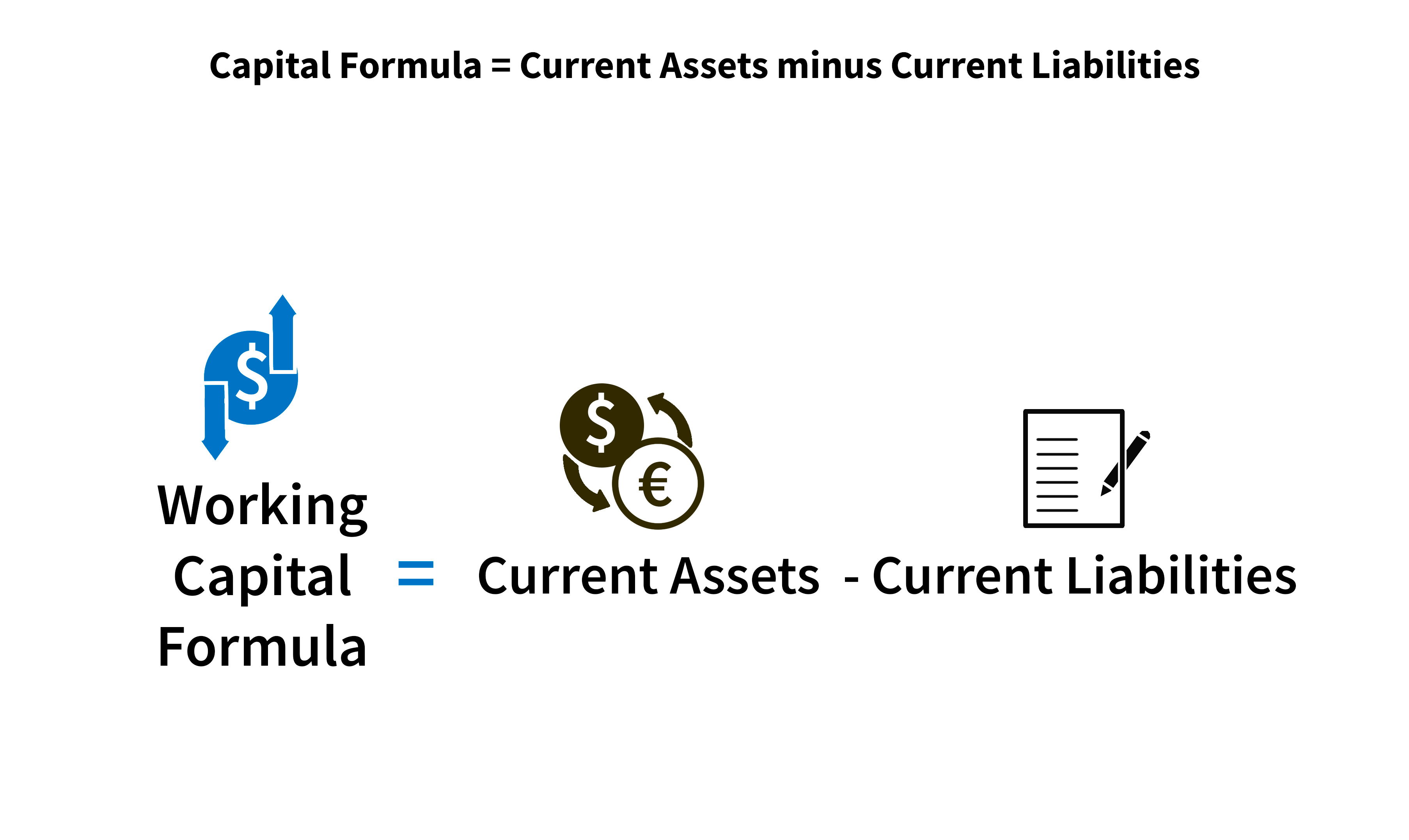

If you are familiar already with what's known as the current ratio, is going to look very similar because working capital uses the same accounts as the current ratio. It uses current assets and current liabilities only as opposed to the current ratio which divides these two numbers. Working capital actually subtracts them, so the formula is Current Assets minus Current Liabilities. That's going to give us our working capital.

The name working capital is essentially a way of saying, after you've paid off the debts you expect to come due in the next year and how much value you have left to essentially work with to help or do something different with the business.

