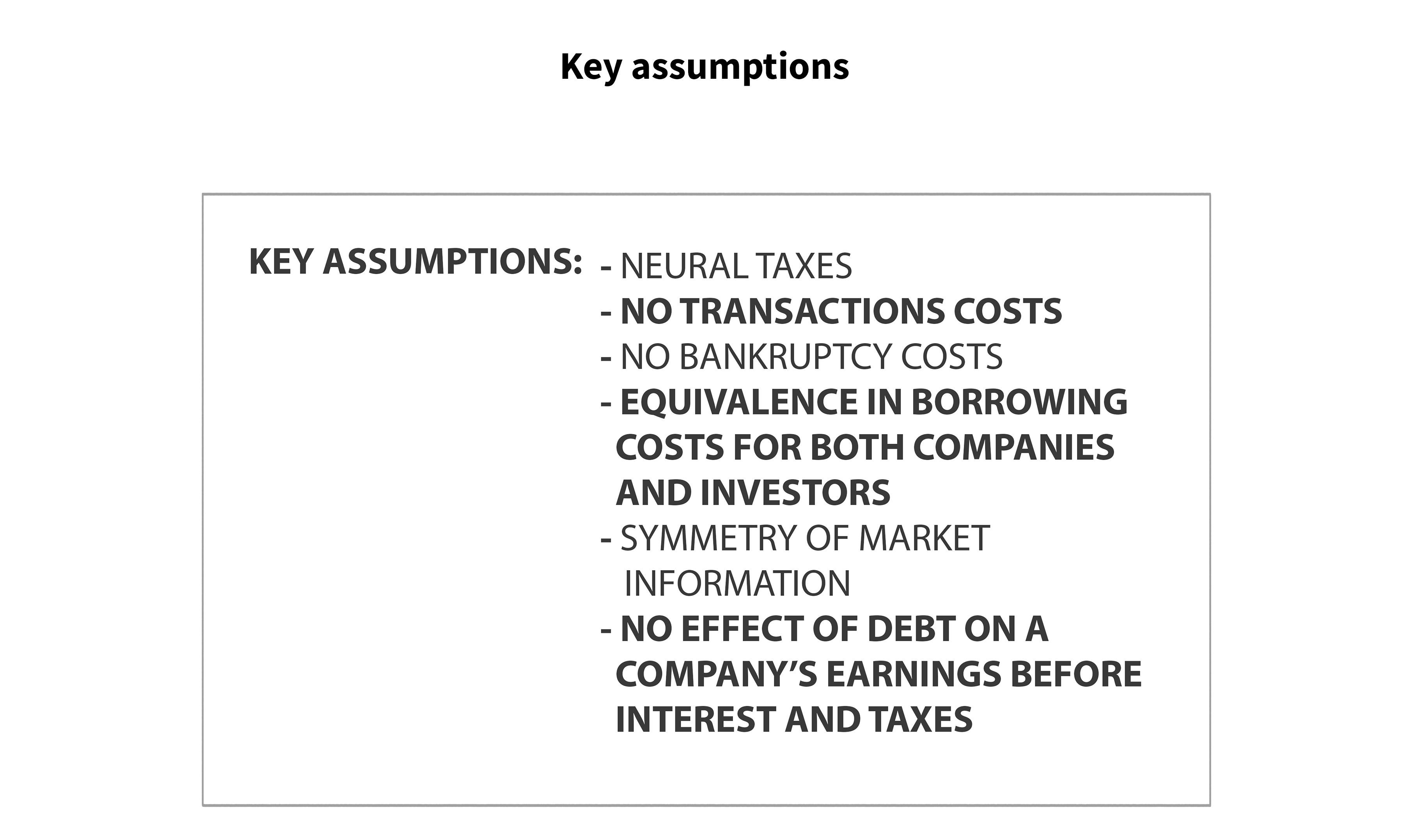

- Neutral taxes

- No transaction costs

- No Bankruptcy costs

- Equivalence in borrowing costs for both companies and investors

- Symmetry of market information

- No effect of debt on a company's earnings before interest and taxes

The theory is also based around some key assumptions:

