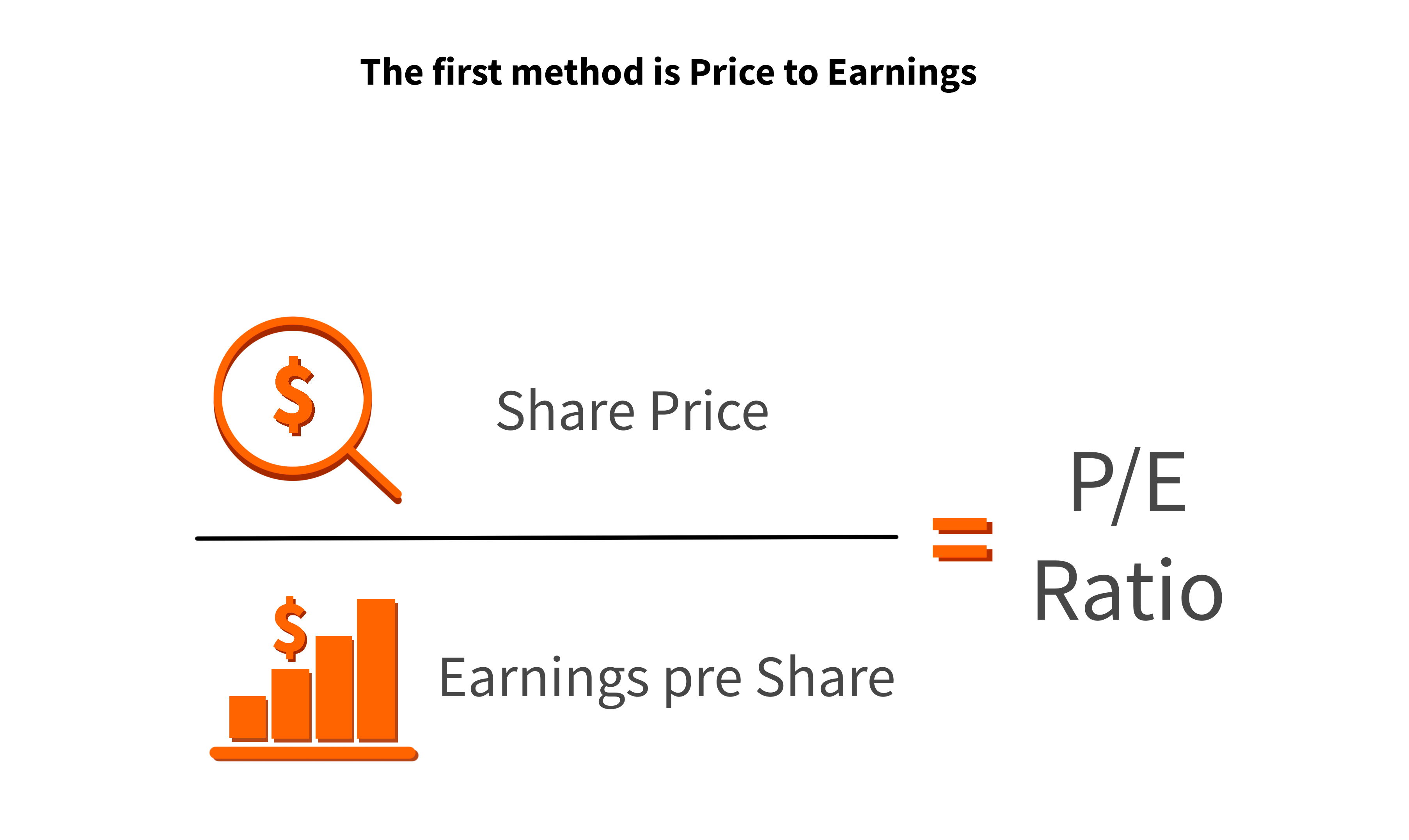

Companies can be valued in a variety of ways. The first method is Price to Earnings, which values a company based on how much money it will make in the future. The P/E ratio indicates how much the market is willing to invest in the company's current operations and its potential for growth. If the P/E ratio is high, it implies that the market is confident in the company's future prospects and is willing to pay more than its current value.

