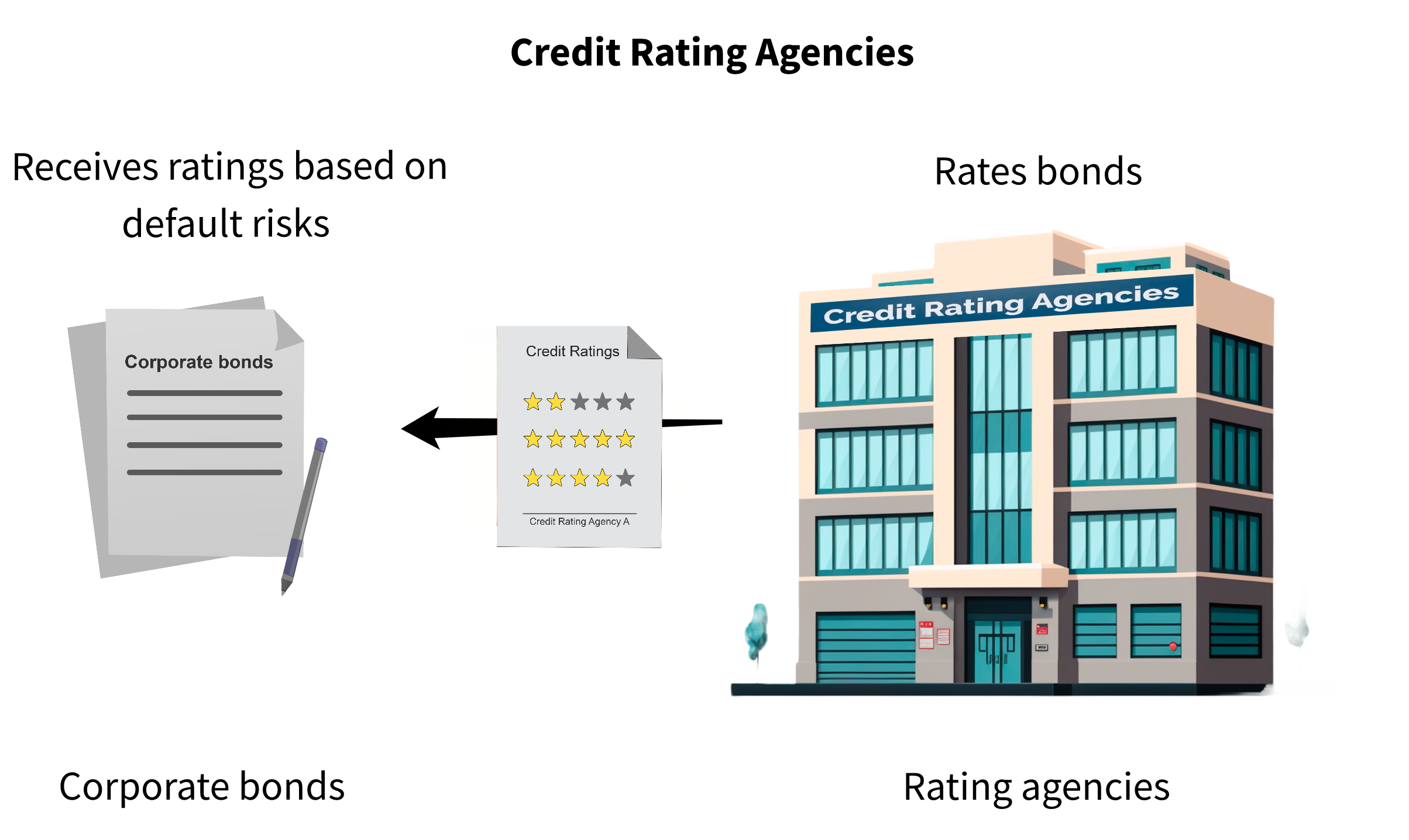

Credit Ratings inform retail and institutional investors about the ability of issuances of bonds and other debt instruments and fixed-income securities to meet their obligations.

In theory, these are fairly straightforward with credit rating agencies essentially having the role of providing objective information with respect to a wide range of debt instruments, from sovereign debt to corporate bonds.

As the name suggests, they issue credit ratings.