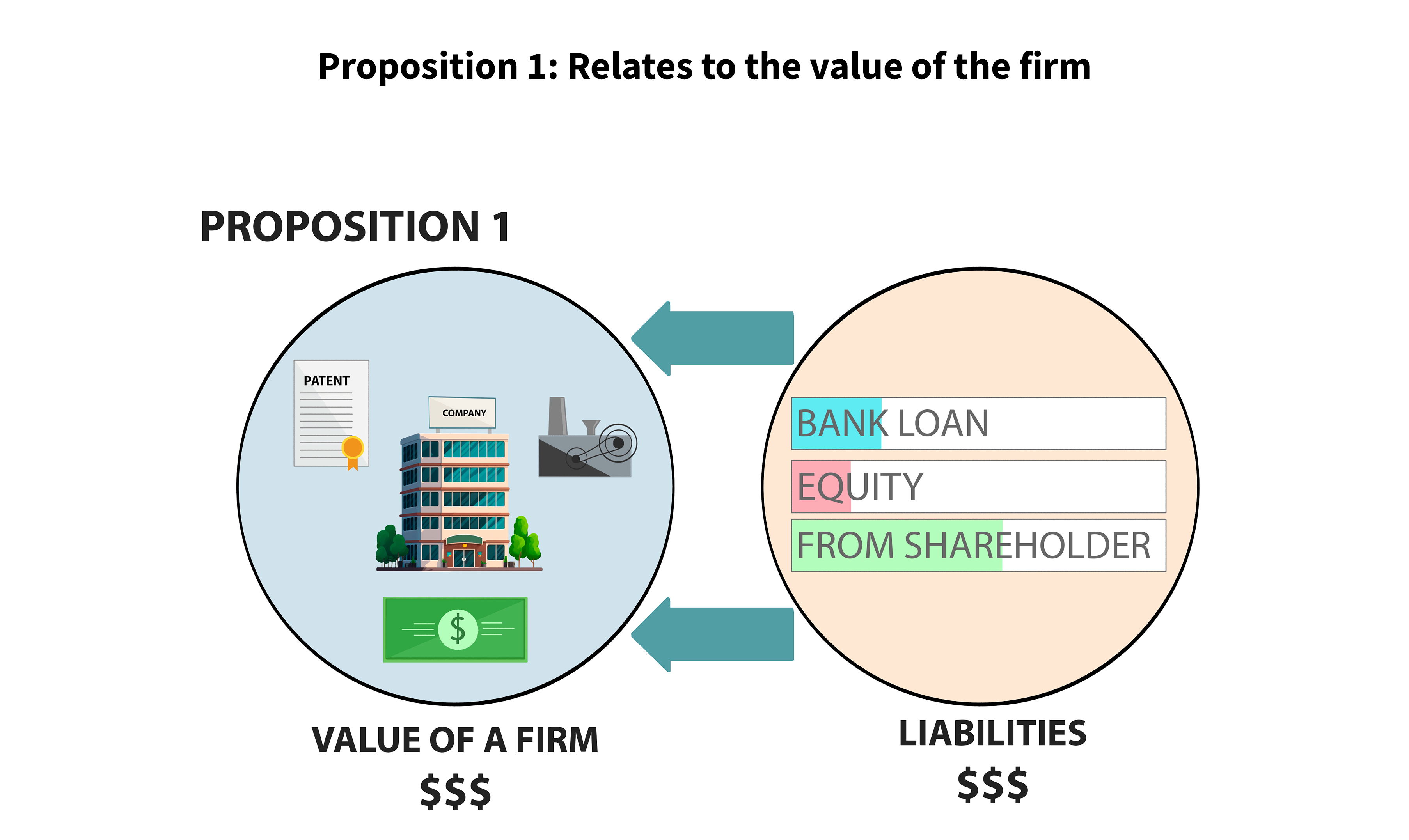

The theory has two propositions: Proposition 1 and Proposition 2

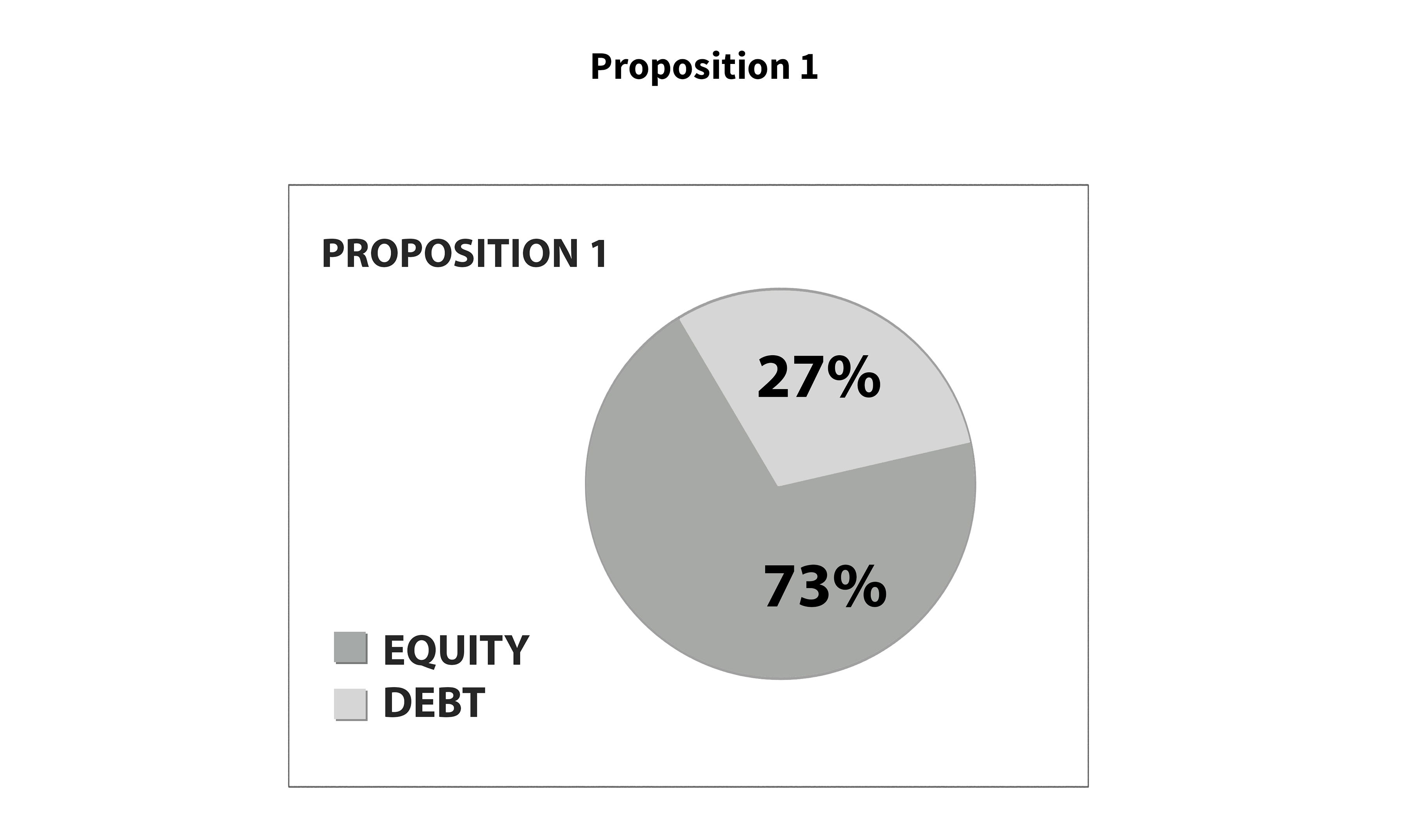

Proposition 1: Relates to the value of the firm

It states that the value of a firm is derived solely from the value of its assets and is independent of the composition of liabilities used to finance those assets.

For example, using the pie model, no matter how you divide the pie, it is still the same size.