How can financial ratios be understood in the simplest way possible?

Whenever you see a fraction, always think of the denominator as being the number one. What does that mean with respect to P/E? The P/E ratio denotes how many times a dollar on the denominator investors are willing to pay. The denominator is one ( it's always one forever) In the numerator, in this case, it is 10. So what this means is for every $1 in earnings, investors are willing to pay 10 times that one dollar, $10 for each one dollar in earnings. If a company grows faster, investors will pay more than 10 times which they might pay 20 times. The faster a company is growing, the higher the price to earnings.

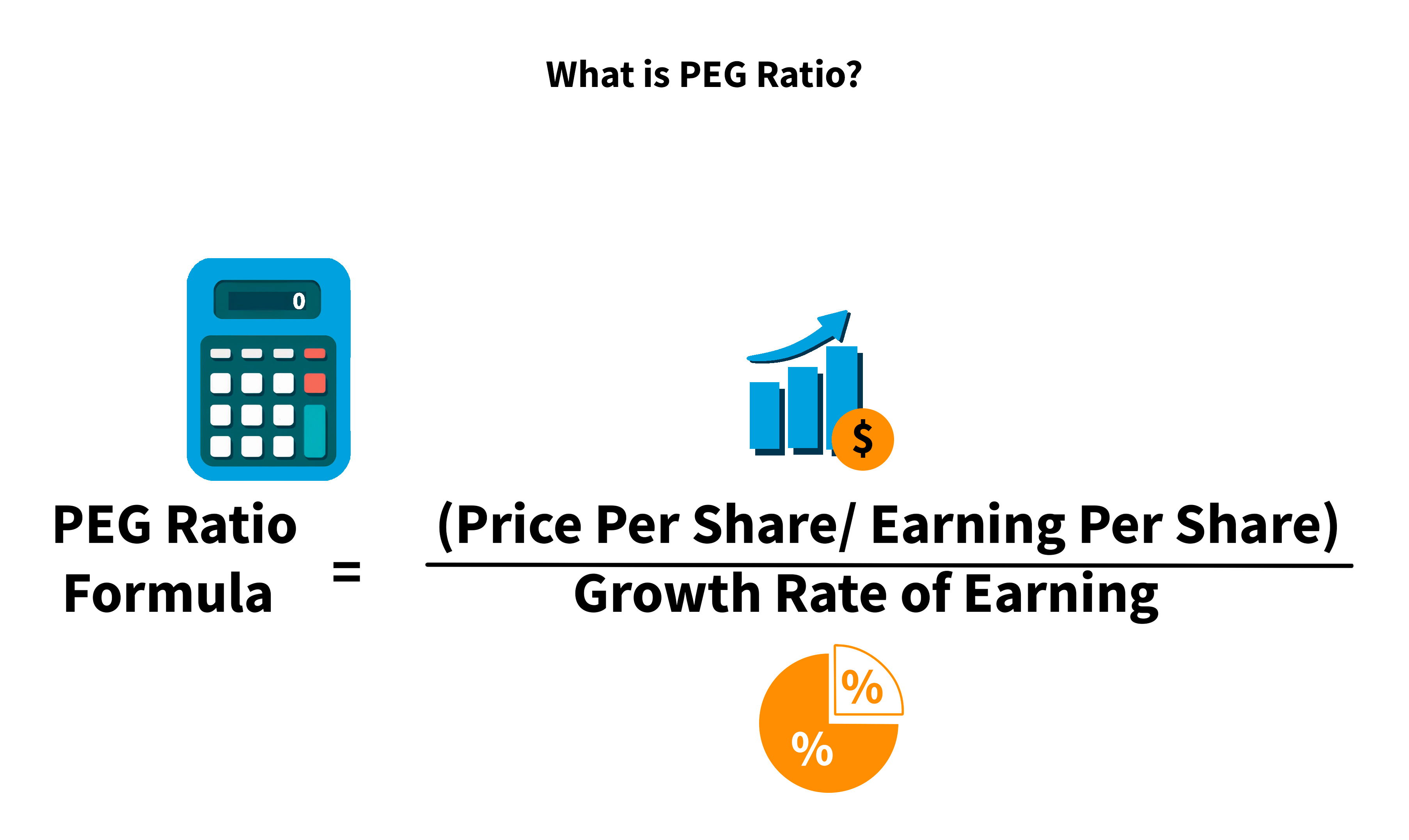

What is PEG Ratio?

How do you value a company then? The rule that people follow is known as a PEG ratio. Historically, the S&P500 trades at about 15 times earnings. Meaning, for every $1 in earnings, investors are paying 15 times or $15. What happens is, the average company in the S&P500 historically grows earnings at 15%. So 15 times earnings divided by 15 is number one, remember that. That's a Price Earnings to growth ratio of one.

If a company is growing faster than 15% earnings, then it should trade at higher than 15 times earnings. So a company that's growing at 20% earnings should trade at 20 times earnings. This is not a perfect Benchmark but it makes it easier to understand this stuff. So a company that's growing at only 10% should only trade at 10 times earnings, and this is called the Price Earnings to Growth Rate (PEG ratio).

In reality, people look at forward earnings, not backward earnings. What a lot of hedge funds do is if a company is trading at way above its earnings growth rate, they'll look to short that company. Meaning, make money if it goes down, and buying a company means going long, shorting a company is the opposite of that. The role that a lot of hedge funds use is, if the P/E is twice the earnings growth rate then it's probably a “short”. For example, if a company is trading at 10 times earnings but earnings are only growing at 5%, then it trades at twice the growth rate, and it might be “short”.

