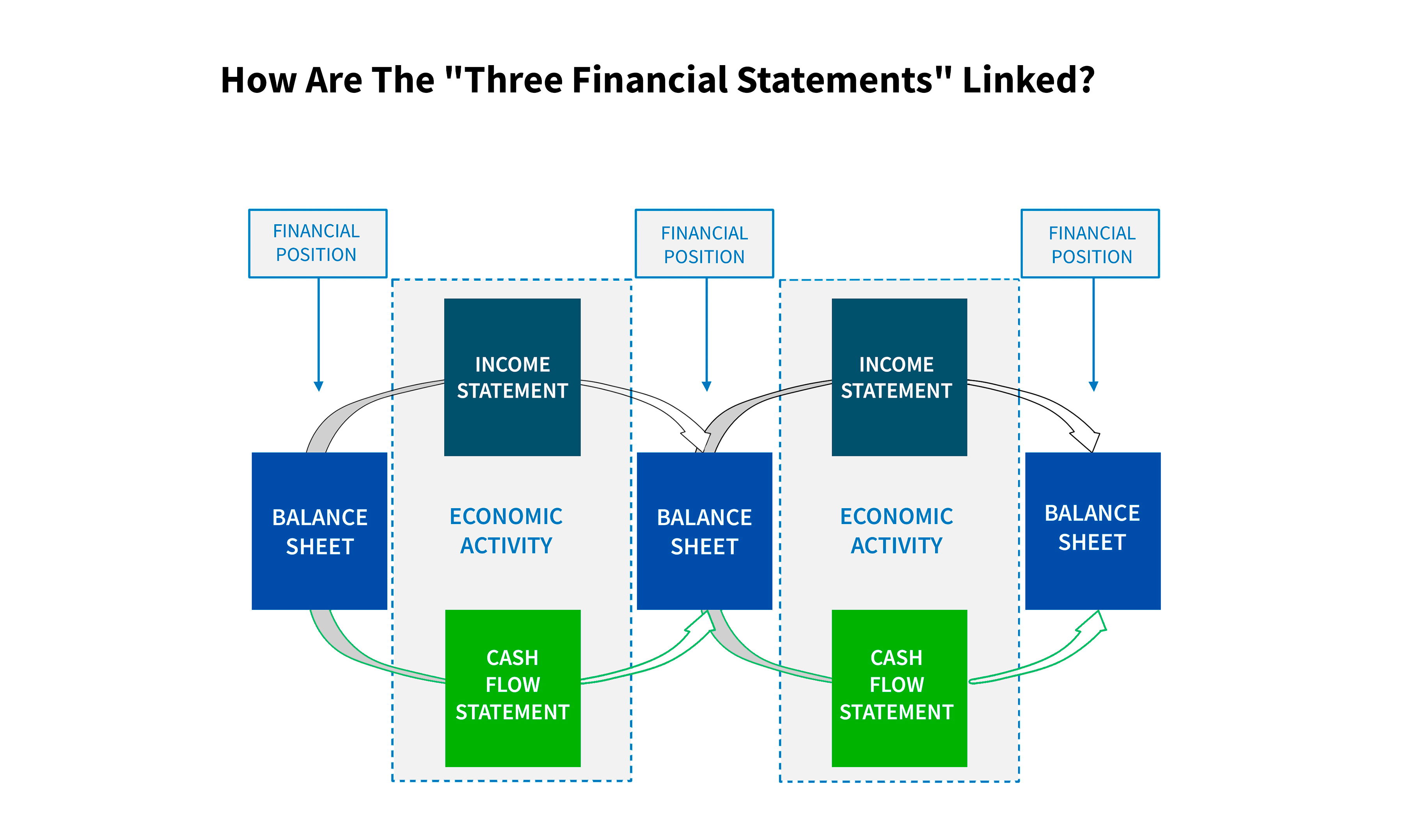

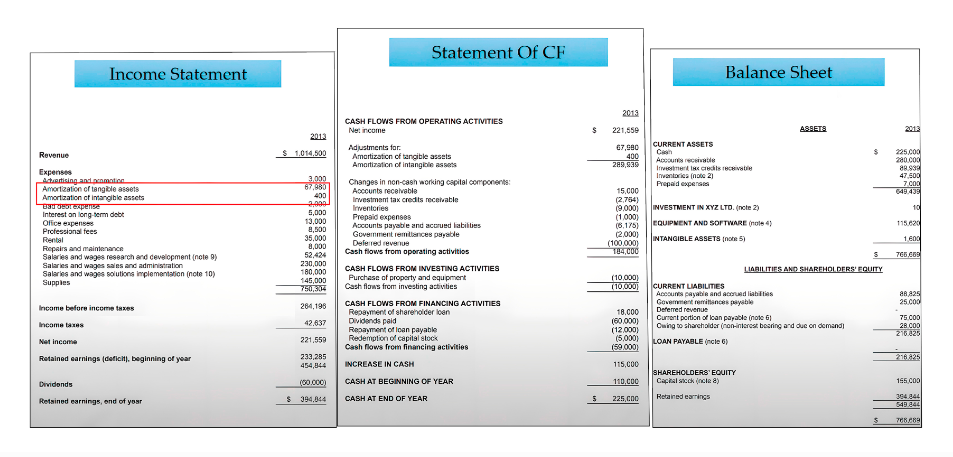

To understand how the 3 financial statements are Linked, let's consider an instance. You may divide the process into steps: prepare the income statement, then the cash flow statement, and finally the balance sheet. Once you complete these stages, you'll arrive at the net income.

