Financial shenanigans purposely alter a company's stated financial performance and financial situation in one of two ways, according to their definition of what they are. The first is to boost current profitability by raising current sales or cutting current costs. Reducing current earnings by increasing current revenues or decreasing current outlays is the second, and perhaps more unexpected, option.

There are plenty of reasons for managers to be interested in making profits in the current period appear like they are higher than they really are. For example, a company may soon go public, it could be in desperate need of a loan from a bank, the top executives may feel like their positions are threatened, etc. So, it's quite clear why someone would want to show a better performance in a current period.

The second group of financial shenanigans is a bit more confusing. Why would anyone be interested in showing a worse performance? For instance, a very strong company may want to create a reserve for a rainy day. So why not save some of the income and prepay some of the expenses so the company comes out on top again next year? Another reason may be that the company is about to be acquired, and the buying company wants the merger to look "fruitful"

This could be accomplished by holding back some of the income now and releasing it after the merger. A third reason could be because a sick company's taking a so-called "big bath", reporting greater losses than justified to clean up in the balance sheet This way, it can more easily look profitable again in the future It's scary how companies can manipulate financial statements in both directions depending on what they want to show investors

The Usual Suspects

There are situations in which financial shenanigans are extra common, where there are greater incentives to fiddle with the numbers. We must now learn how to round up the usual suspects.

Particularly, we should be careful with companies that:

1. Are making lots of acquisitions

2. Has dumb incentives for managers

3. Are private

4. Recently went public

5. Recently changed the business model

6. Has operational problems

Typically, a company that is making a lot of acquisitions, especially of weaker companies, could have something to hide There's a very big difference between growth from acquisitions and organic growth from the core business. Don't make my mistake and be extra skeptical when you see this behavior.

It's quite common for managers to receive bonuses if their unit or department performs well If these bonus systems are formed in a clever way, they can create incentives that are favorable for the stock owners. However, if they are formed in a dumb way, they can be truly harmful.

Private companies are often not required to issue audited financial statements meaning that, they haven't been checked upon by an outside certified public accountant. A company that is about to go public may be interested in inflating earnings as typically, many of the early shareholders will make exits.

A warning sign in and of itself, changing the business model likely indicates that the company's primary operations are no longer feasible. Additionally, it offers the chance to manipulate earlier accounting principles. If the business strategy changes from being clear-cut to being obscure, be very wary.

Operational problems are probably the biggest ones. Specifically, you should be extra careful when the growth of sales and profits are declining, there are large amounts of receivables or inventory to sales, and operating cash flow is slowing down in relation to earnings.

The Seven Shenanigans

The top seven tricks used by businesses to deceive investors are as follows:

1. Revenues that are either inaccurately or prematurely recorded. The exchange acts as a directing factor, and revenues are recorded once the earnings process is completed. Businesses break this rule, for example, when they report income while there is still a ton of work to be done. Think about a five-year deal with an IT company. contract for the delivery of a certain piece of software, but chooses to report the entire five-year revenue in the first year.

2. False revenue is being recorded. This is an amalgamation of the previous shenanigans. Companies will sometimes decide to create revenue out of thin air. Among the tricks are the following:

- Recording sales when it is highly unlikely that the customer will ever be able to pay.

- Lending transactions are referred to as revenue rather than debt.

- Instead of a reduction in operating costs, rebates are recorded as operating income.

3. Income can be increased through one-time gains. Keep an eye out for revenue-generating investment income, such as when a company sells shares in a subsidiary. Keep an eye out for balance-sheet reclassifications as well.

4. Current costs are postponed to a future or past era. A business should deduct costs that won't result in future benefits and capitalize on those that will. Companies are allowed to push expenses like these to the balance sheet rather than directly deducting them from revenue in the current period when investing in assets that are likely to create profits either directly or indirectly over longer time periods. This certainly appears fair, but it's quite simple to tamper with it by capitalizing a cost that should be identified as an operating expense or by capitalizing a cost that should be identified as an operational cost. Costs can then be spread out across the anticipated lifetime of that asset.

5. Incorrectly reducing or failing to record liabilities. If an organization must make future sacrifices, it has assumed liability. An airline company that does not record liabilities for frequent flyer incentives each time a ticket is purchased is an excellent example. A different, more common example is a company changing the accounting assumptions used in its pension plans.

6. Putting off the receipt of existing revenues. Revenues should be recorded in the period that they are earned. It is incorrect to report revenue in a later period if the service is provided in the current period. One of the more common shenanigans among successful companies is the creation of reserves in the current period in order to release them later. And why are they doing it? Because Wall Street rewards companies that provide a smooth ride with higher trading multiples.

7. Future costs are charged to the current period as a special charge. Expenses must be billed when the benefit is received. Exaggerated figures listed under the category of special charges should be avoided. Companies that write off acquisition expenditures too quickly should be avoided. The shenanigans can be innocent or overtly fraudulent. A warning sign is when accounting projections in pension plans change.