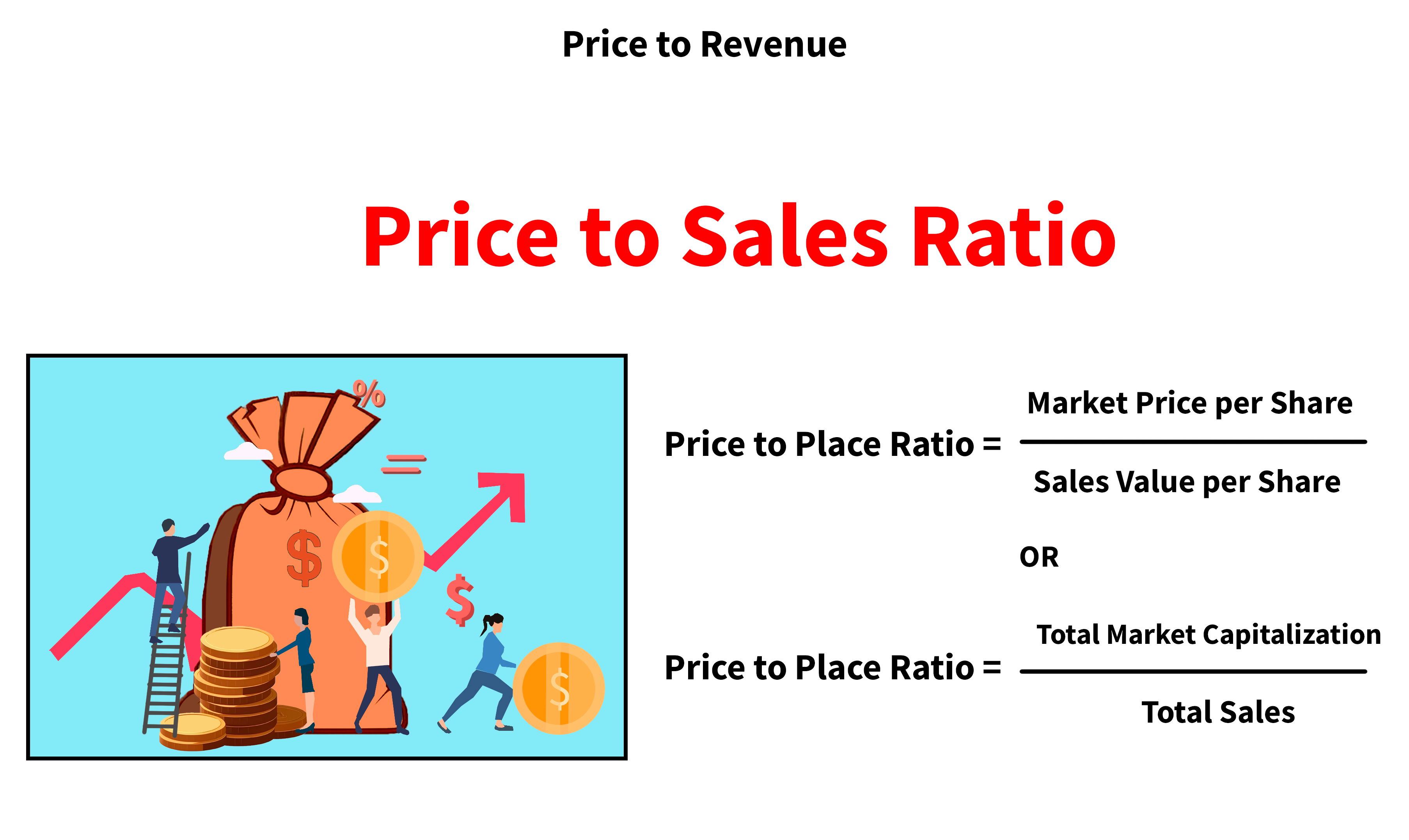

Price to Revenue

Let's now move on to the Price to Revenue. Price to Revenue is really similar to Price to Earnings, except in the denominator, you've got revenue. Remember, the denominator is always one, so if a company has a Price to Revenue rate of 20 times, that means for $1 Revenue it has on the denominator, investors are paying 20 times that $1 in revenue. You do this if a company is not yet profitable.

A lot of people would ask: What is the going rate like? Why should I value a company at 15 times its revenue? or 10 times the revenue? or 20 times? How do I know? Well, it all depends on the growth rate of that company. And the sector. The best way to value companies is to look at P/E multiple based on earnings estimates in 5 or 10 years.