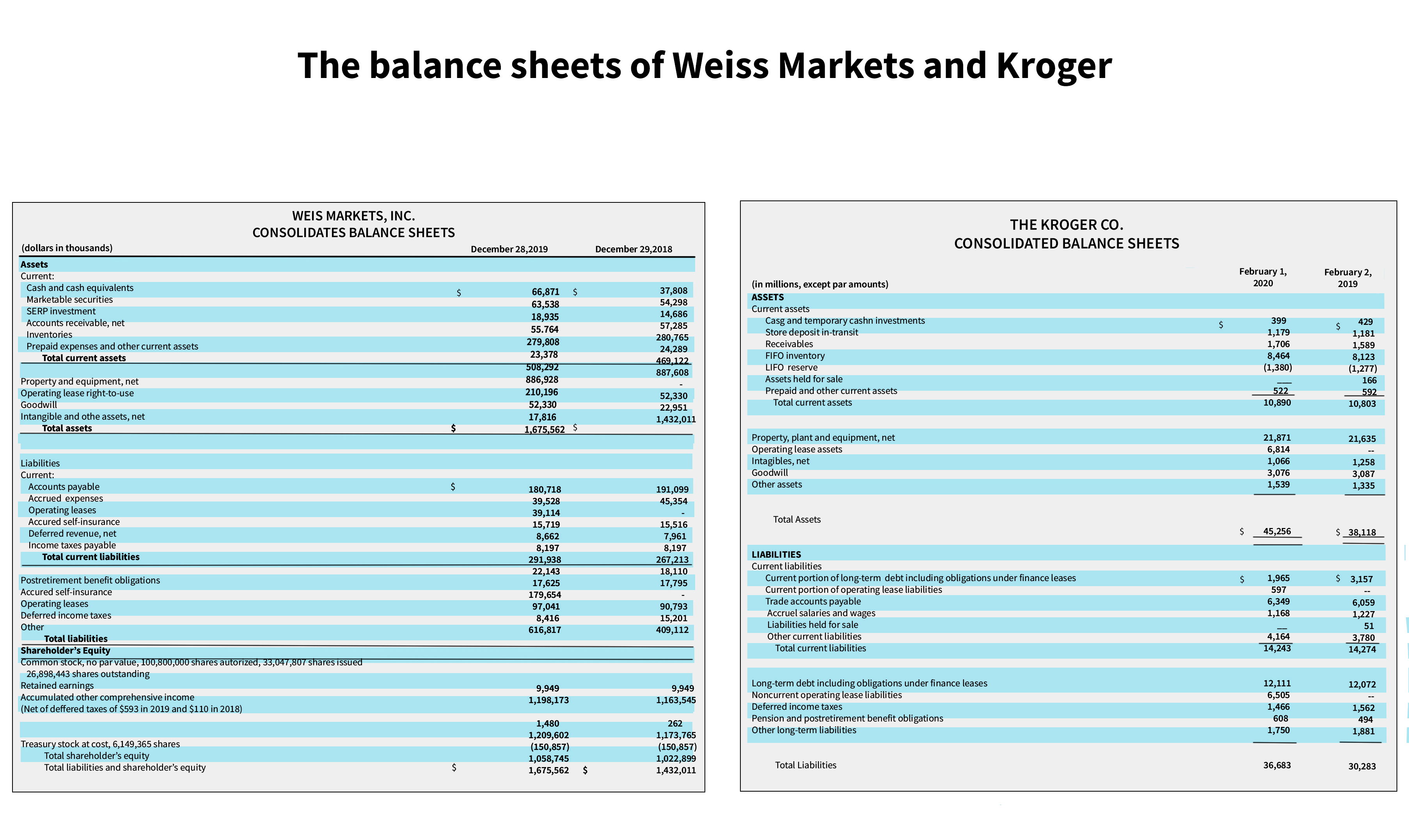

Here, we have the balance sheets of Weiss Markets and Kroger, both in the grocery industry.