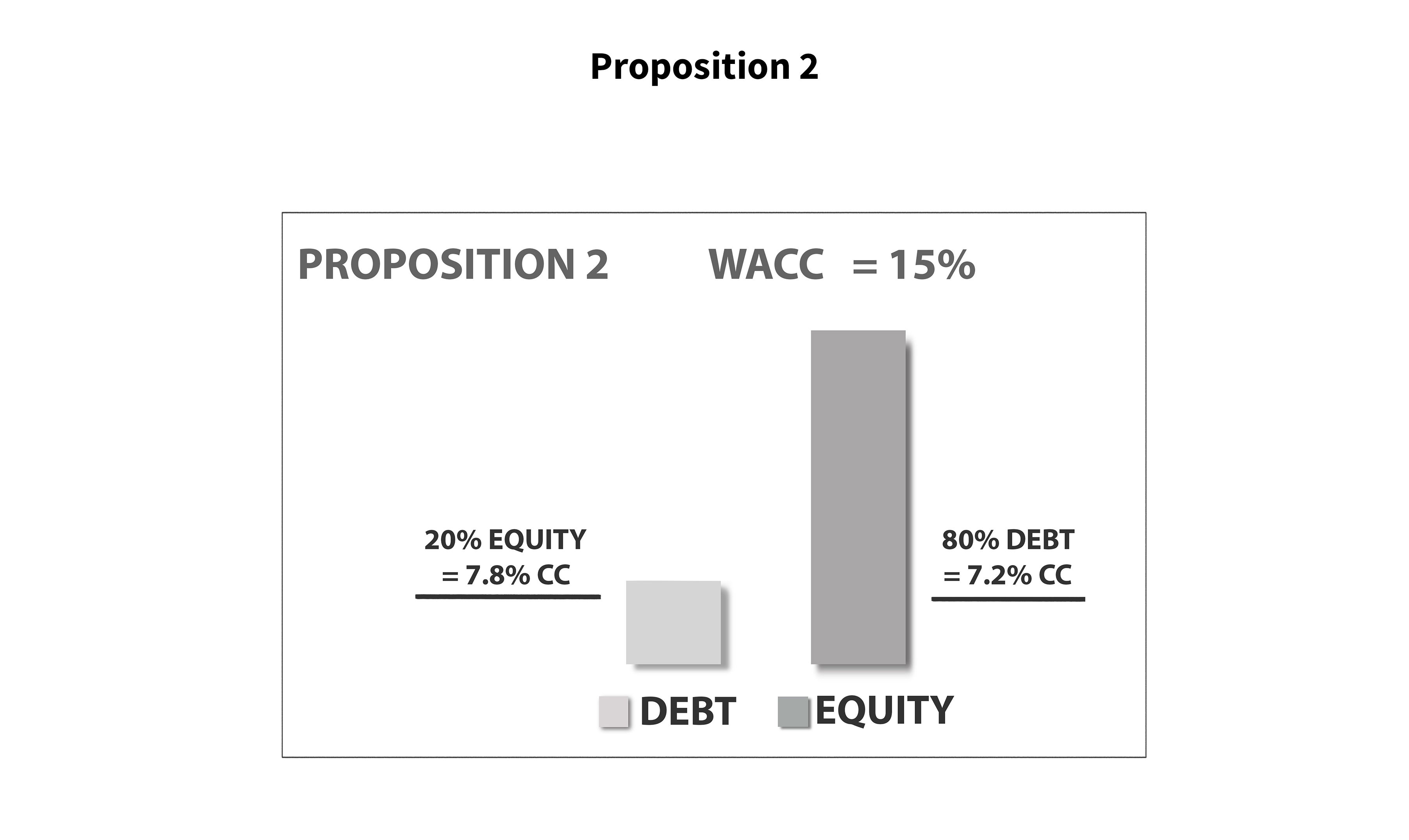

Proposition 2: Looks at the WACC (Weighted Average Cost of Capital)

It states that the WACC is unaffected by the capital structure of a company because any change in debt to equity ratio is exactly offset by the cost of equity.

For example, if we increase the amount of debt to equity we can see that the changes in the Cost of Capital still amount to the same WACC.