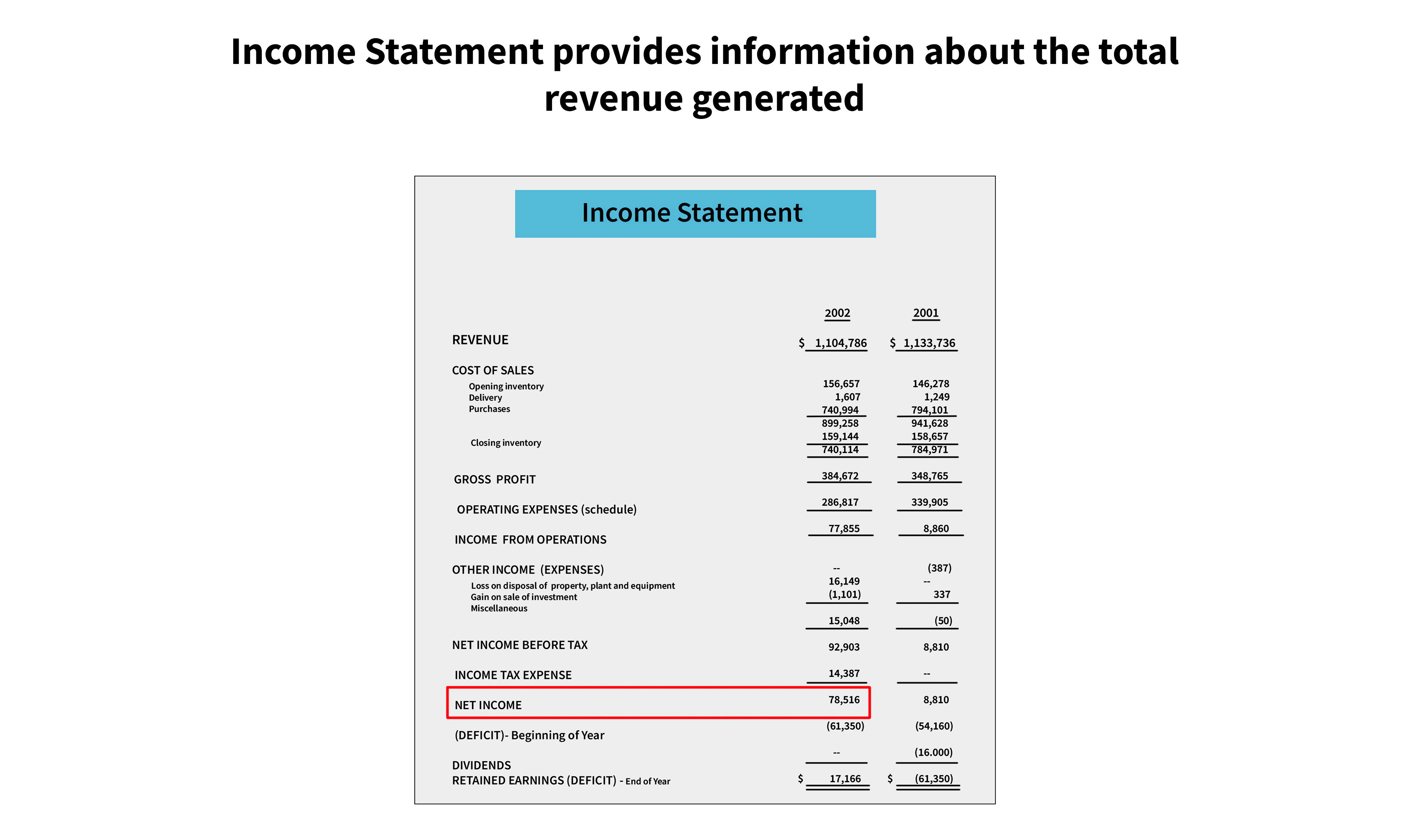

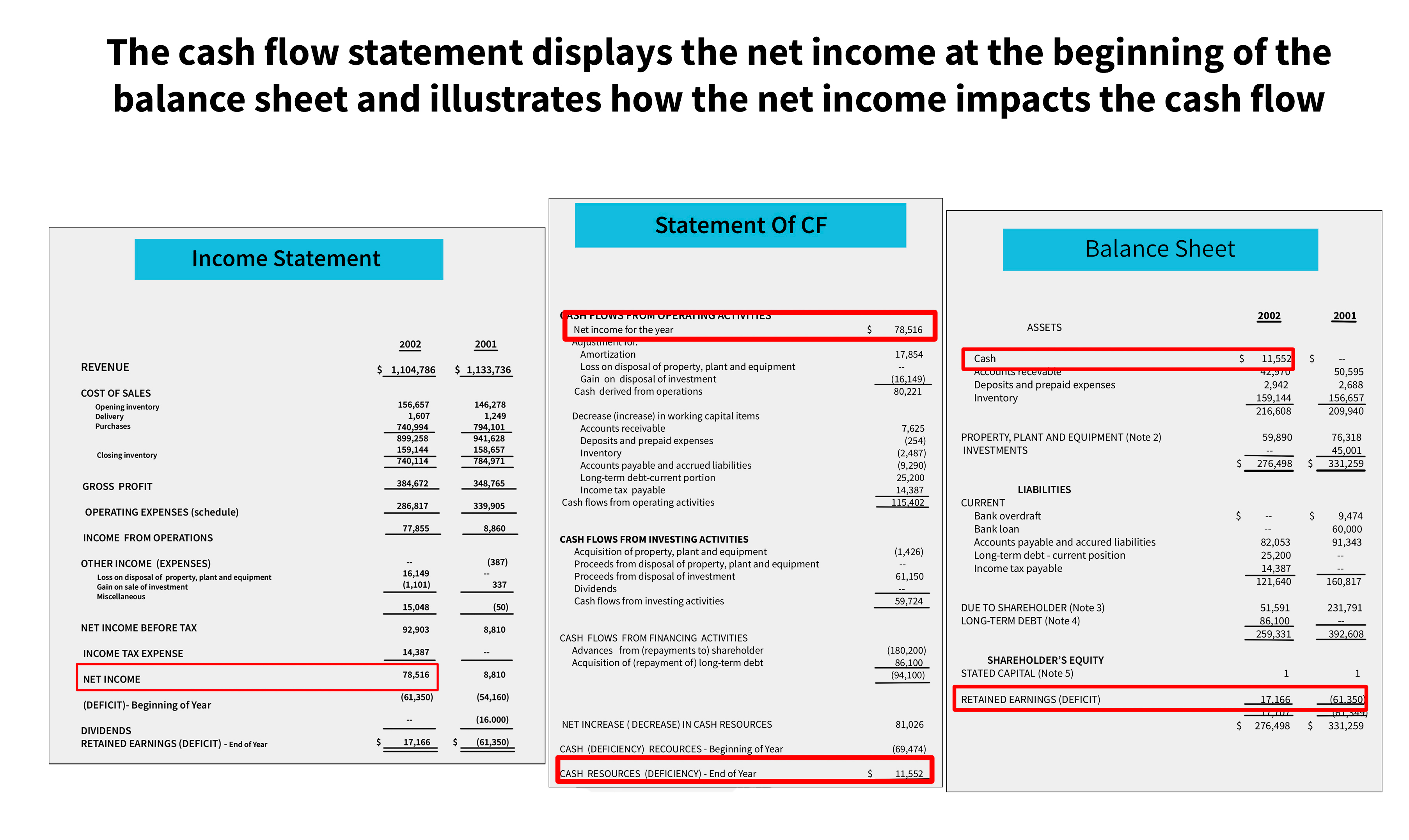

The income Statement provides information about the total revenue generated. On the other hand, the Cash Flow Statement evaluates the variances between cash and cash equivalents by removing non-cash expenditures and alterations in the working capital. Additionally, retained earnings allow for Net Income to be presented on the Balance Sheet as shareholder equity. Moreover, current assets must be adjusted to include cash, cash equivalents, and any necessary adjustments to the cash position after updating it in the Cash Flow Statement.

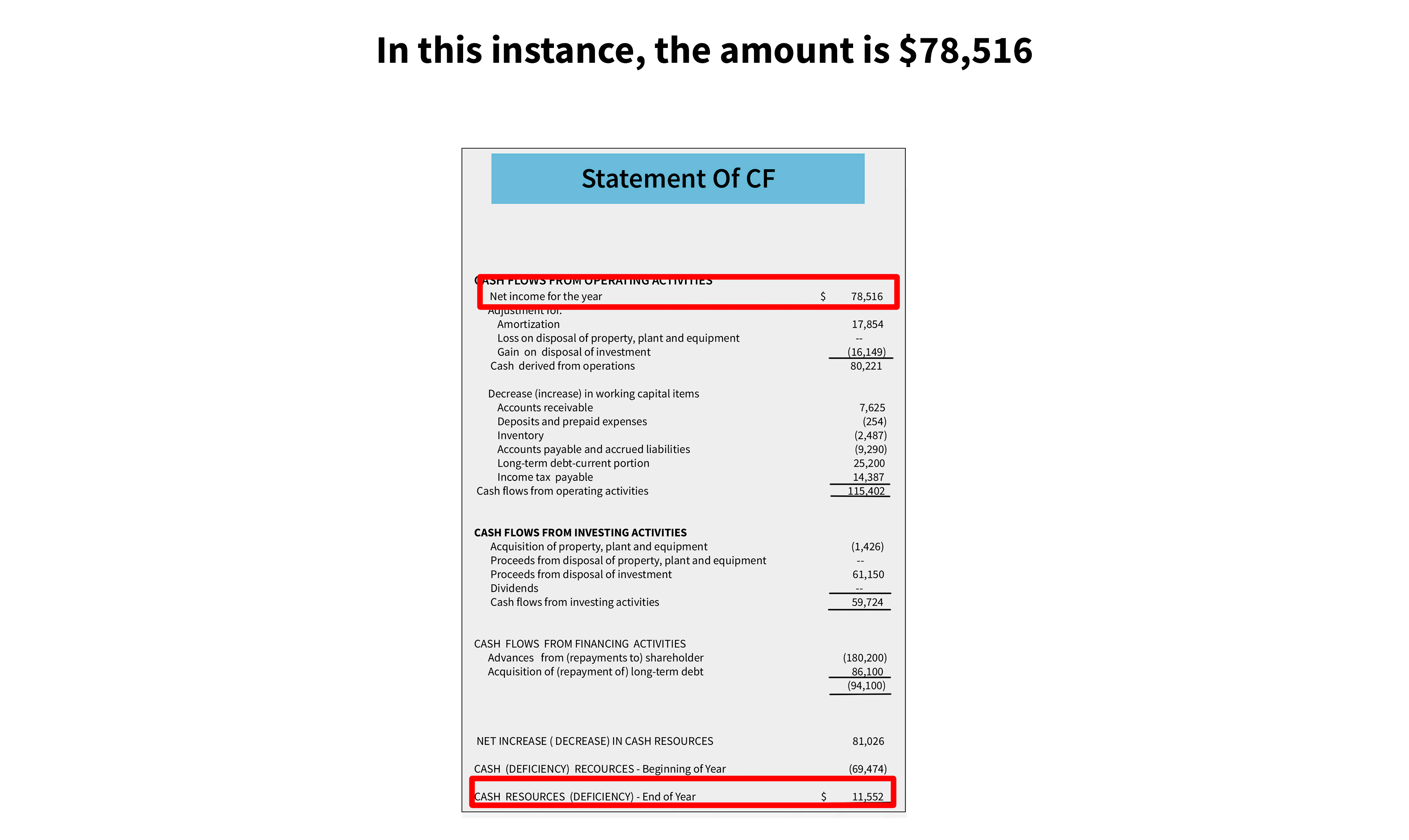

In this instance, the net income amount is $78,516. The results will be reflected on the cash flow statement on the top line. You then make your adjustments for non-cash charges and for working capital changes. And as you work your way down to the very bottom, you'll be able to calculate the new cash balance for the existing year at the end of the period.

To summarize, the total cash flows from operating, investing, and financing activities resulted in an $81,000 increase. However, the business incurred a deficit of $69,000, which means that the new cash balance is only $11,552. This information is recorded in the cash statement.