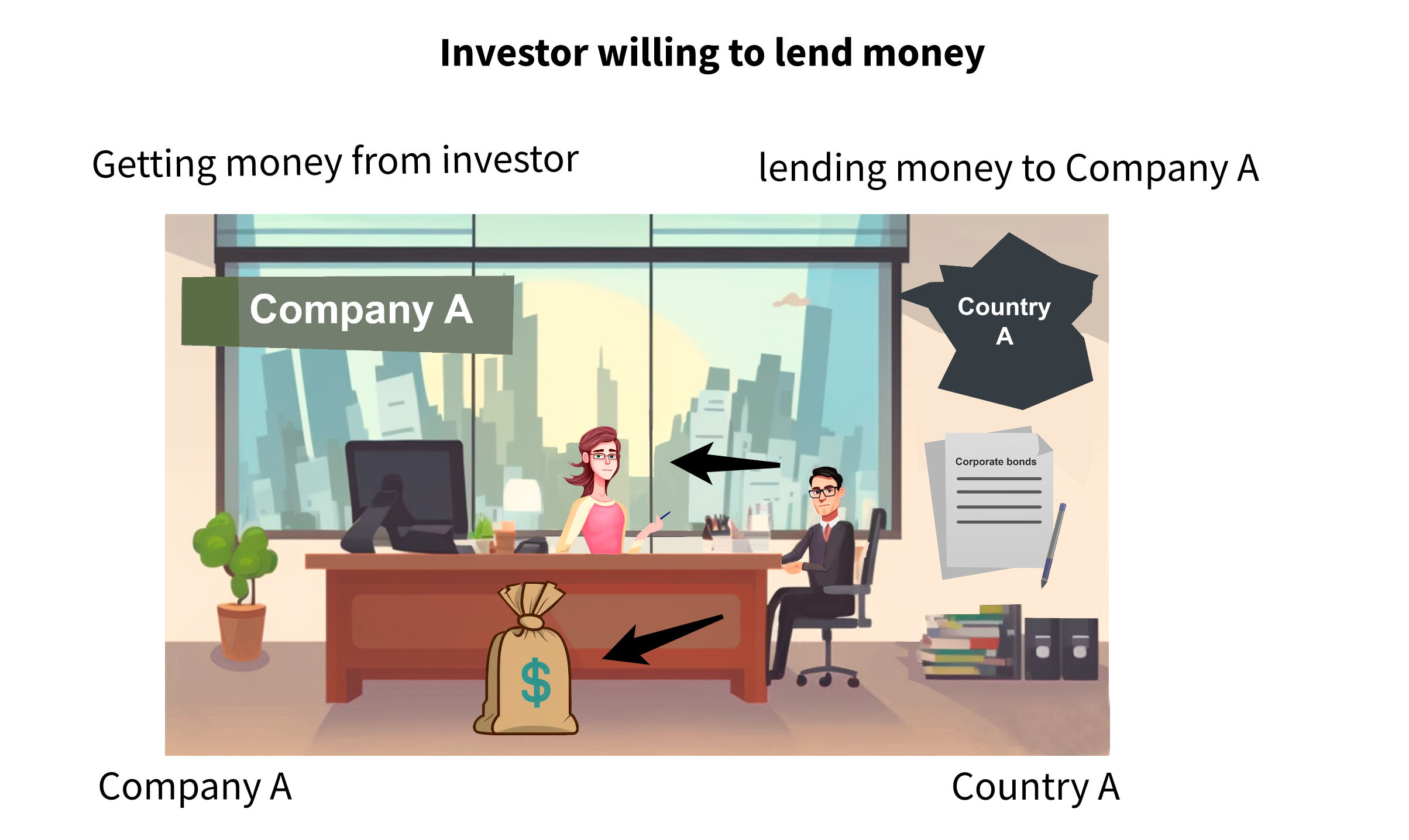

For example, Robert might be interested in lending money to Company A by purchasing bonds, with the company in question located in Country A.

To decide whether or not it is a good idea, he doesn't just analyze the company age rating, but he also takes the sovereign credit rating of Country A into consideration in an effort to figure out if the company plus jurisdiction duo makes sense.

