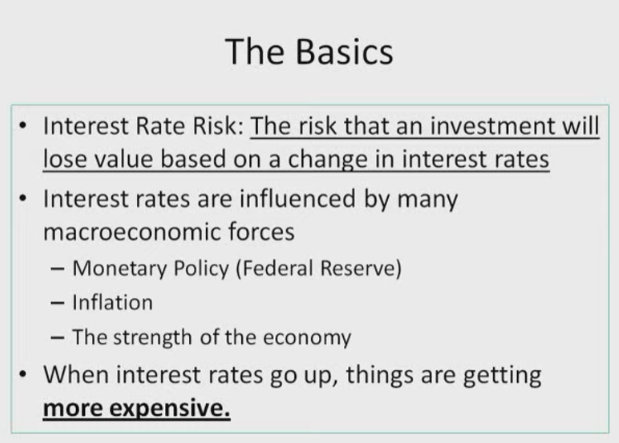

What exactly is interest rate risk?

It's not a very intuitive concept, but basically, the idea is interest rate risk is the risk that an investment will lose value based on a change in interest rates. Interest rates are influenced by a number of macroeconomic forces, like Monetary Policy. When you hear about the Federal Reserve setting interest rates, that is certainly an important input. Inflation is also quite relevant. Interest rates typically increase as items get more and more expensive. The strength of the economy also is a factor. As the economy gets stronger, more and more people want to borrow money to invest and debt gets more expensive, so interest rates also increase along with it.

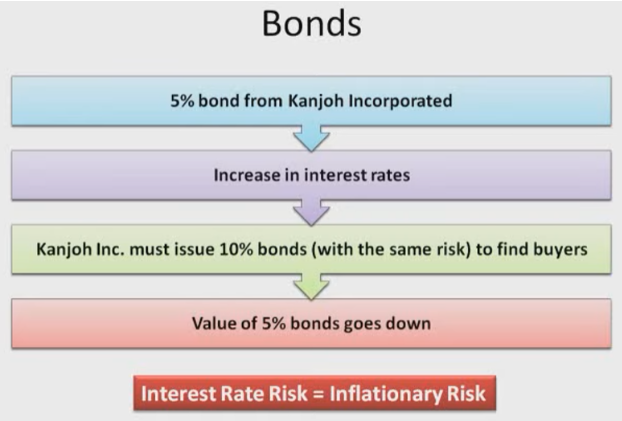

Let's now understand how interest rates can affect the price of a specific security. The example we're going to use bonds.

Let's take a trip to the land of Kim Julia where Kanjoh Incorporated issues 5% bonds. Now, all of a sudden Kim Julia starts to grow as an economy, and things are getting more and more expensive. Businesses are prospering and interest rates start to rise. These businesses all want to borrow more money because everything is getting bigger and bigger and things are growing really fast. So Kanjoh Incorporated wants to jump in on this. They want to make a number of different acquisitions and start a new set of product developments, but they don't have enough cash on hand, so they need to issue new bonds in order to finance this growth.

Remember that with the exact same risk, it's still the same company. In order to find buyers, no one will buy the 5% bonds anymore because there are plenty of other good investment opportunities out there, so the cost of capital for Kanjoh Incorporated increases; they must issue bonds with a higher interest rate.

So what does this mean?

This means that the value of the existing 5% bonds goes down. Think about it: if I'm an investor and I can buy 10% Kanjoh Incorporated bonds with the exact same risk, why would I pay the same amount of money for 5% bonds? I'd much rather buy the 10% bonds. So the people who own the 5% bonds, if they want to sell them, they have to sell them at a lower value, and this means that their price goes down.

Basically, the idea here is that as interest rates go up, the cost of goods and services also goes up as well, and that can certainly affect the value and price of different investments.

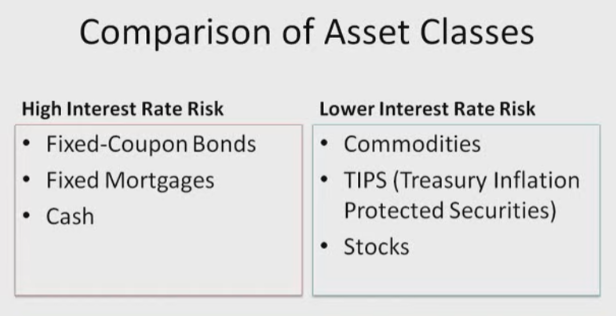

Let's now try to understand a comparison of asset classes.

What are some of the assets that have a high-interest rate risk and what are some asset classes that are a little bit more protected?

As mentioned in the previous example, Fixed Coupon Bonds (bonds that have a specific interest rate throughout their entire maturity) tend to have a pretty high-interest rate risk. A very similar example is fixed mortgages. If I have bought up a mortgage that is paying a fixed coupon rate over a number of years and interest rates start going up, that mortgage is going to be worth less. Probably the single riskiest investment with regard to interest rate risk is actually cash. This is very counterintuitive because a lot of people think cash is really safe, but it's not.

Think about it: if interest rates start going up if inflation starts going up, my cash - the power of my individual dollar - goes down. I might have the same number of dollars, but those dollars won't buy as much.

Let's now move on to some of the securities that are a little bit more protected from interest rate risk. One example of this is commodities. Commodities tend to be very well hedged against inflation because as goods and services tend to get more expensive, commodities (gold, different types of food like wheat and orange juice) also tend to get more expensive as well. So commodities tend to go up in value when interest rates are going up.

Another example of something that's relatively protected against interest rates is TIPS (Treasury Inflation-Protected Securities). The basic idea is that these are Treasury securities issued by the US government that are indexed for inflation. So if inflation tends to be higher and interest rates are going up, these TIPS will pay a higher coupon rate. Now, if inflation is lower, they'll pay a lower coupon rate, as a result, you're a little bit protected from inflationary risk and interest rate risk. The amount of money that you receive every year varies based on the interest rates.

Finally, stocks are partially hedged against interest rate risk as well. They're not fully. There are some risks associated with inflation, so stocks are not the best example here. But if you think about it, buying stock is buying a stake in a company, and when things are getting more expensive, companies have to charge more money in order to reap higher profits. Things are growing, so stock values can possibly appreciate along with higher interest rates and higher inflation. But there are other factors in play here as well, so this is not a hundred percent correlation by any means.

The big takeaway here is that inflation and high interest rates erode purchasing power. The power of your individual dollars goes down when inflation and interest rates tend to go up. The central question is: What can my dollars buy? If you are receiving 5% a year, but those individual dollars are not worth as much, then that 5% really isn't as valuable, and that is what interest rate risk is all about.