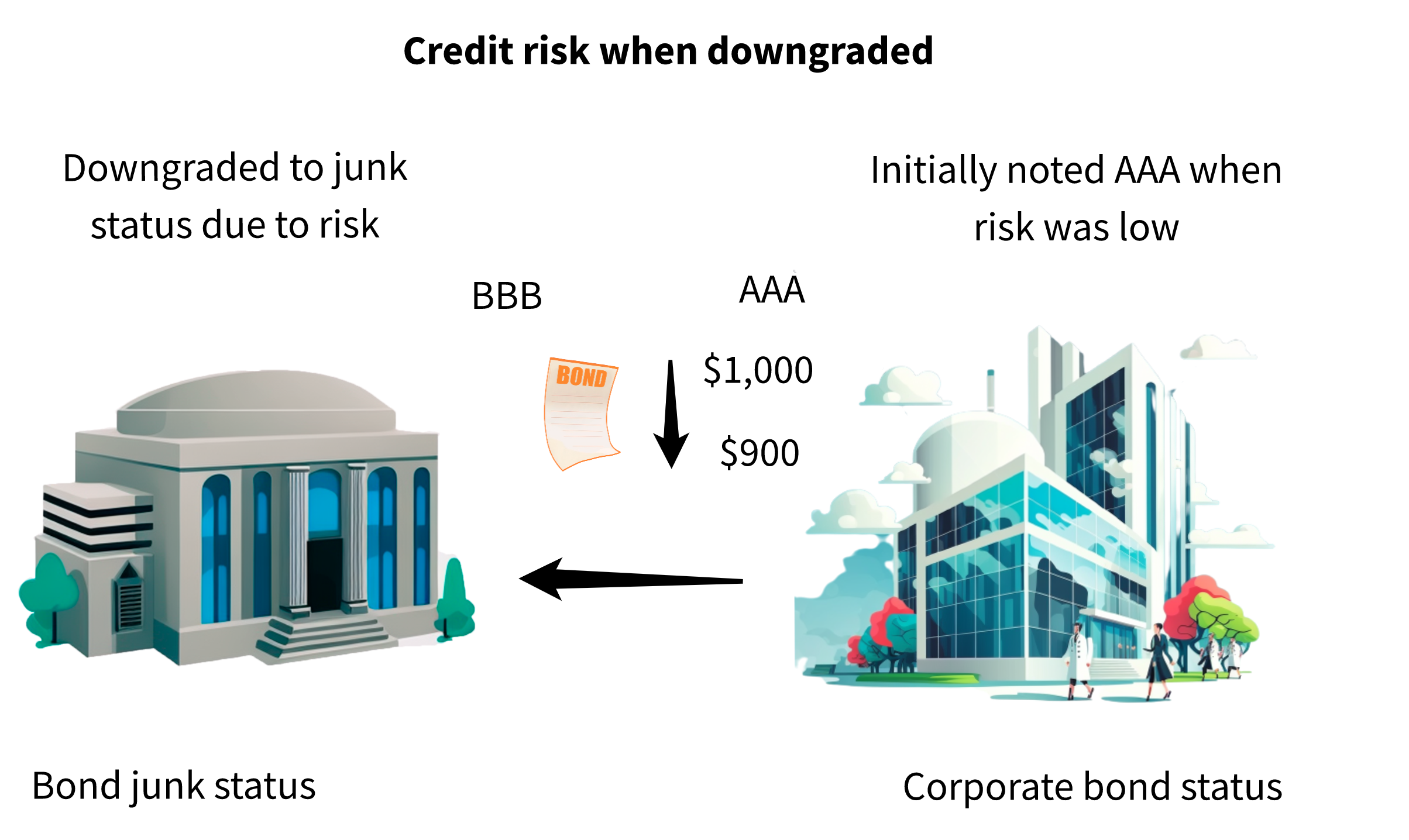

These are bonds that belong to relatively large or stable companies and are considered safe. Even the largest of institutions face the risk of defaulting on their debt, and they have to pay a higher interest rate than government bonds.

The politically correct title for the third category is "high-yield bonds". They're commonly referred to as “junk bonds” because that's essentially what they are. These are bonds that belong to new or unstable companies that have a high risk of defaulting on their debt, so they need to pay their investors a higher interest rate. People who buy these types of bonds are essentially gambling on whether the company will last long enough to pay back the debt. There's a high probability of losing money, but not if you choose the right companies.

