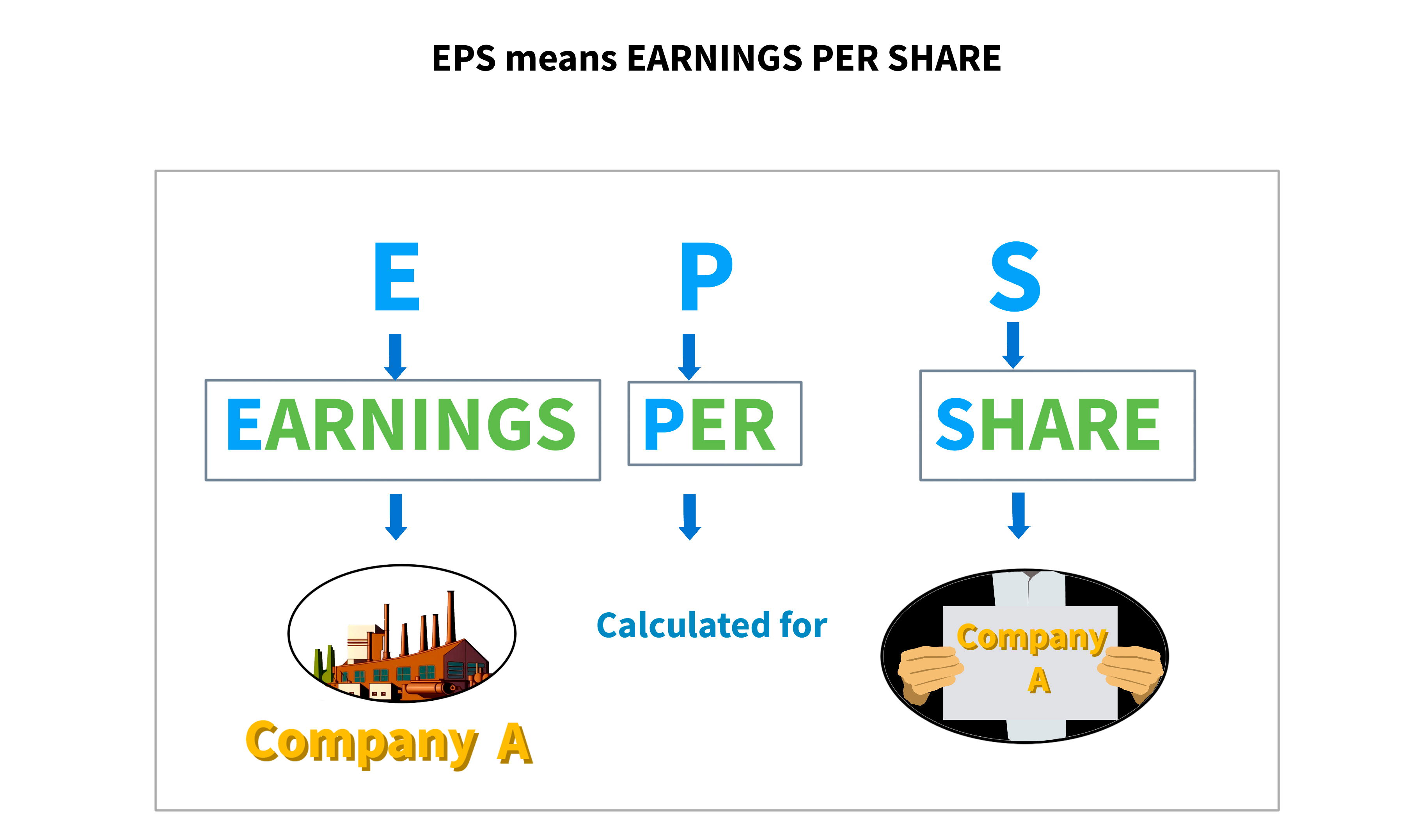

EPS means EARNINGS PER SHARE, i.e, Earnings of the company you invested in, calculated for each share of the company.

