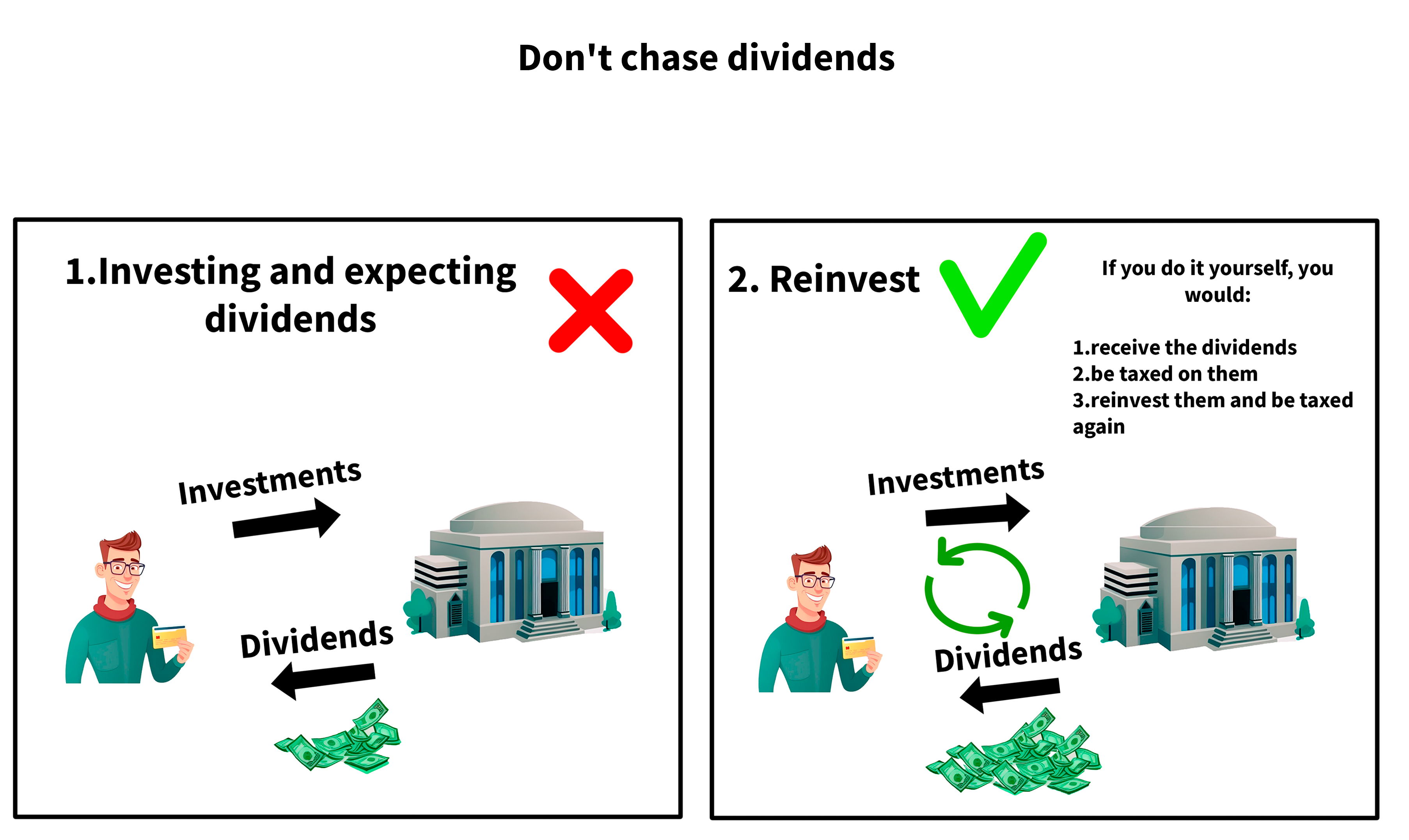

Don't chase dividends

If the company is doing well, it is preferable for them to reinvest their profits in order to benefit from the compounding effect.

If you do it yourself, you would:

- receive the dividends

- be taxed on them

- reinvest them and be taxed again

Instead of paying taxes when you receive the dividend, it would be better for the company to reinvest its net income to be able to grow and thus generate more benefits next year. If cash flows in and out of the company, it will have a significant impact on the system of compound effects that occurs within the company over time because as a dividend receiver, we will be paying taxes and we will not be able to benefit from the company's internal rate of growth on the taxes paid that we lose.