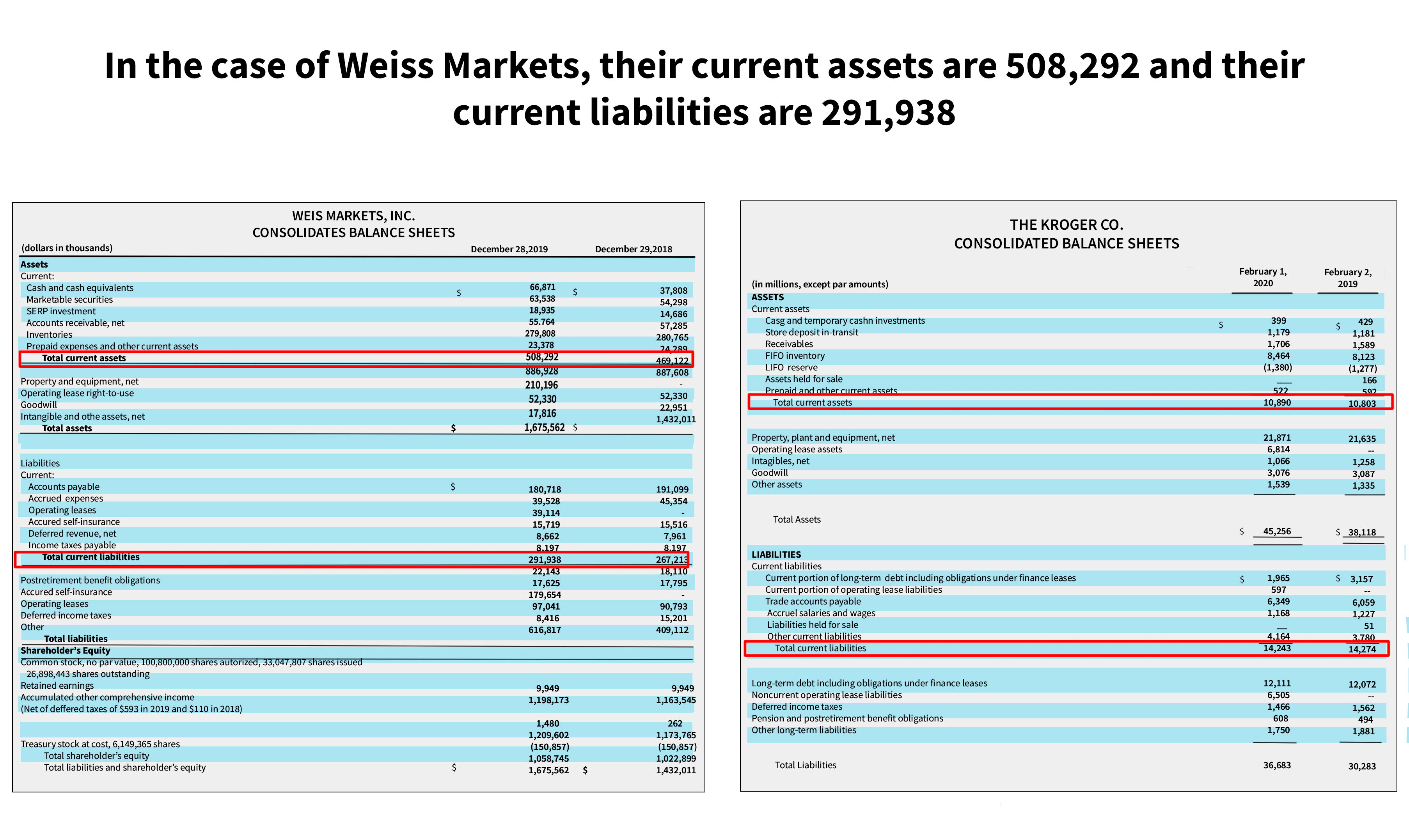

We're going to pull the current assets and current liabilities from both companies. In the case of Weiss Markets, their current assets are 508,292 and their current liabilities are 291,938. On Kroger’s side, we have current assets of 10,890. Don't let the scaling throw you off, Kroger's numbers are in millions Weiss's numbers are in thousands. Then we're going to have current liabilities of 14,243.

We'll do a little math on this. Let's do Weiss first, 508.292 minus 291938 gives us working capital of 216354. if we do Kroger, we've got 10890 minus 14243, or a negative 3353.

Remember that after you pay off your current debts, how much money do you have left to work with? And so, in the case of Weiss, they're going to have 216. This is actually 216 million. They're going to have 216 million left to work with after they've paid off their current debts. Kroger on the other hand won't have anything left. In fact, they don't have enough money to pay off their current debts, and we could have figured that out by looking at this ratio, working capital. We could have also figured it out by looking at the current ratio because that tells us a similar thing. In fact, both of these ratios are what we consider liquidity.

It's a little misleading to say the word ratio because we didn't actually do a ratio, and here we did a subtraction. We just kind of generically referred to it that way but this is essentially telling us that Kroger doesn't have enough money. The magic number here is greater than or equal to zero and it's okay to come in at zero.

You pay off your current debts and you have nothing excess to work with. However, the more you have, the better off you are. What you don't want to be is less than zero because that means you can't pay off your current debts and you're going to be in trouble if you don't make moves to counteract this. There you have it working capital for two different companies with very different outcomes, and this is how you would interpret those outcomes.

Positive vs. Negative Working Capital

Working capital is easy to understand when broken down: it's the amount of cash or cash equivalents you have left after paying off all short-term debts. Calculating current assets involves subtracting liabilities from current assets. The amount of working capital you have will depend on if your current assets are more or less than your current liabilities, but having a negative working capital is not desirable as it shows whether you have enough money to cover your short-term debts. This is a key factor that investors and CFOs use to evaluate the health and risk level of a company.

What exactly does having Positive Working Capital necessarily mean?

A company's short-term debt risks are reduced when it has enough current assets, and any additional working capital can be put to use investing in the company's future growth. But, a large cash balance could indicate that the company is passing up some opportunities. To achieve “positive working capital”, it may be necessary to bring in external financing. On the other hand, if assets are less than liabilities, it could be challenging for the company to settle its current liabilities.