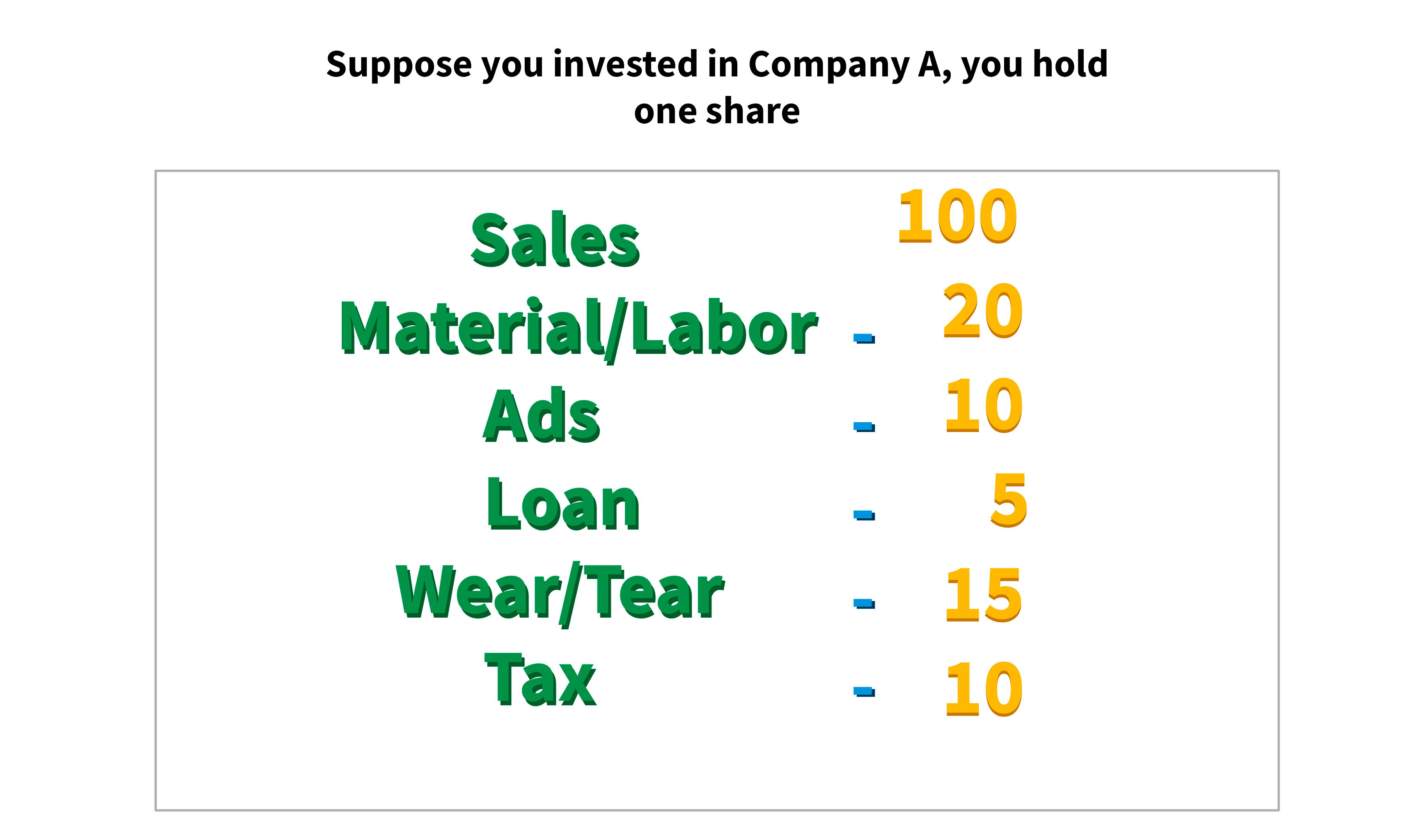

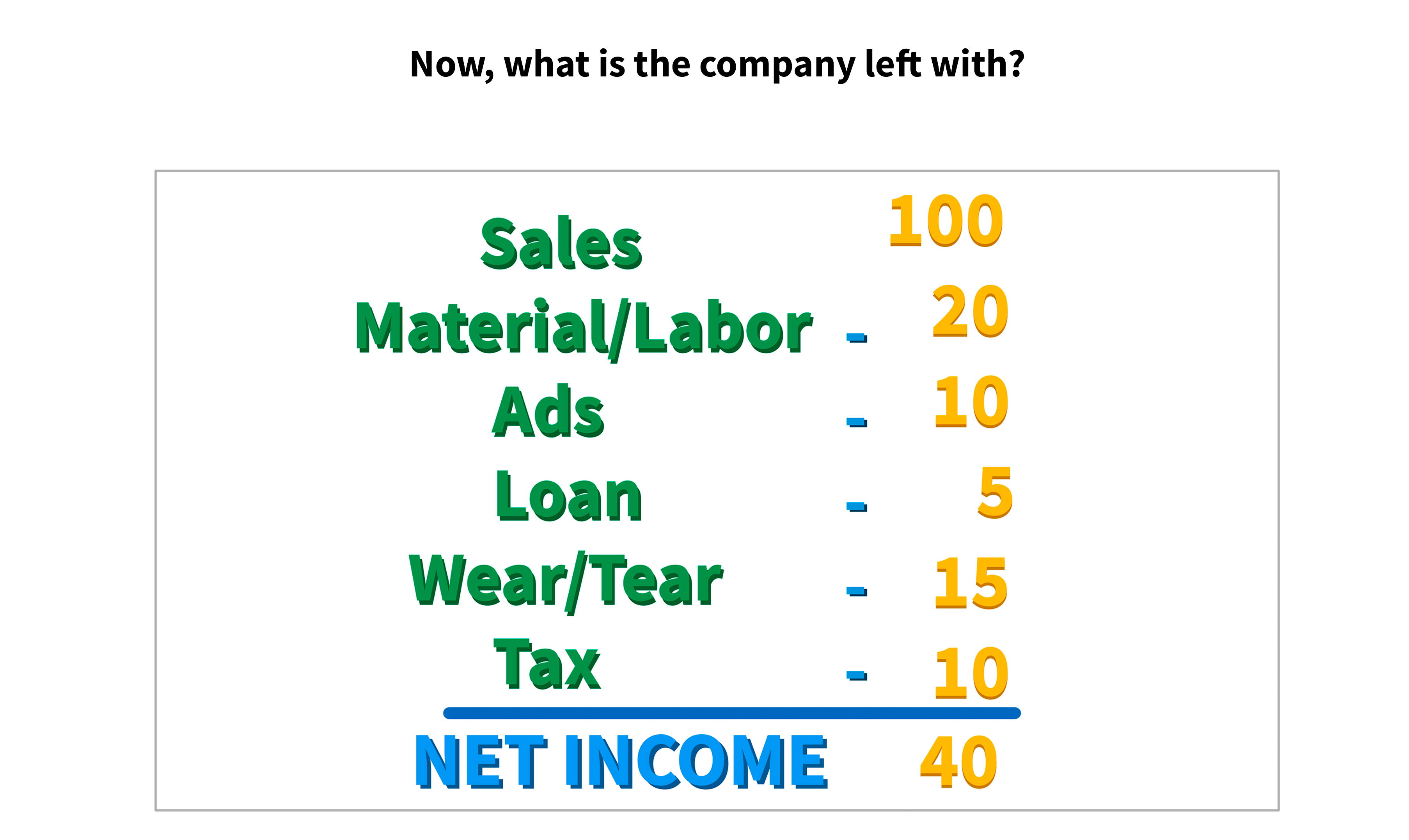

Suppose you invested in Company A, you hold one share. Just like you, 9 other people also invested in the company. They also hold one share each. So, totally there are 10 common/public shareholders holding 10 shares of the company. The company s revenue is $100. Meaning that company A, from the sale of its goods/services, generated a total income of $100. But the company has some costs and expenses also..right? It has to pay$20 for the cost of raw materials and labor, $10 for advertisement costs and managing the office, $5 towards debt payment, $15 towards the wear and tear of the machinery, and $10 towards taxes.

Now, what is the company left with? How much of its earnings are left? $40, right?