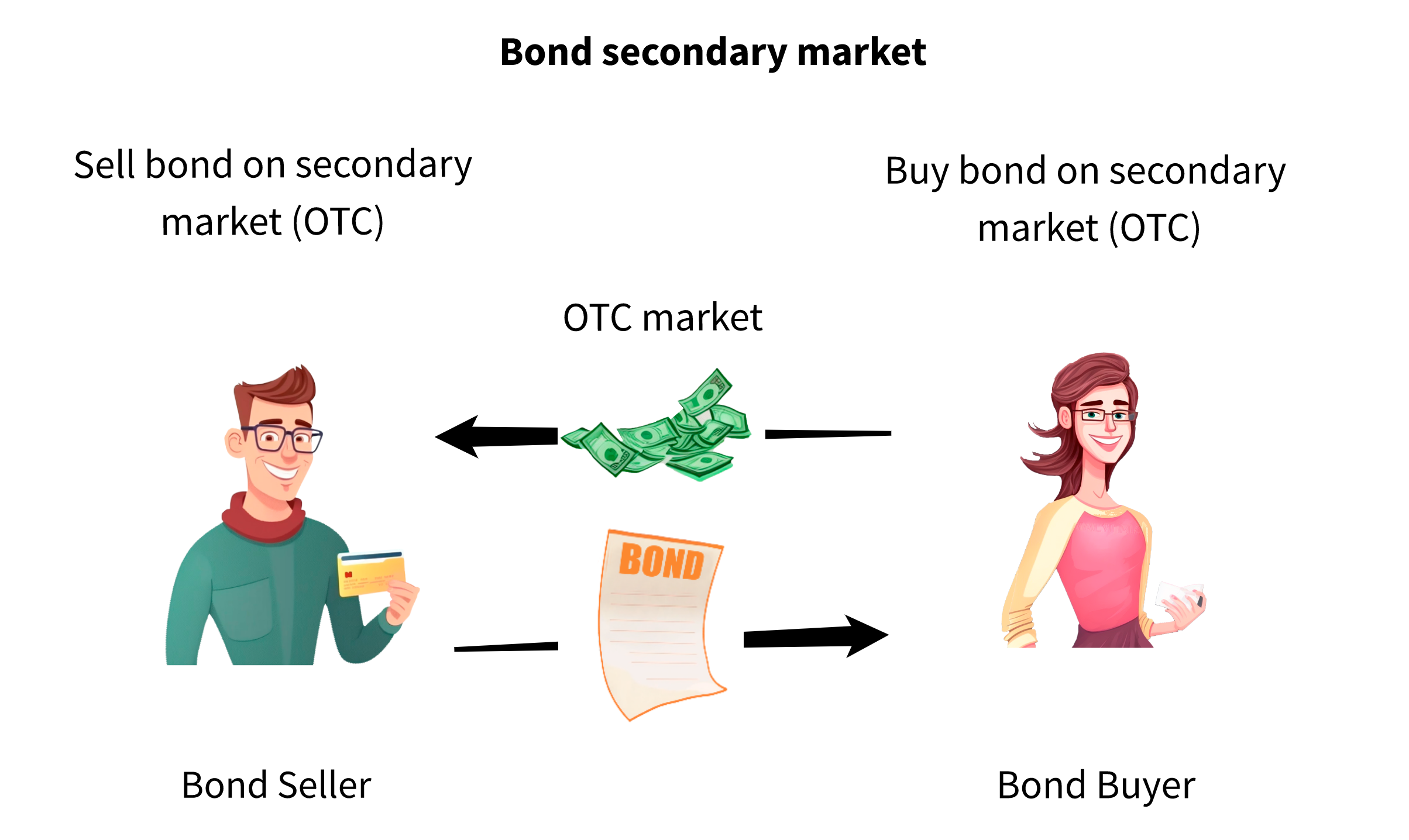

Now we know what types of bonds exist out there and how you can actually make money off of them. Aside from making an interest payment on a regular basis, bonds actually offer a second source of return. If you, as an investor, wanted to get out of your debt agreement with the company, you could actually sell your bond to a secondary investor. The investor would pay you for the bond and then receive your future interest payments in your place.