In essence, that is how your fresh financial resources are shown on the balance sheet. The net income of $78,516 is the difference between the deficit and the current surplus in retained profits, which is then transferred to retained earnings. The cash flow statement displays the net income at the beginning of the balance sheet and illustrates how the net income impacts the cash flow. So that's a little quick way to really, a mental shortcut.

In addition, another way you could answer this question is by using depreciation and most questions will be based on depreciation so. This is an operating expense on the income statement, and it really impacts the net income, which eventually becomes a net income question, focusing just on depreciation.

Depreciation appears as an operational expense on the income statement.

Although no money is actually spent, it showed up as a positive number in the part of the financial statement designated to operating activities. The asset being accounted for is listed under the total depreciation across various periods of ownership on the balance sheet.

So let's take a look at another example:

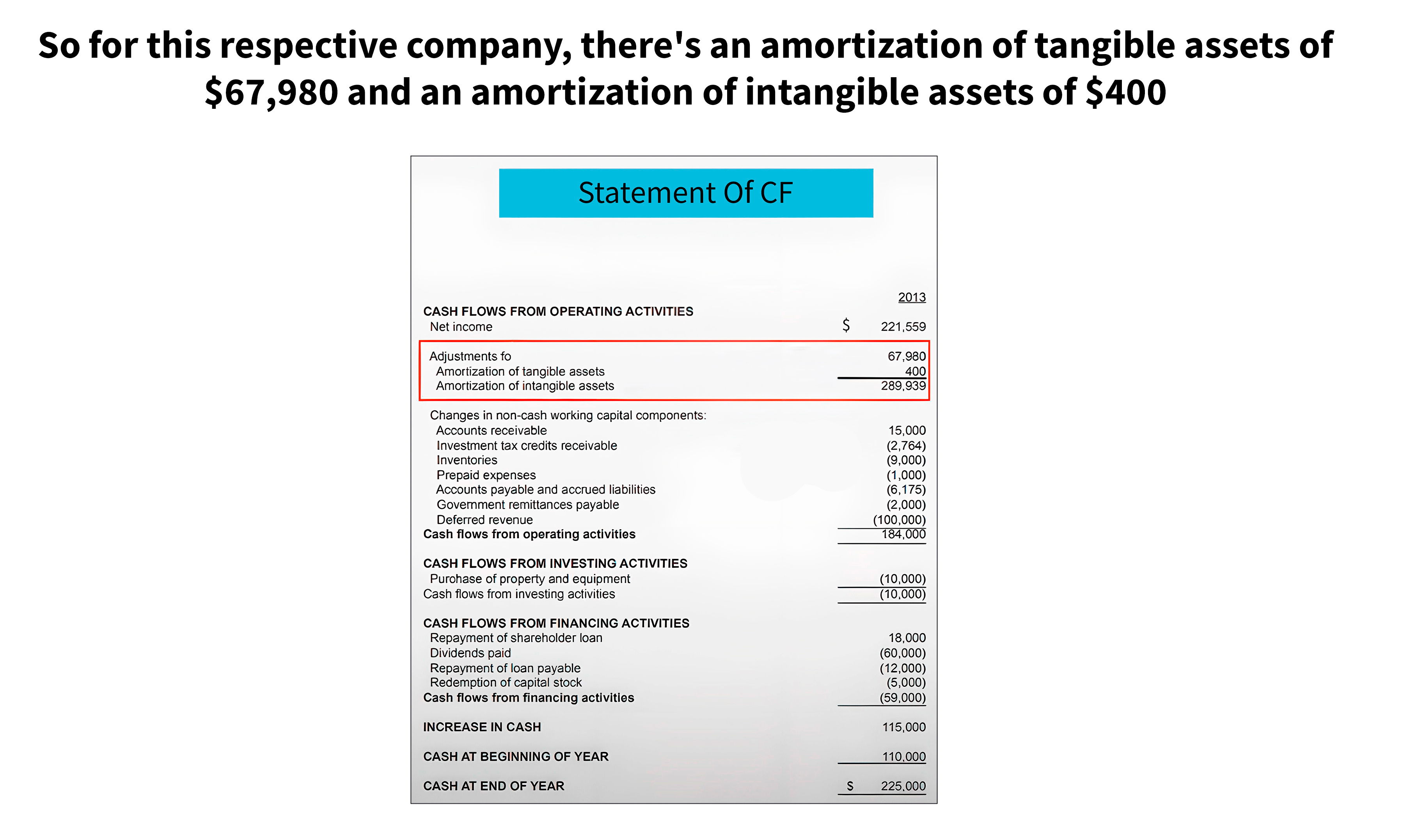

So for this respective company, there's an amortization of tangible assets of $67,980 and an amortization of intangible assets of $400. Since it is not a cash payment, the non-cash expense is incorporated into the cash flow statement and is included as a positive value in the cash flows from operating activities.

Net income is influenced by depreciation, which is apparent in the income statement. It's unfairly impacted because it's an accounting term. It's not really a real cash outflow for the business. They're not actually paying $67,000 to someone, so that's added back in order to properly calculate cash for the respective business.

