Following the news these days you might get the idea that our national economic system isn't doing so well. Some of this general anxiety is natural considering the ongoing effects of the 2008 economic crisis. One topic that is gaining renewed interest is the idea of returning our monetary system to the so-called gold standard. At one time, most of the world's economies, the United States included, were based on a gold standard.

Gold Standard and how it differs from our current Monetary System

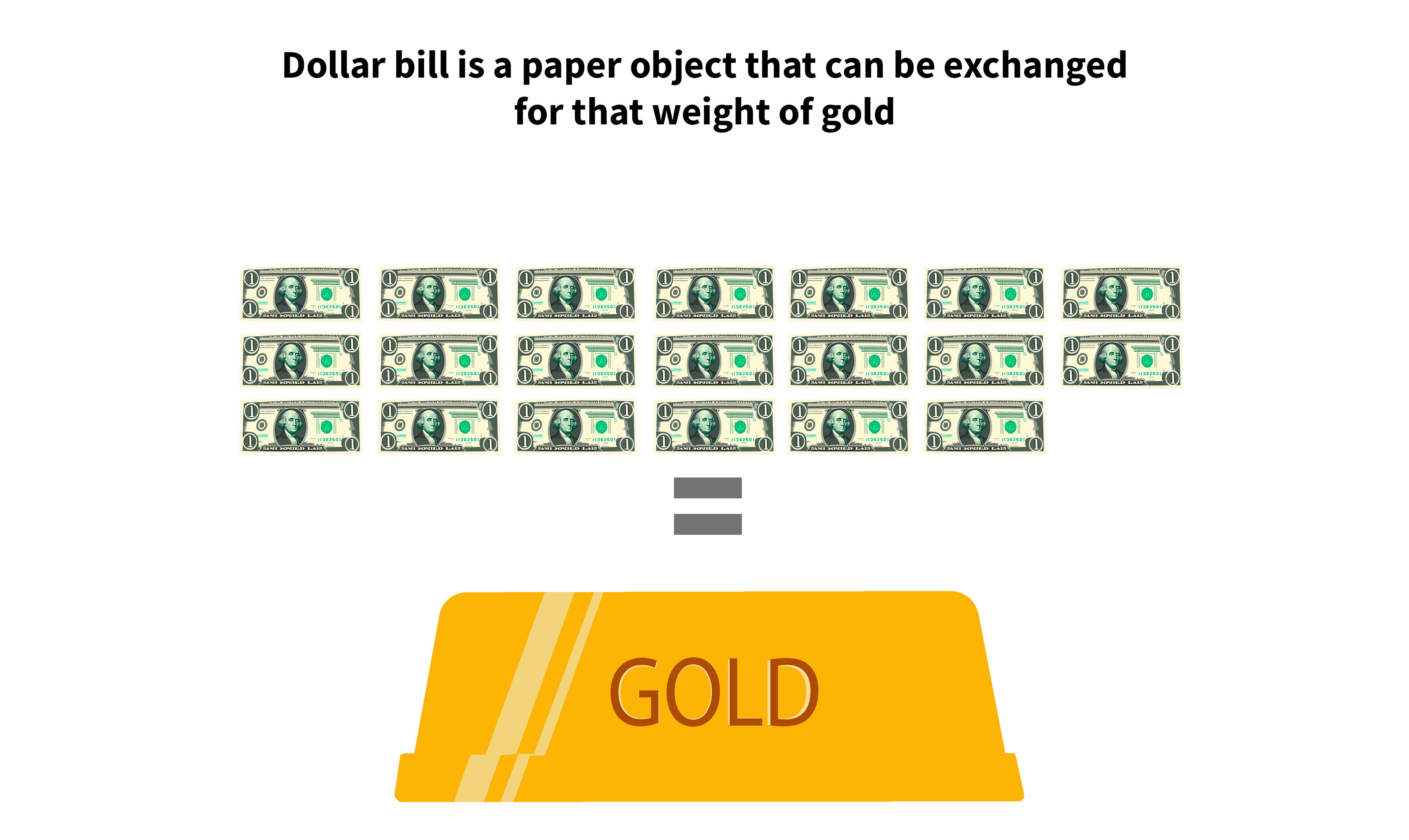

The government sets the value of its paper currency to a certain weight of gold under a gold standard, and a dollar bill is a paper object that can be exchanged for that weight of gold. For example, in the early twentieth century, a dollar was defined as one-twentieth of an ounce of gold in the United States. So a dollar it would take twenty dollar bills to purchase one ounce of gold.

In 1971, the United States dismissed the gold standard in favor of a 100% fiat money system. Today, there isn't a single country that backs its currency with gold.

What are the key differences between a Fiat system and a currency backed by gold?

Under a fiat money system, a dollar is just an accounting unit. A dollar bill is no longer made redeemable in gold or any other asset. However, paper money is stipulated as legal tender that is to say that people can legally pay their debts including taxes using paper money. So paper money circulates because it is convenient as a payment instrument and can be used to discharge a debt.

Key Takeaways:

1. Most of the world's economies, including the United States, once employed the gold standard.

2. The government sets the value of the paper currency to a specific weight of gold under a gold standard.

3. The United States abandoned the gold standard in 1971 in favor of a 100% fiat money system.

4. Under a fiat money system, a dollar is just an accounting unit, and paper money is stipulated as legal tender.