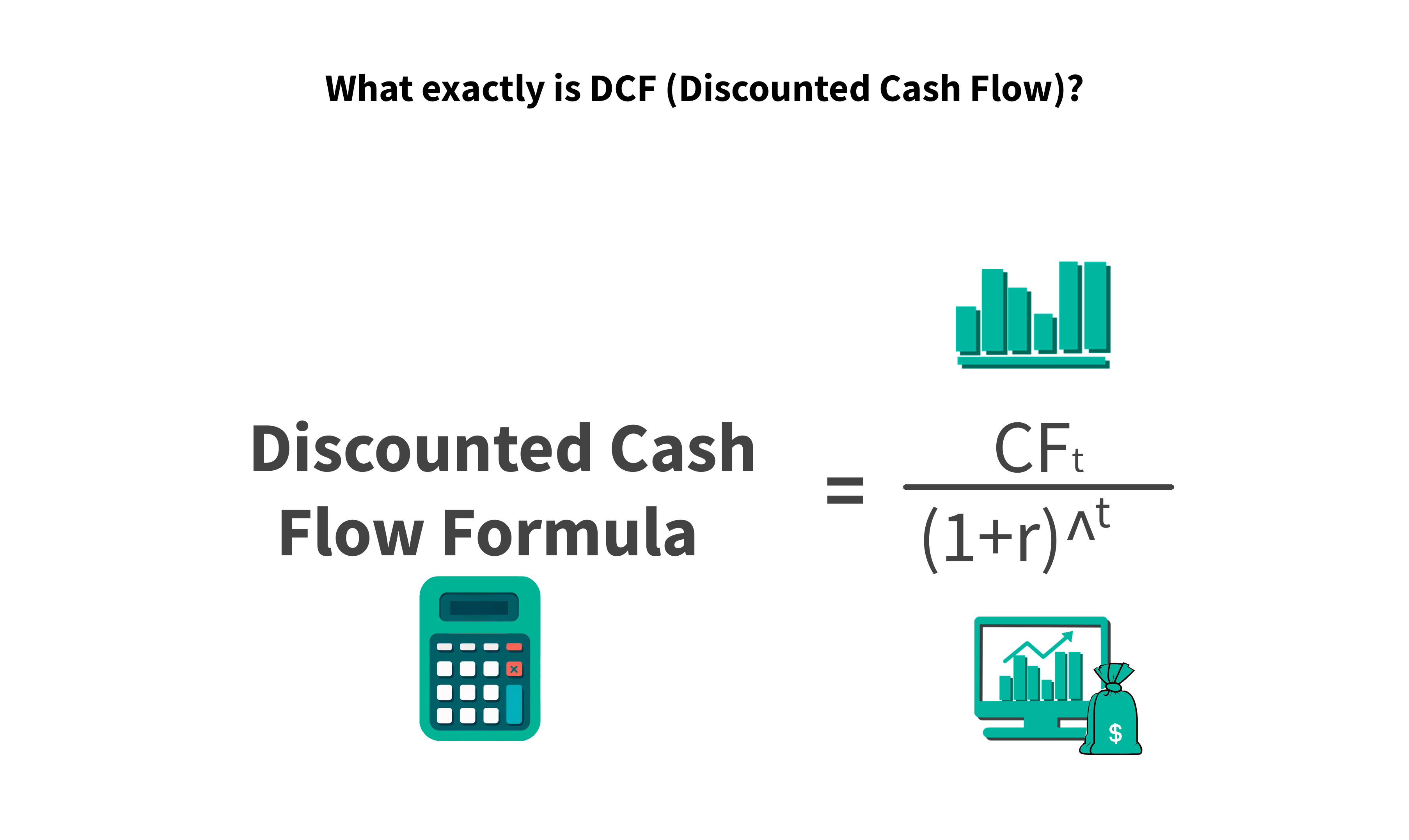

What exactly is DCF (Discounted Cash Flow)?

The third way to Value companies is DCF or Discounted Cash Flow. There are a lot of independent variables when you value a company based on DCF. What that means is, you value a company based on how much cash you think that company will make every single year into the future, then you discount all that into today's terms. DCF analysis attempts to calculate the present worth of an investment based on estimated future returns.

To determine the value of an asset, discounted cash flow models are used. It is both quantitative and qualitative in character and is regarded as a fundamental analysis technique. To anticipate future cash flows, DCF models call for specific assumptions. Analysts spent a lot of time researching economic, environmental, and social factors that will affect future free cash flow while crafting these assumptions.

Because of this, DCF analysis is typically regarded as being thorough and as the industry standard for determining an investment's fair value. The weighted average cost of capital (WACC), tax rates, and cost of equity are only a few of the numerous variables that go into DCF estimates.

Key Takeaways:

1. Price to Earnings (P/E) values a company based on how much money it will make in the future and indicates how much the market is willing to invest in the company's current operations and its potential for growth.

2. The PEG ratio denotes how many times a dollar on the denominator investors are willing to pay. The faster a company is growing, the higher the price to earnings.

3. Price to Revenue is similar to Price to Earnings, except, in the denominator, you've got revenue.

4. Discounted Cash Flow (DCF) models are used to determine the value of an asset and are regarded as a fundamental analysis technique.

5. DCF analysis is typically regarded as being thorough and as the industry standard for determining an investment's fair value.