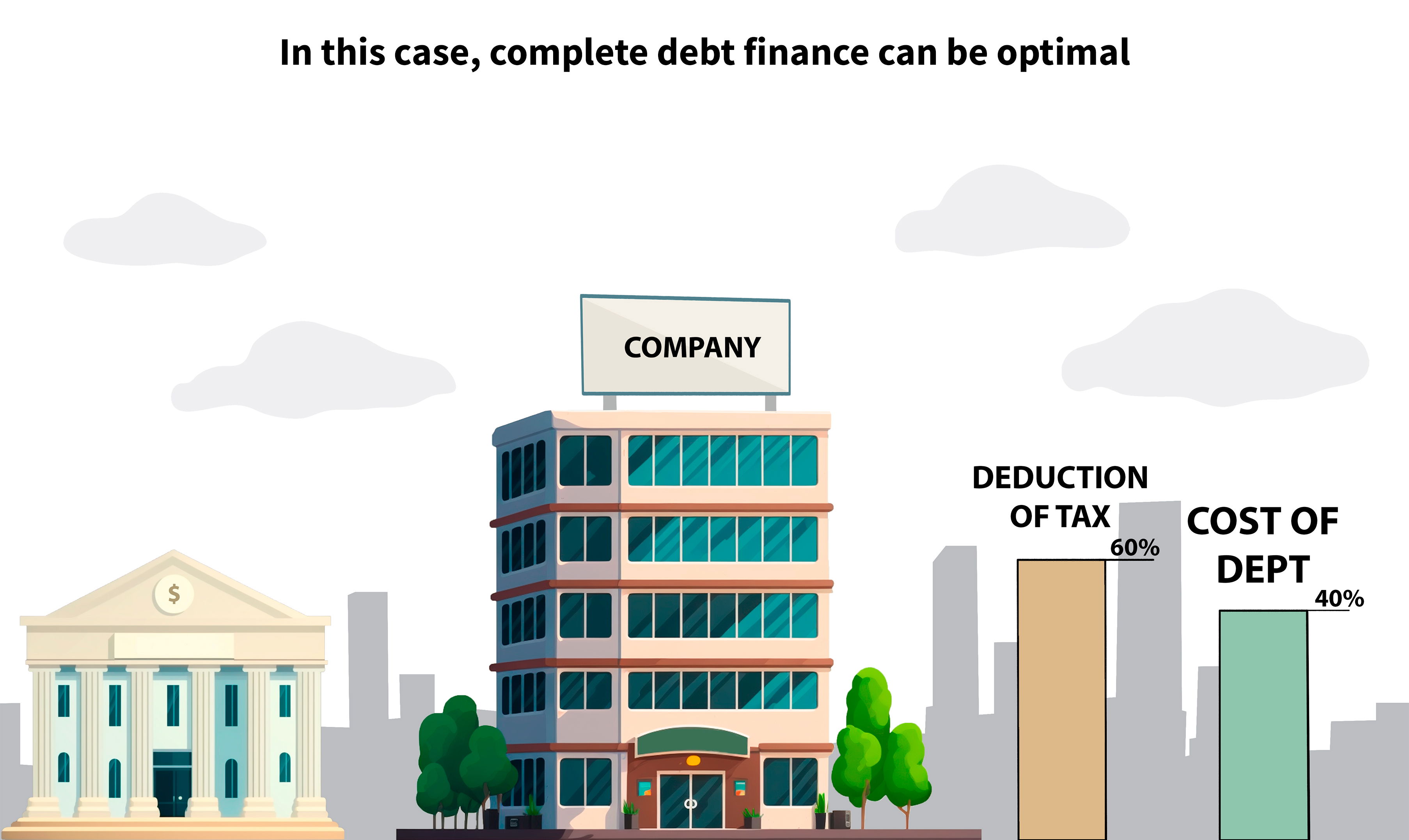

The theory was then further developed to include corporate taxes in this case because the Interest paid on debt is tax deductible it makes debt a cheaper source of finance which increases the value of the firm by increasing cash flow.

In this case, complete debt finance can be optimal.

The effect of taxes on proposition 2 means that the WACC is reduced when a company is highly leveraged.