What does having Negative Working Capital necessarily mean?

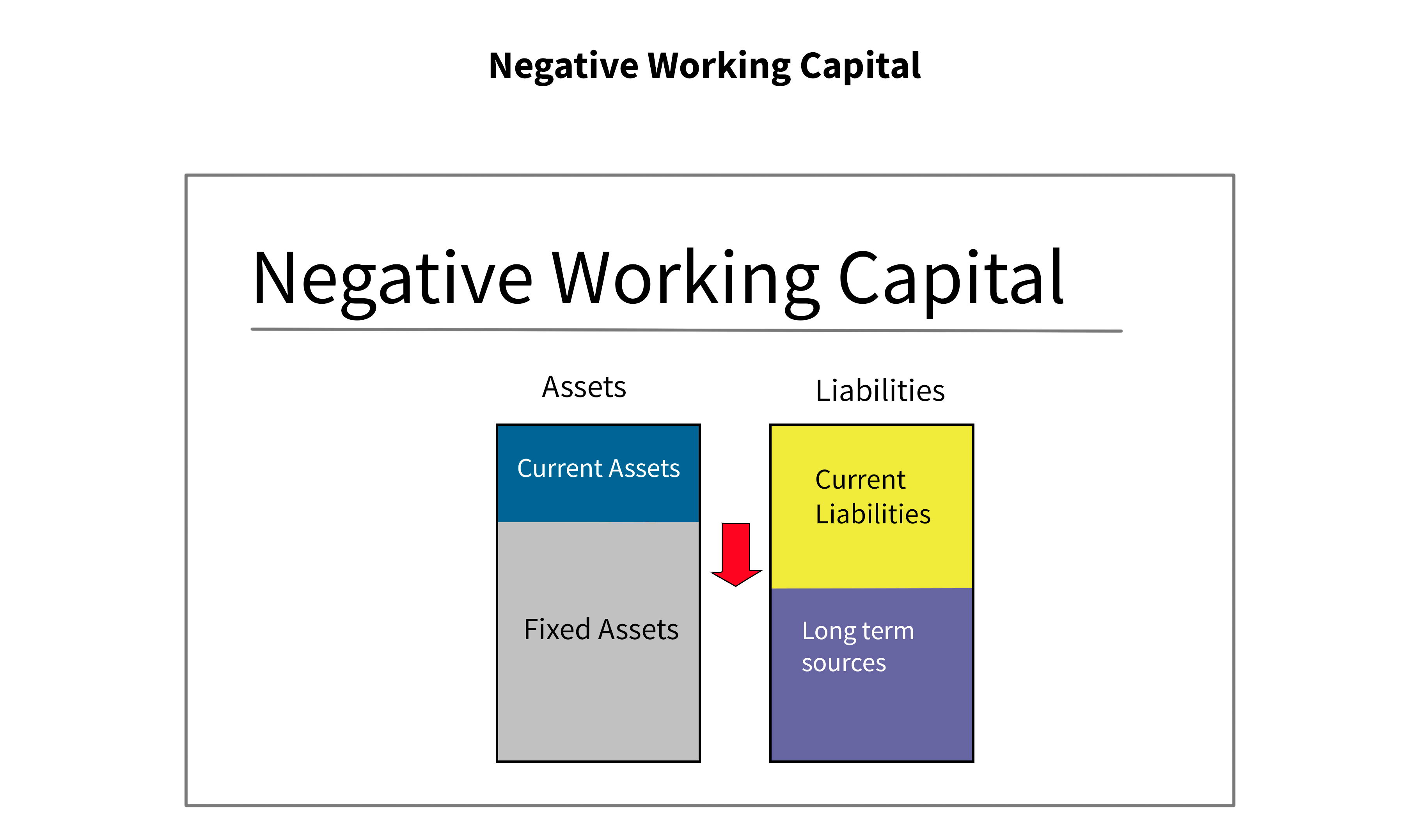

When a corporation has more short-term liabilities than short-term assets, it has “negative working capital”. It may be difficult for the company to meet its responsibilities and pay salaries as a result of this. If nothing is done to address the problem, it might stunt the company's expansion and raise questions about its management and business strategy. To address this, companies may think about obtaining a working capital loan to pay operating expenses and close any cash flow gaps.

Key takeaways:

- Working capital is a financial metric that measures the amount of money that a company has left over after meeting its short-term obligations.

- This metric uses the same accounts as the current ratio but subtracts rather than divides.

- Companies with positive working capital have more financial resources to invest in their operations, whereas companies with negative working capital may struggle to meet their current debts.

- It is a crucial liquidity ratio that can assist investors and analysts in assessing a company's financial status.