Why does an increase in the fair value of marketable securities impact both the balance sheet and income statement of a company?

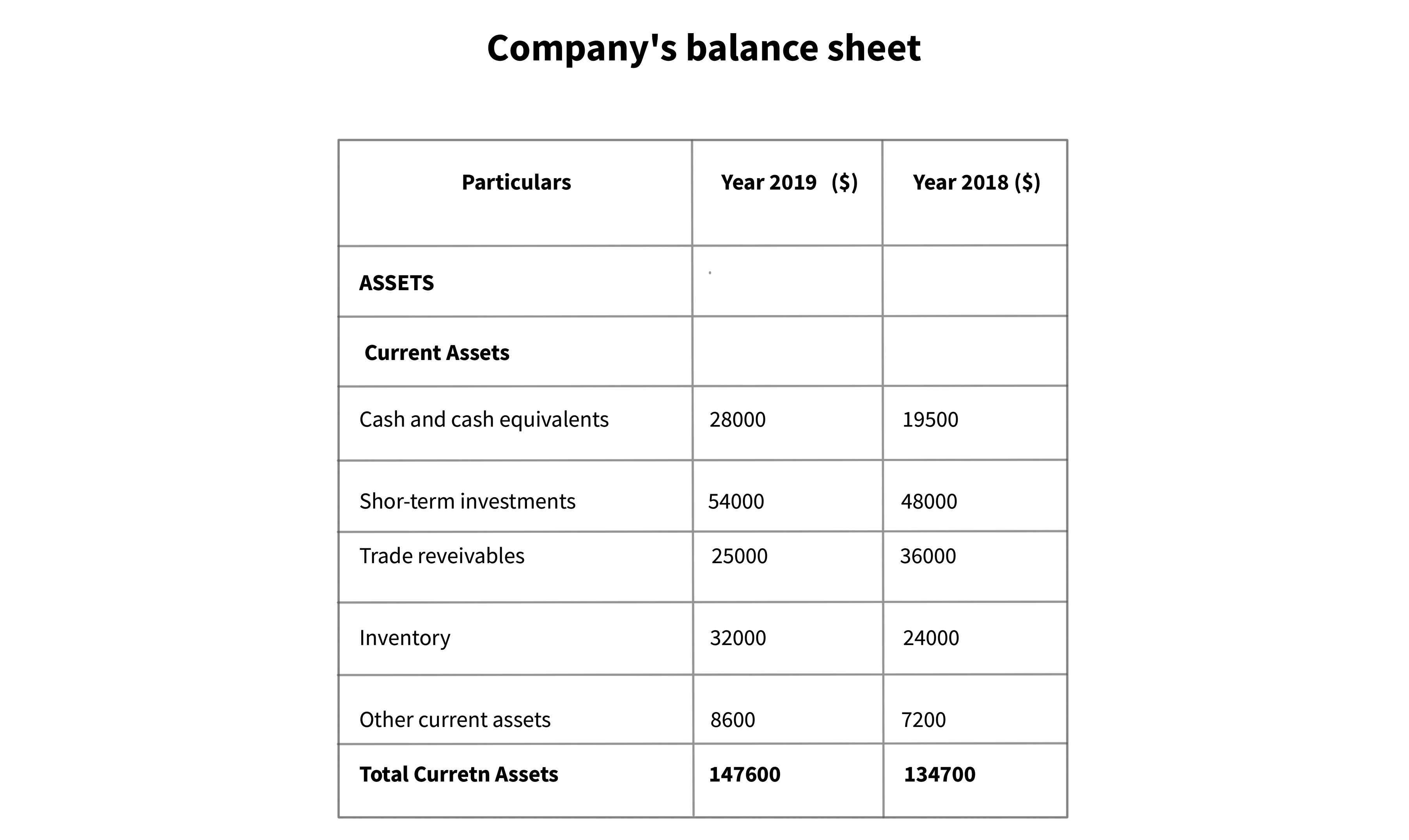

The fair value of marketable securities is reported as an asset on the balance sheet. An increase in the fair value of these securities would result in an increase in the asset's value, which would increase the company's total assets. This would lead to an increase in the shareholder's equity, as equity is the difference between the total assets and liabilities of the company.

An increase in the fair value of marketable securities results in a gain on the income statement, which is recognized as income. This income would be reported as part of the company's total revenues. As a result, the company's net income would rise, which would have an impact on the company's profitability.

Let's take a look at how marketable securities are represented on a company's balance sheet. The following is an excerpt from a corporation's balance sheet:

It's worth noting that an increase in the fair value of marketable securities may have tax consequences, which would be reflected in the income statement. This, however, would be subject to the specific tax laws and regulations in the relevant jurisdiction. Overall, an increase in the fair value of marketable securities has a positive impact on a company's financial position, as it leads to an increase in both assets and income.

PROS:

- It aids in maintaining a particular level of liquidity for a company, lowering the risk associated with liquidity.

- The entity's funds are organized into sources from which funds can be realized as and when needed by investing in marketable securities.

- Compared to cash equivalents, marketable securities offer superior returns. So, it is preferable for companies to invest a sufficient amount of their cash in marketable securities in order to increase the returns on their cash holdings.

- There are two types of liabilities for every entity: short-term and long-term. Marketable securities' quantity aids the firm in covering its immediate liabilities.

- A company can determine whether there is any gap between the maturity of its marketable securities and the due dates of its short-term liabilities and examine whether it can be closed with the injection of funds.

- Marketable securities can be used by analysts to compute various liquidity ratios to assess the company's financial health.

CONS:

- Even if marketable securities are kept, a business may nevertheless have a liquidity crisis because it becomes challenging to match assets and liabilities on a date-by-date basis. In order to combat this, organizations might retain reserves that can be used when an emergency occurs.

- If there is a legal necessity to keep a certain amount of money in marketable securities, that requirement may become unworkable for entities because they risk losing out on higher profits that they could have gotten from investing in other alternatives.

Key takeaways:

- If the fair value of marketable securities rose, the asset shown on the balance sheet would be worth more.

- The overall assets of the company would increase as a result of this increase in the fair value of marketable securities, which would ultimately increase shareholder equity.

- A gain would also be recorded as income on the income statement as an outcome of the increase in fair value.

- As a result of this income being included in the company's total reported revenues, the net income would rise, which would have an effect on the profitability of the business.

- The particular tax ramifications of the fair value increase would rely on the applicable jurisdiction's tax laws and regulations.