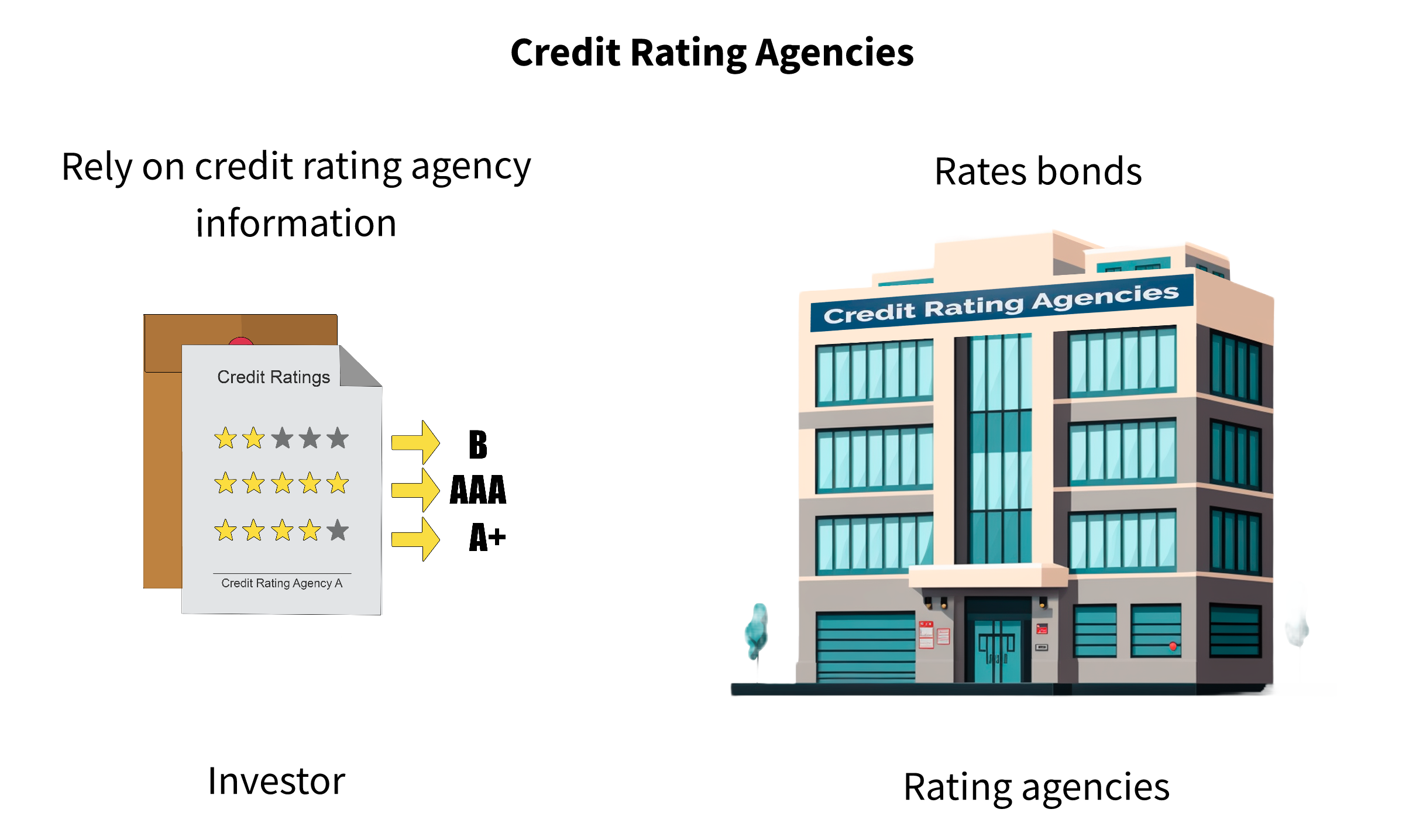

From individuals like Robert to large institutional investors, quite a few market participants rely on credit rating agency information.

As logical as all of this may sound, there are potential problems, such as:

- The fact that one of the so-called “Big Three” essentially controlled the credit rating space with a market share in the 95% zone for Standard & Poor's, or SNP Moody's, and Fitch.

- There have been examples of disastrous failure on behalf of credit rating agencies, such as the Great Recession. With them being recklessly over-optimistic by granting high ratings to the now infamous mortgage-backed securities despite red flags. Such as the real estate bubble, unfolding subprime loan risks, etc.

- There are disincentives associated with quote-unquote upsetting powerful nations by lowering credit ratings and various others, let's call them “Barriers to Objectivity”.

From the mercantile credit agencies of the 1800s to today's credit rating agencies, there has been a clear role in the ecosystem for these entities for quite a while. However. as always, limiting yourself to simply considering them yet another tool in your arsenal would be wise because blind trust tends to be detrimental to your net worth.

Key Takeaways:

1. Credit ratings inform retail and institutional investors about the ability of debt instruments to meet their obligations.

2. Credit rating agencies provide objective information about a wide range of debt instruments.

3. Individuals and large institutional investors rely on credit rating agency information.

4. The “Big Three” credit rating agencies have a large market share.

5. There have been examples of disastrous failure on behalf of credit rating agencies.

6. There are disincentives associated with upsetting powerful nations by lowering credit ratings.

7. Credit rating agencies should be considered as a tool, not blindly trusted.