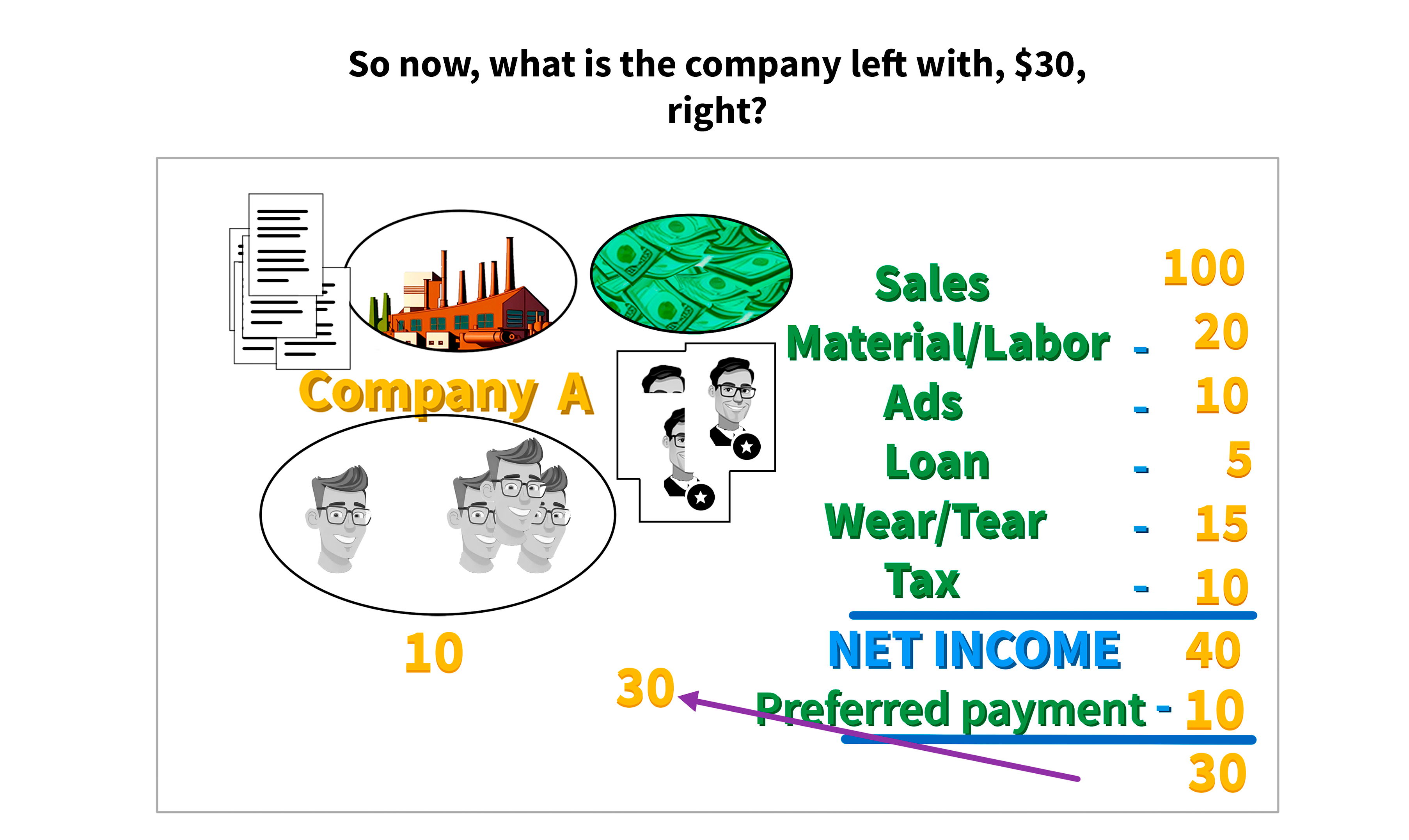

Whatever earnings the company is left with after paying all the costs and taxes ...is nothing but NET income. Out of this net income, the company has to pay some money to the important stockholders also known as the preferred stockholders. You might be wondering who these important stockholders are.

Preferred stockholders are the people who invested a lot of money in the company, more than we common people. Say, for example, there may be big institutions that invested in this company, or the company has issued some special stocks to its very important employees, they are all preferred shareholders.

This means they are more important to the company than common retail investors like all of us. So, from the net income, the company has to pay out money to the preferred or more important shareholders first. This money is what we call the preferred dividends if the company has a policy of paying dividends.

So, in this case, let's say the company paid $10 as dividends to the preferred shareholders. So now, what is the company left with, $30, right?

This $30 is what we as common investors totally have to look at. But remember, you are not the only common shareholder. There are a total of 10 shareholders as we discussed in the beginning. So, this earning of $30 divided by 10 shares is the earning calculated for each share, i.e the earnings per share.

To find EPS, simply divide the company's total earnings by the total number of shares. The more the earnings, the more will be the EPS. Hence EPS tells us how profitable the company is.

Can we compare the two companies by looking at the values of EPS and decide that the company with a higher EPS is a better pick for us?

No, not really. We have to look at other factors like ROE (Return on Equity) which is a topic of discussion for another day. But overall, we need to understand that EPS is a great indicator of the company s earnings and helps us decide on the company s performance in conjunction with other factors like ROE.

Key Takeaways:

1. The total number of shares outstanding is divided by the company's total earnings to calculate Earnings Per Share (EPS).

2. Combining EPS with other factors such as ROE gives us an insight into a company's earnings and helps us assess its performance.

3. Preferred stockholders are more important to the company than ordinary retail investors, and they must be paid out of net income before anyone else.

4. The higher the earnings, the higher the EPS, which shows how successful the company is.