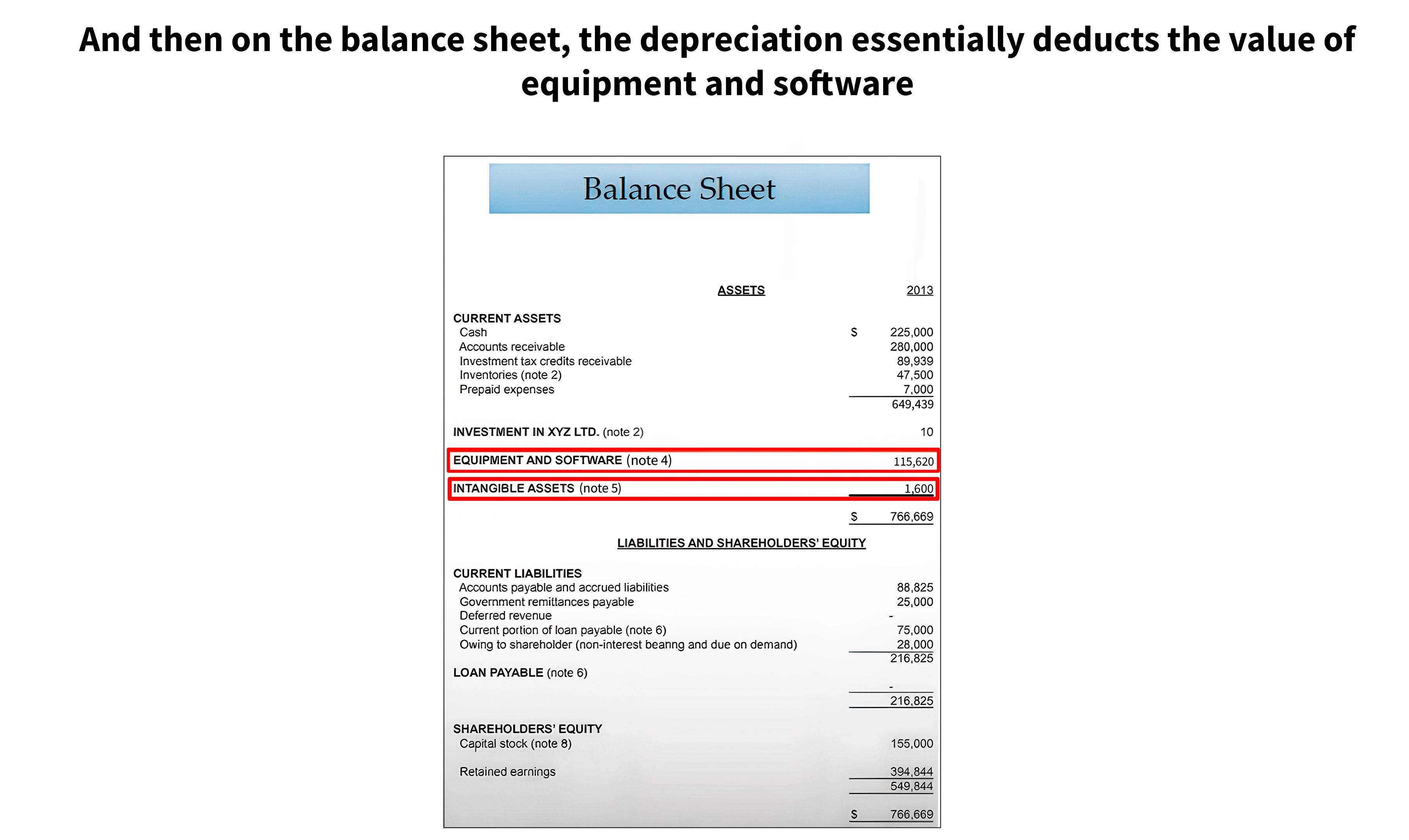

On the balance sheet, the depreciation essentially deducts the value of equipment and software, which is the tangible assets, and then $400 for intangible assets. So really, on some balance sheets, especially if it's very detailed, there will be a sub-account right over which says less accumulated depreciation. Whereas, for most balance sheets, especially for public companies, there is no sub-account. Essentially, you have to really calculate the difference between the two by subtracting the values between one period and the other, assuming no capital expenditures.

How would a $10 depreciation charge impact the three financial statements?