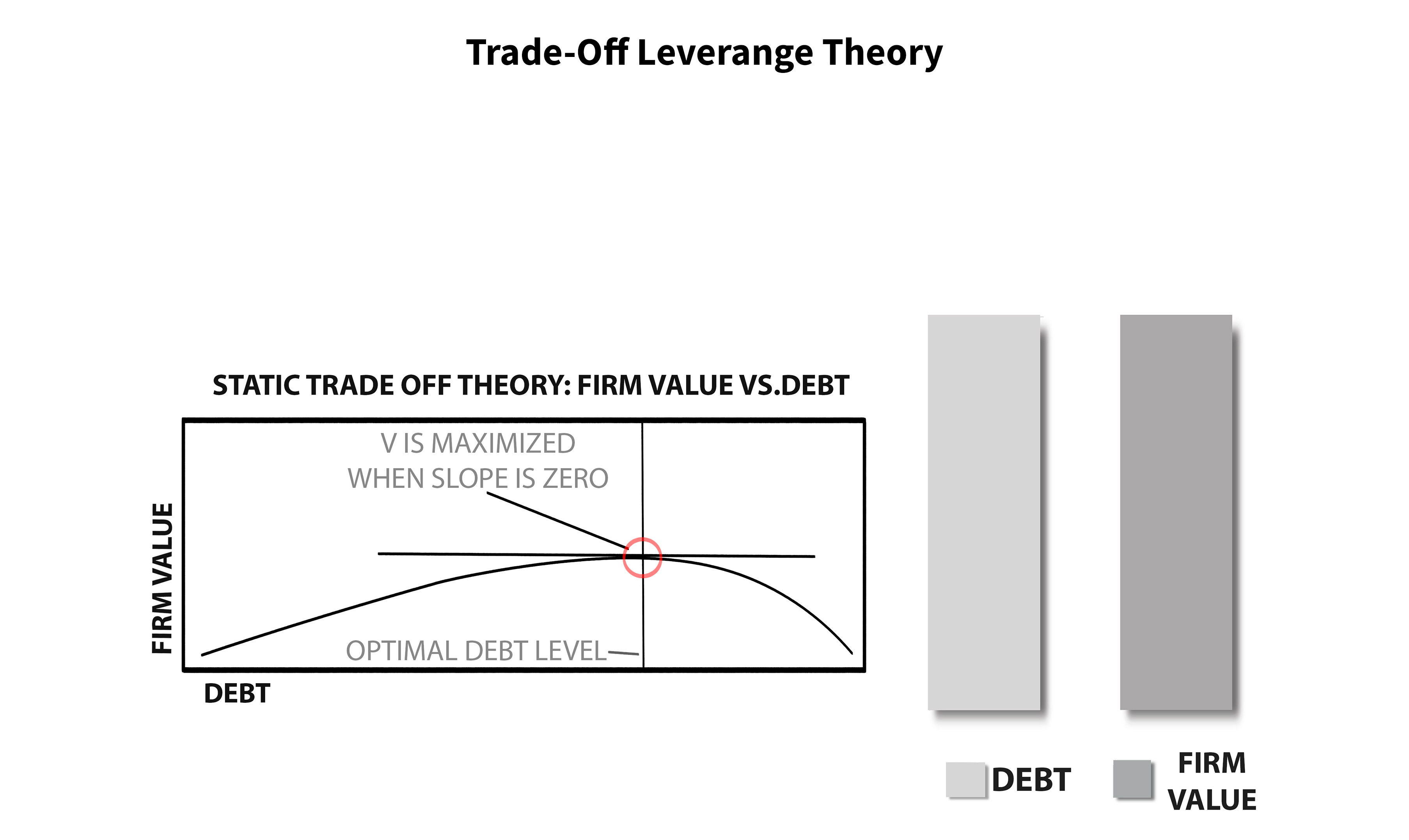

Trade-Off Leverage Theory

States that the closer the company gets to bankruptcy the higher the bankruptcy costs. These costs eventually become greater than the tax savings on debt finance and the value of the company begins to decrease. It means that there is an optimal capital structure that creates maximum value.