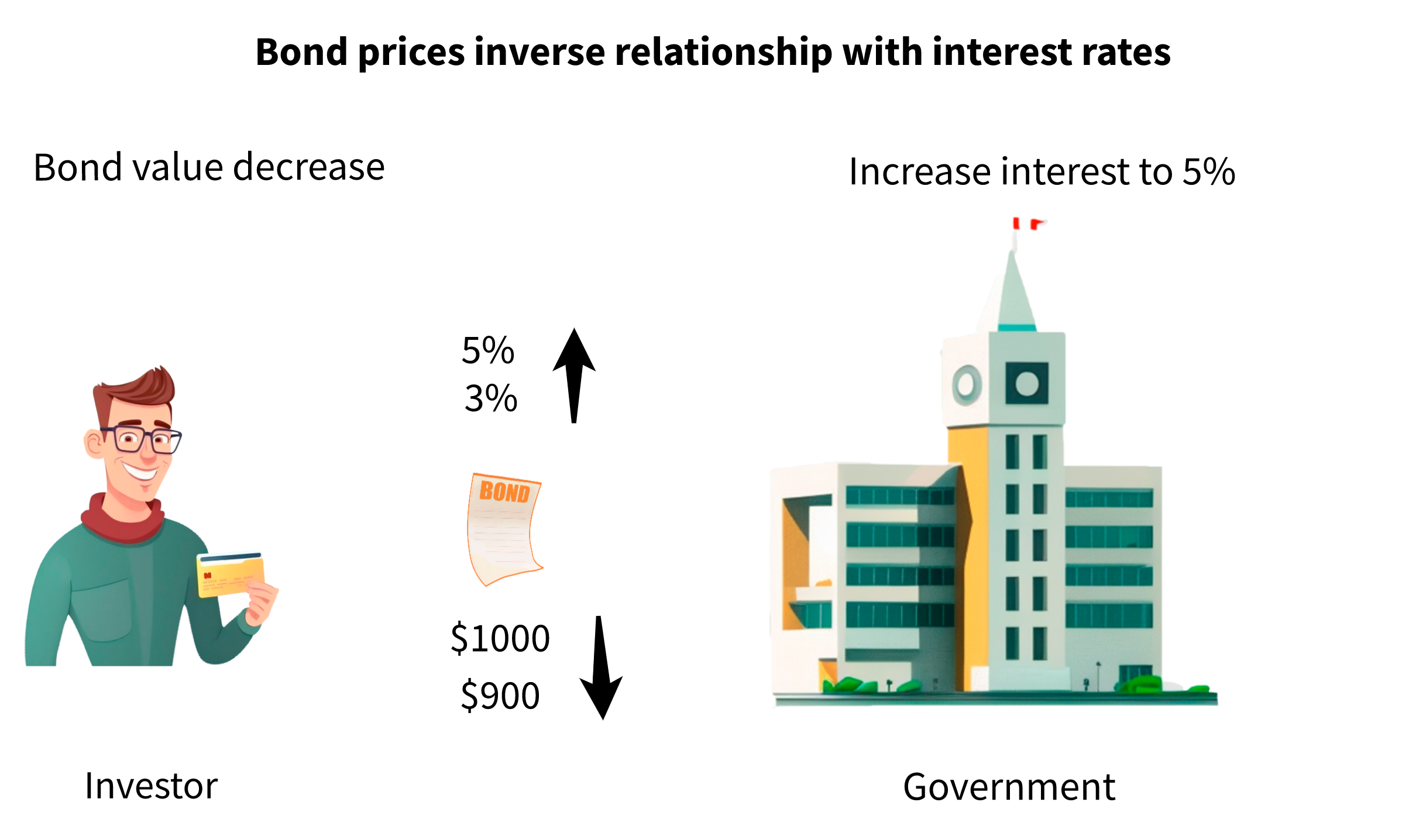

The interesting thing, however, is the market value of the bond. This means that the price at which you could sell it actually changes over time. If factors move in your favor, you could sell the bond that you purchase for $1000 for even more money down the road. This is because the value of a bond actually has a negative relationship with the interest rates being paid by other companies in the market.

Let's say that you buy a government bond for $1,000 that pays 3% once a year.

A month later, the government decides to pay a higher interest rate of 5% on all future bonds based on a variety of factors.

This would decrease the market value of your bond for the same $1000 used to purchase your 3% bond. You could have purchased a 5% bond if you bought it today.

This means that you'd have to offer it at a discounted price if you ever wanted to resell your bond to someone, given that your bond is less attractive than the 5% bond. The flip side is also true. If you buy a bond and interest rates go down, your bond will become more valuable because it now offers a higher-than-normal interest rate. You could get more money than you paid for the bond if you sell it, and the value of the bond could go up or down depending on the risk of the debt not being paid.

For example, if a bond is upgraded from junk status to corporate bond status, it will likely appreciate the market value. However, it only matters if you trade your bond before its maturity. If you don't need to consult early or aren't interested in chasing extra return, then you can simply hold on to your bond and receive the initially borrowed amount from the company at maturity. It is really important to know more about bonds and how you can use them to improve your wealth.

Key Takeaways:

1. Companies obtain funds from investors by issuing bonds and entering into contracts with the lender.

2. Bonds are usually held for an extended period of time, and the rate of interest is based on the borrower's capacity to pay back the loan.

3. Not all bonds are created equal and they are given a seniority ranking in the event of a company going bankrupt.

4. Government bonds are considered the least risky and pay low-interest rates.

5. Corporate bonds are considered safe but have a higher risk of defaulting on their debt and paying a higher interest rate than government bonds.

6. High-yield bonds are those issued by young or insecure businesses that face a high chance of going bankrupt.

7. The interest rates that other corporations in the market are paying can affect how much a bond is worth over time.