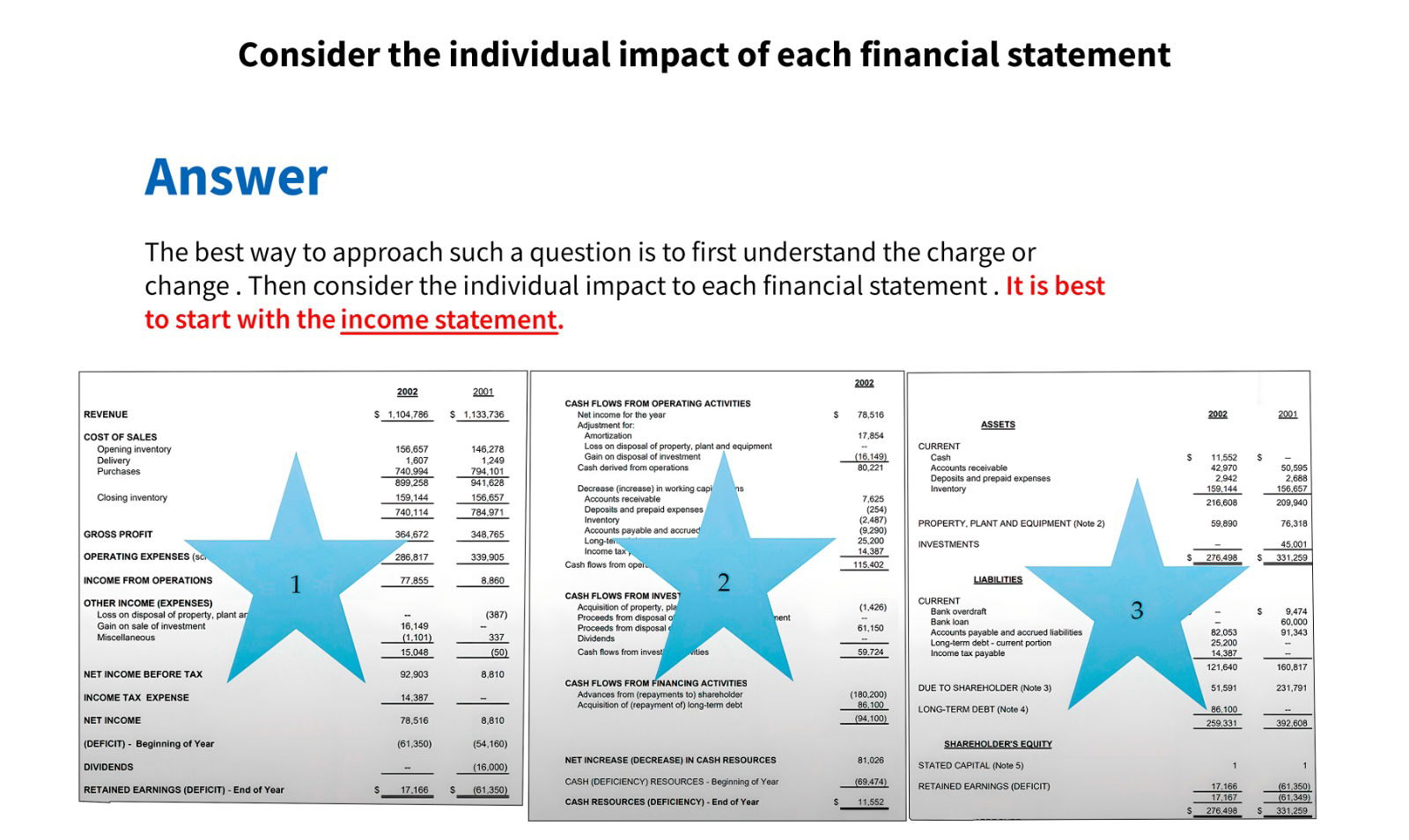

They'll usually offer you a very simple tax rate, sometimes 50%. Let's assume 40% in this example. The best way to approach such a question is to first understand the charge or change, then consider the individual impact of each financial statement. As always, it's best to start with the income statement, and the best way to do it is you work your way in levels. First is the income statement, next is the cash flow statement, and lastly, the balance sheet.

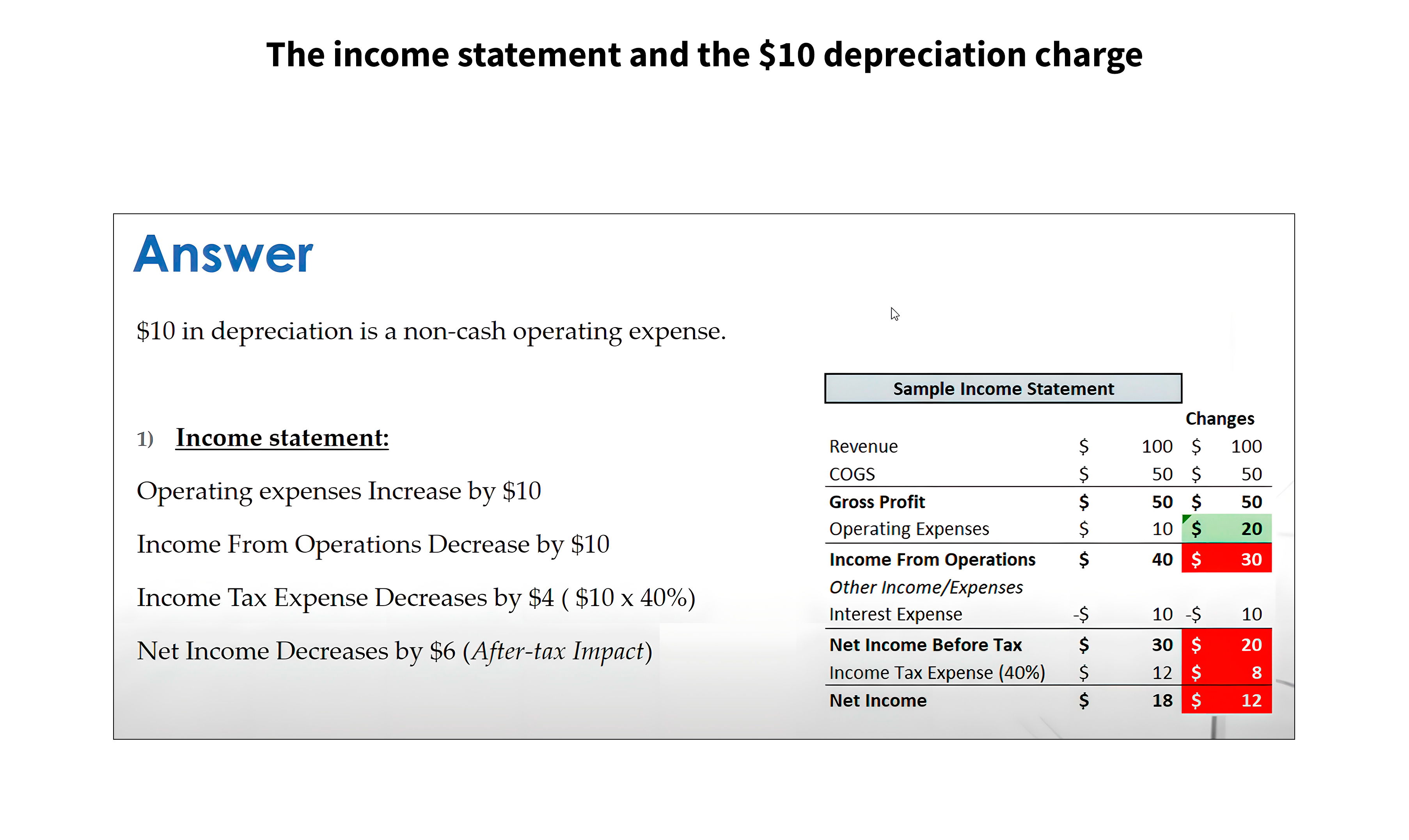

Let's start off with the income statement and the $10 depreciation charge.

This is the existing performance of the business, and what changes relative to the charge, which is $10, right? In this case, Operating Expenses increased by 10, and EBIT, or Earnings Before Interest and Taxes, decreases by $10, and then the income tax that is paid for the business decreases. When we talk about a tax shield, this is essentially the tax shield.

As your depreciation increases, that reduces the amount of income from operations, and therefore less tax is paid on less income from operations. So really, the decrease in tax expense from a $10 depreciation is the tax rate times the depreciation charge, so it's $10 times 40%. So income tax decreases by $4. So say for example it's a $100 depreciation charge, and a 50% tax rate, the tax rate shield would be 100 times 50%, so it would be $50, right?