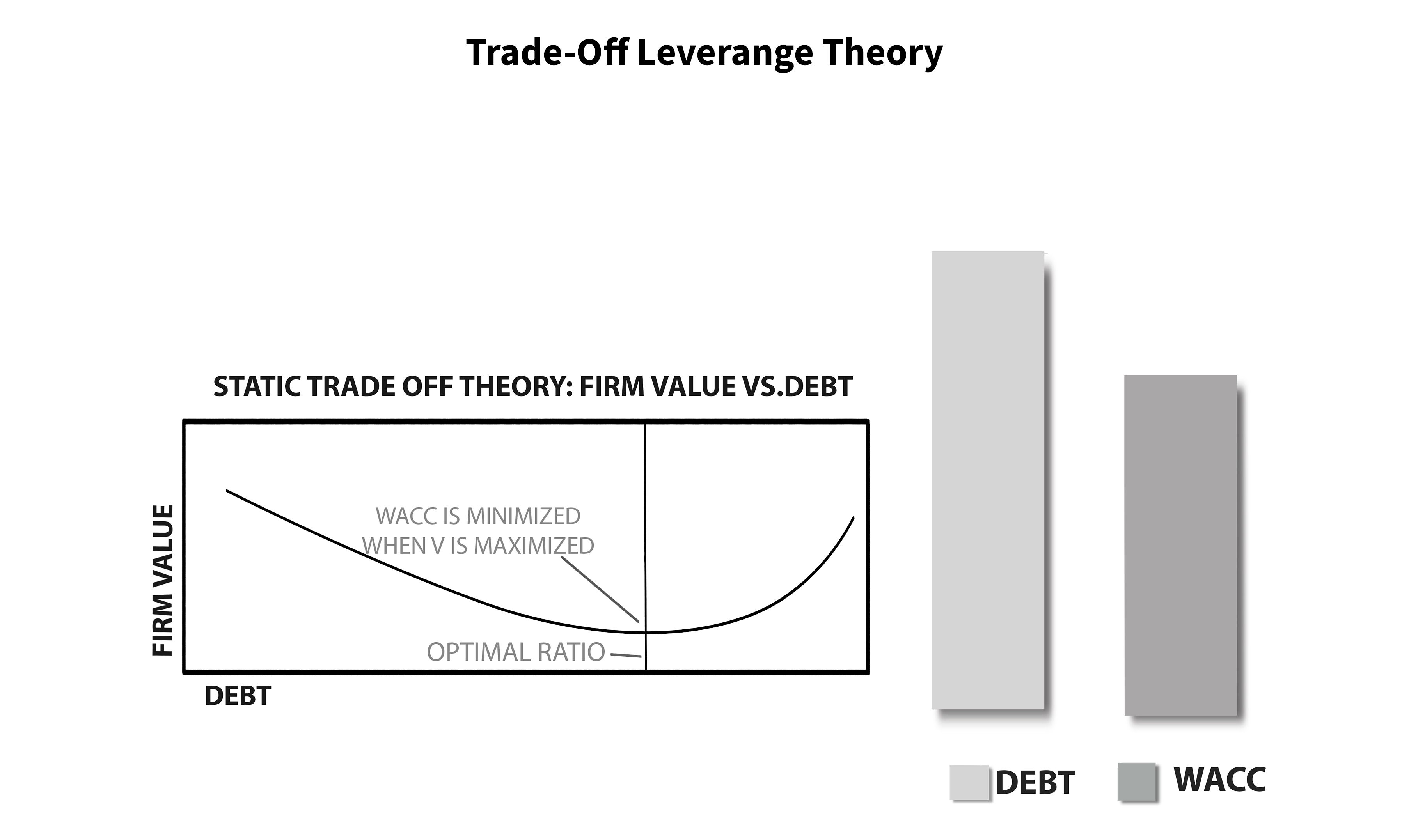

A mix of debt and equity finance. The effect on the WACC is that the closer the company gets to bankruptcy the higher the bankruptcy costs become and therefore the cost of debt finance starts to increase the WACC.

Key Takeaways:

1. The Trade-Off Leverage Theory states that the value of a firm is derived solely from the value of its assets and is independent of the composition of liabilities used to finance those assets.

2. The WACC is unaffected by the capital structure of a company because any change in debt to equity ratio is exactly offset by the cost of equity.

3. The effect of taxes on proposition 2 means that the WACC is reduced when a company is highly leveraged.

4. There is an optimal capital structure that creates maximum value, a mix of debt and equity finance.

5. The closer the company gets to bankruptcy the higher the bankruptcy costs become and therefore the cost of debt finance starts to increase the WACC.