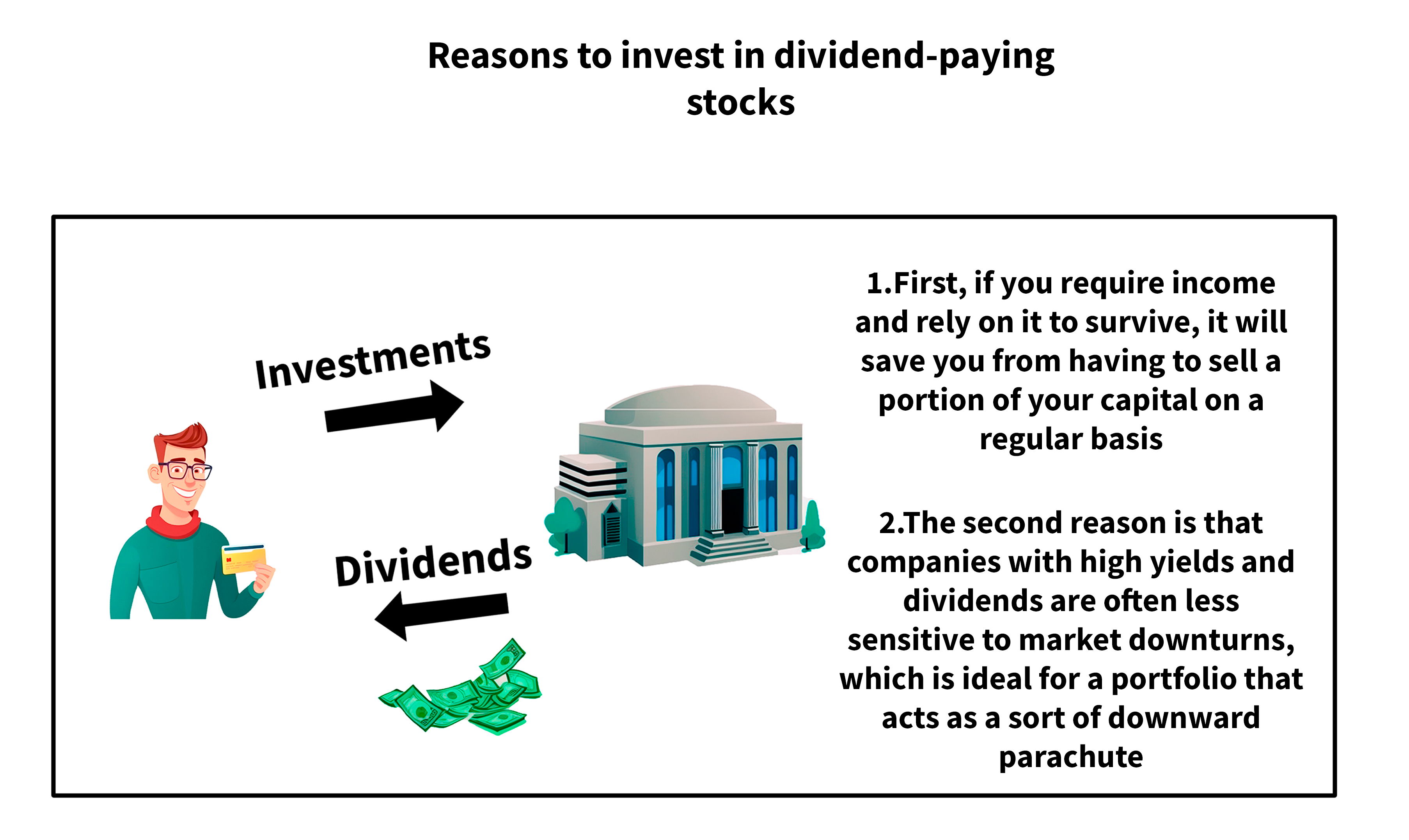

Reasons to invest in dividend-paying stocks

However, there are two compelling reasons to invest in dividend-paying stocks with high yields. First, if you require income and rely on it to survive, it will save you from having to sell a portion of your capital on a regular basis. The second reason is that companies with high yields and dividends are often less sensitive to market downturns, which is ideal for a portfolio that acts as a sort of downward parachute. When the value rises, it always reassures investors to see the high dividends and rate of return.

As a general rule, dividends are paid out of a portion of the profit. The goal is for dividends to be as low as possible. That is, the lower the dividend, the more long-term sustainable it is for the company. If a company begins to pay high dividends, it will be under pressure to keep doing so even if the economy slows or revenue remains stable.

Dividend payout ratio

When the dividend payout ratio (total dividends paid / net income) is high, even the slightest drop in net income the dividend payment will be difficult to sustain. We understand that the higher this percentage, the riskier it is, because it makes the dividend very sensitive to the company's results.

Dividend growth and stability are two other important factors to consider. We also don't want to see the inverse: dividend rising with stagnant or falling net income.

Cash flow per share

Another criterion to consider is cash flow or cash flow per share. Even if the result is positive, it does not always reflect the company's actual cash flow. It can sometimes be higher or lower. We need to look at the exact cash flow numbers since the cash allows us to pay the dividend. In other terms that the company is capable, in terms of cash flow and paying its dividend.

What’s more important is to see how the dividend has reacted in a period of recession during a crisis.

Remember to look at various ratios, particularly the payout ratio. Examine a dividend's performance trend. Check to see if they had the cash flow to pay the dividend, and most importantly, consider how the company has historically kept up its dividend rate even in times of adversity. Comparing company results growth and dividend payout ratios gives us a good idea of how the company is prioritizing internal growth versus dividend payment.

Summary

- If a company is doing well, it is better if they reinvest their profits within the company rather than paying a dividend because paying a dividend requires us to pay taxes, which is very expensive for us over time (compounding effect). On the contrary, reinvesting their profits will help the company grow, which will benefit us in the long run.

- Examine their dividend's performance trend.

- Find out if they have the cash flow to pay the dividend.

- Analyse how the company has historically kept up its dividend rate even in times of adversity compared to its net profits evolution.

- Compare company results vs dividend payout ratio

Appendix:

“We have used some of our cash to make great investments in our business through increased research and development, acquisitions, new retail store openings, strategic prepayments and capital expenditures in our supply chain, and building out our infrastructure. You’ll see more of all of these in the future. Even with these investments, we can maintain a war chest for strategic opportunities and have plenty of cash to run our business. So we are going to initiate a dividend and share repurchase program.”

Tim Cook

Finding interesting returns, whether in the financial markets or elsewhere, is extremely difficult today. As a result, some investors are turning to dividends to find attractive rates.