So our income tax in that example, all else assuming being unchanged, would decline by 50%, by $50. For net income, it's the difference between the pre-tax charge, the change in tax, and really what that is. Net income is influenced by depreciation, which is apparent in the income statement. When you think about the income statement, the operating expense increases by 10, therefore net income must decrease by 10, no, because net income is after-tax.

Our income from operations, yes, does decrease by 10. However, we have to account for the tax shield, right? So our income tax decreases by a certain amount because we're making less from the business. Therefore, our net income decreases by only $6 rather than 10, which would be pre-tax.

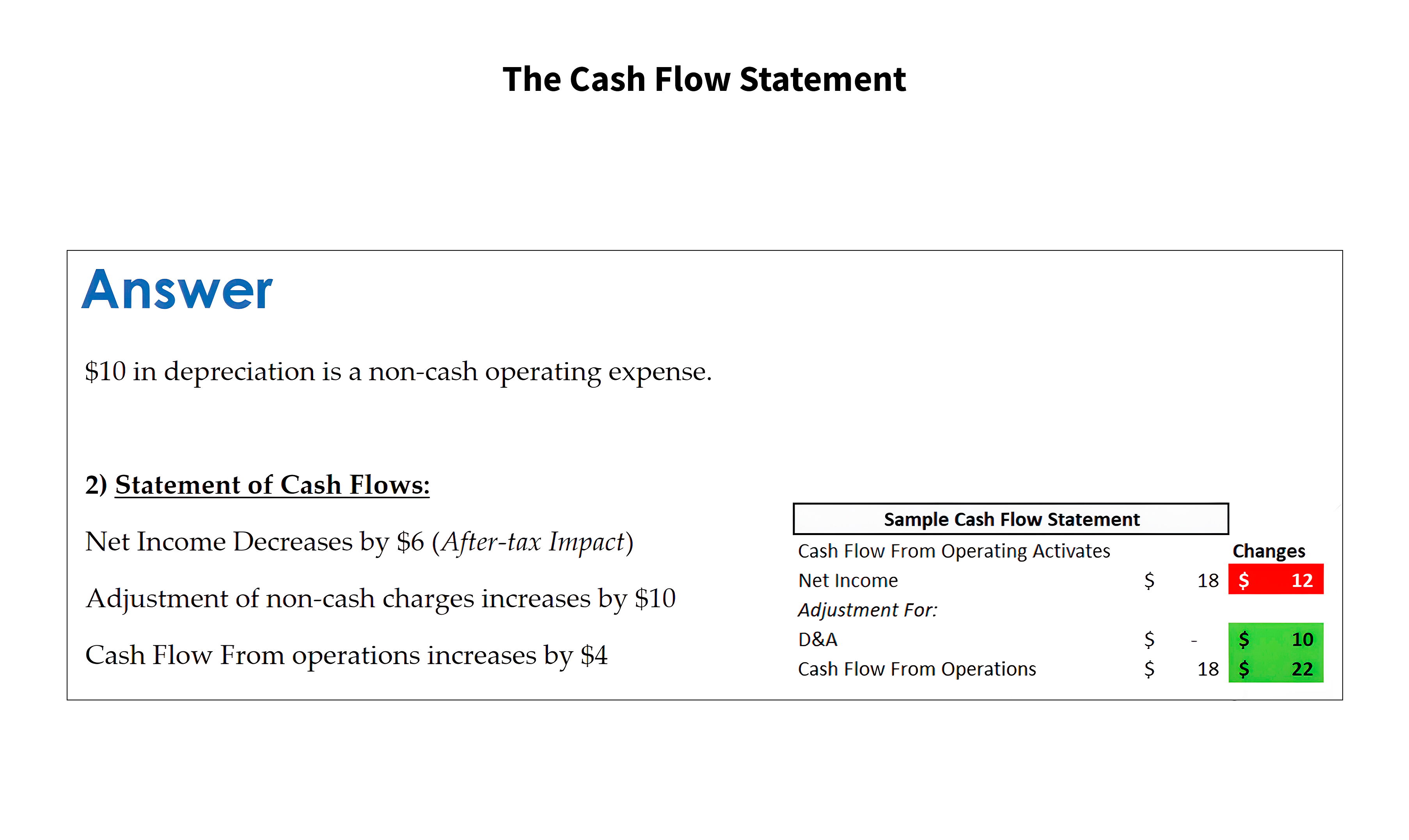

So now let's move over to the Cash Flow Statement

The net income for the statement of cash flows would decrease by 6, the same effect. So at the top line, in this case, we're assuming net income was previously $18, and so cash flow from operations would be 18 because we're not assuming any depreciation, right?

In this case, it would decline by 6 and the new net income would be 12, which is exactly the same as the bottom line of the income statement, and then we adjust for non-cash charges. Since depreciation has increased to $10, that is a non-cash charge. The cash flow statement objective is to accurately record changes in cash and cash equivalents. Non-cash outlays such as depreciation and amortization is included in the statement.

In this case, our net income is 12, and we add 10, so Cash Flow from operations is actually 22. The difference between the two is $4, which is the tax yield and that's why when we talk about the tax yield being a good thing. The real cash benefit of depreciation is that we pay less tax, generating more cash from the business. On the income statement, that's not shown, but on the statement of cash flow, it's actually shown. So cash flow from operations increases by 22.

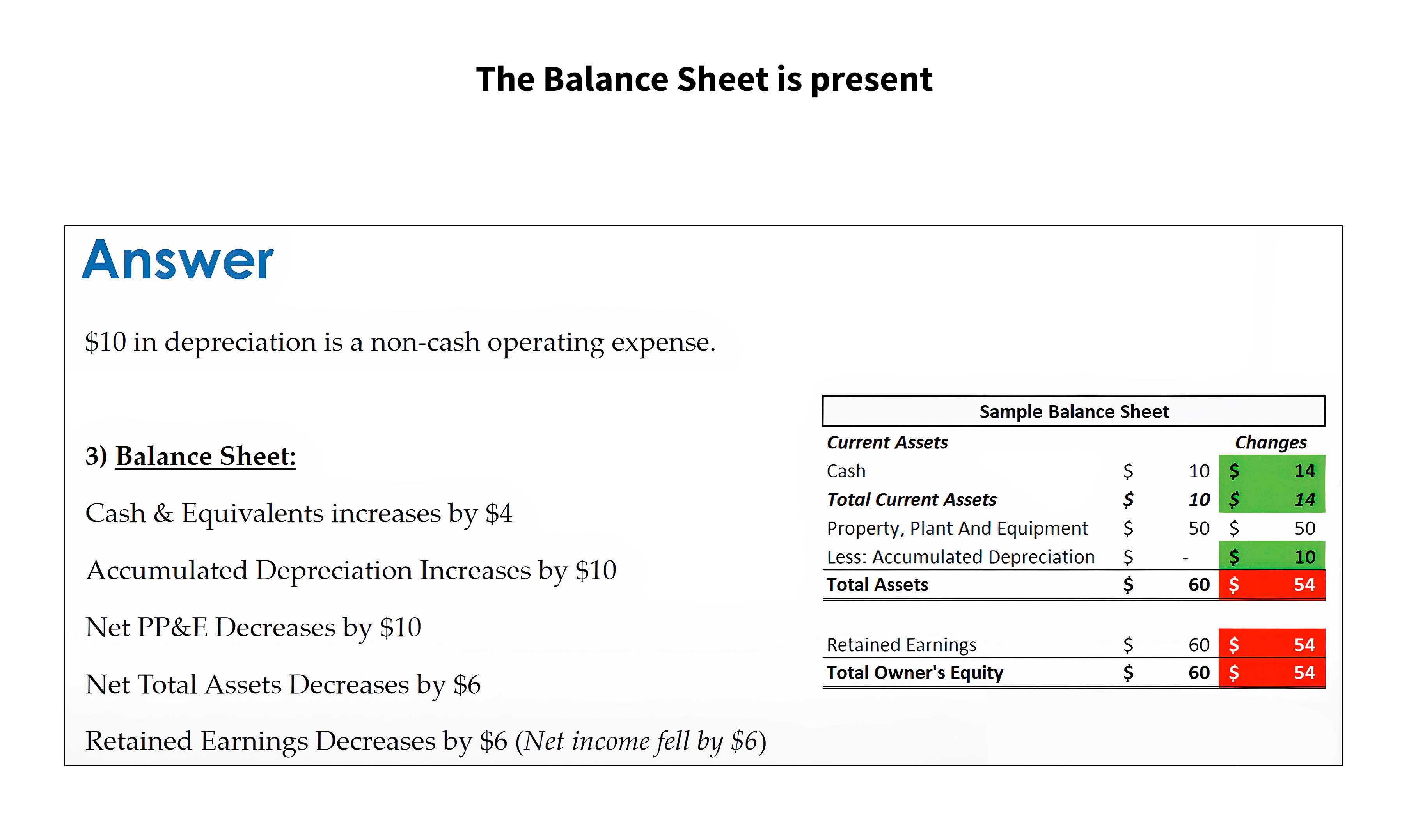

Lastly, the Balance Sheet is present

We now have a decline of $6 from the income statement, and we have an increase of $4 in cash and cash equivalents, which was reported on the cash flow statement. We now go and look at current assets. So cash increases by $4 and our property, plant, and equipment, accumulated depreciation increases by 10. Then our net change, the net value of property, plant, and equipment decreases by $10, so our total assets decreased by $6.

We have an increase, a decrease of 10, and an increase of 4 from cash and cash equivalents, so the net difference is net total assets decrease by $6. Then the second impact on the balance sheet is the $6 decline in retained earnings. Remember, because net income flows into retained earnings and so our retained earnings decline by $6.

Income statement, you identify the charge and it's an operating expense. Our income from operations decreases by $10 and there's a tax shield on that, right? So the expense itself, the pre-tax expense times the tax rate, which is 40%. So our income tax rate, the income tax that we pay, declines by the net result which is $4. The difference between the pre-tax charge and the amount that income tax declines by, is what net income declines by which is $6. We flew into the top of the cash flow statement, so the cash flow statement declines at the top by $6. We then add back the non-cash charge because it's depreciation. Our Cash Flow from operations is a net difference, which is $4, that increases by $4.

We then flow into the balance sheet. Our cash and cash equivalents increased by $4. For our property, plants, and equipment, the net value decreases by $10 because of accumulated depreciation. So the net change in total assets is a decrease of $6, and then net income since it declines by $6, flows through into retained earnings. So retained earnings declined by $6 as well. Remember, assets equal liabilities plus equity, which, well, in this case, $6 equals $6, and therefore it balances, and that's the net impact of a $10 depreciation charge.

Key Takeaways:

1. The three financial statements, namely the Income Statement, Cash Flow Statement, and Balance Sheet, are all interconnected.

2. The Income Statement provides information about the total revenue generated and the net income, which is then presented on the Balance Sheet as shareholder equity.

3. The Cash Flow Statement evaluates the variances between cash and cash equivalents by removing non-cash expenditures and alterations in the working capital.

4. Current assets must be adjusted to include cash, cash equivalents, and any necessary adjustments to the cash position after updating it in the Cash Flow Statement.

5. Depreciation is an operating expense on the Income Statement that impacts net income, which eventually becomes a net income question. Although no money is actually spent, it shows up as a positive number on the Income Statement.

6. The asset being accounted for is listed under the total depreciation across various periods of ownership on the Balance Sheet.

7. The depreciation essentially deducts the value of equipment and software, which is the tangible assets, and any intangible assets.

Overall, it's important to understand the individual impact of each financial statement and how they are linked to better comprehend a company's financial performance.