THINGS TO CONSIDER BEFORE LOOKING AT THE FINANCIAL STATEMENT

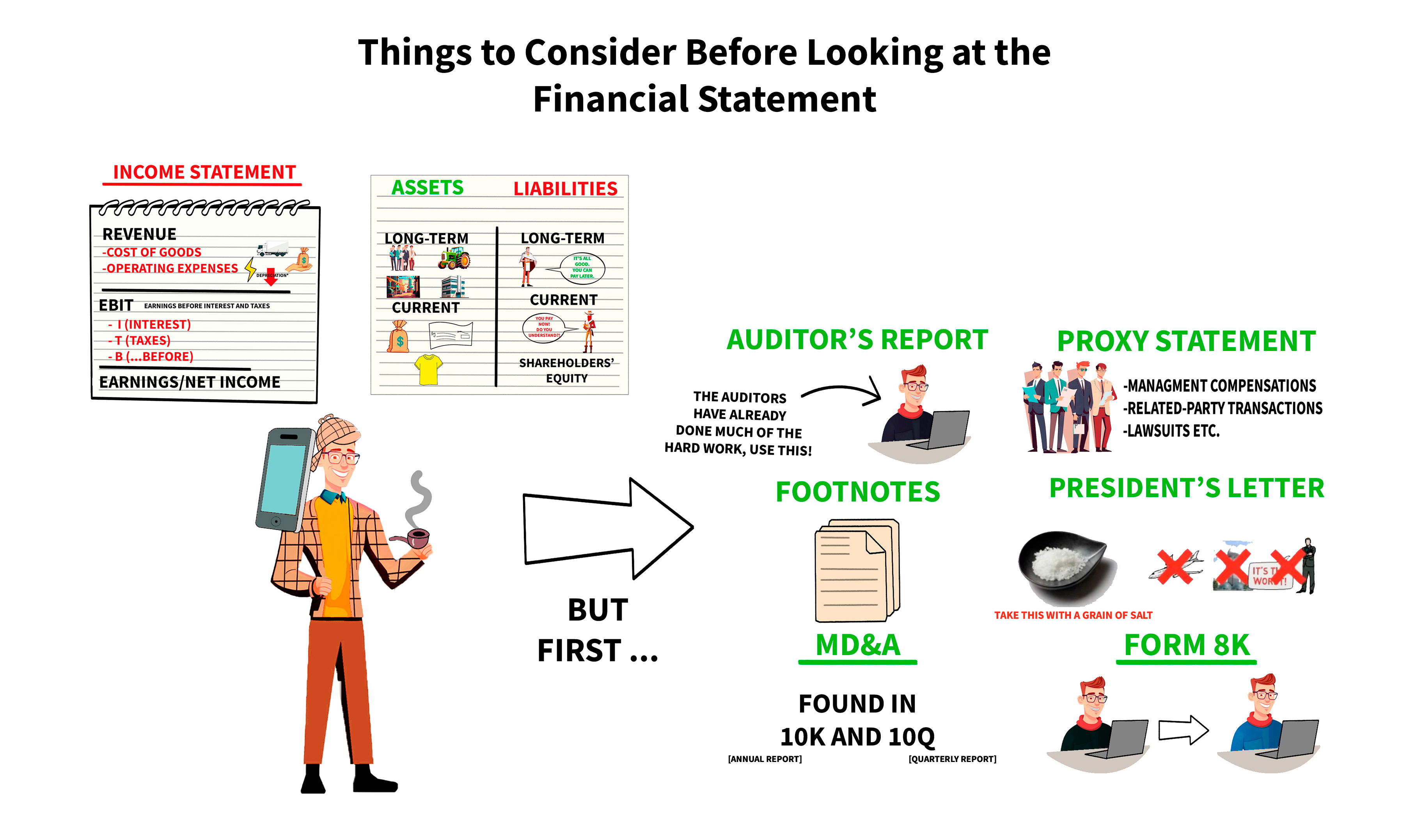

Identifying these shenanigans can be done through a thorough investigation of a company's financial statements, but as this is quite time-consuming, we should make the process more efficient by first considering:

1. Auditor's Report. This is the first go-to The auditor has spent plenty of time examining the company's reporting, don't waste your time by not using this resource Look for the absence of opinion or of a qualified report Also, think about the reputation of the auditor.

2. The Proxy Statement. Look for management conversations and for related party transactions Also, look for things such as lawsuits and other contingencies.

3. Footnotes. Look for the accounting policies and be extra alert when you see changes in these from year to year Also, search for long-term commitments that the company has.

4. The president's letter. We should definitely read the comments that the CEO makes every year or so about his company, but you should also definitely take this with a grain of salt. A pilot wouldn't crash his own plane, an architect wouldn't admit a flawed design, and a CEO would never badmouth his own company. Watch out for the word "challenging" though, and any synonyms to it. It is a red flag.

5. The MD&A. This is the management discussion and analysis found in the 10Ks and 10Qs. Beware when the management tries to twist unfavorable developments into favorable ones Also, beware of high management turnover.

6. Form 8K. A company must submit a form 8K whenever there's a major event relevant to shareholders that have been happening. There are plenty of important ones, but for financial shenanigans, changes in auditors top the list.

Once you've read through this, consider calling one of these persons with concerns: The CFO, the head of Investor Relations, the corporate controller, or the treasurer. Often, this can help you to quickly gauge whether one of your assumptions is correct or not. If you are already a shareholder of the company, remember that these people are essentially working for you.

Common-Size Analysis

The common-size analysis is a very useful technique for investigating a company's financial statements. Not only from a shenanigans perspective but also from a performance perspective. The tool can be used for cash flow statements too, but I think it's more useful and common for income statements and the balance sheet. Common-size analysis can be used vertically, which means within a year, or horizontally, to express changes between years.

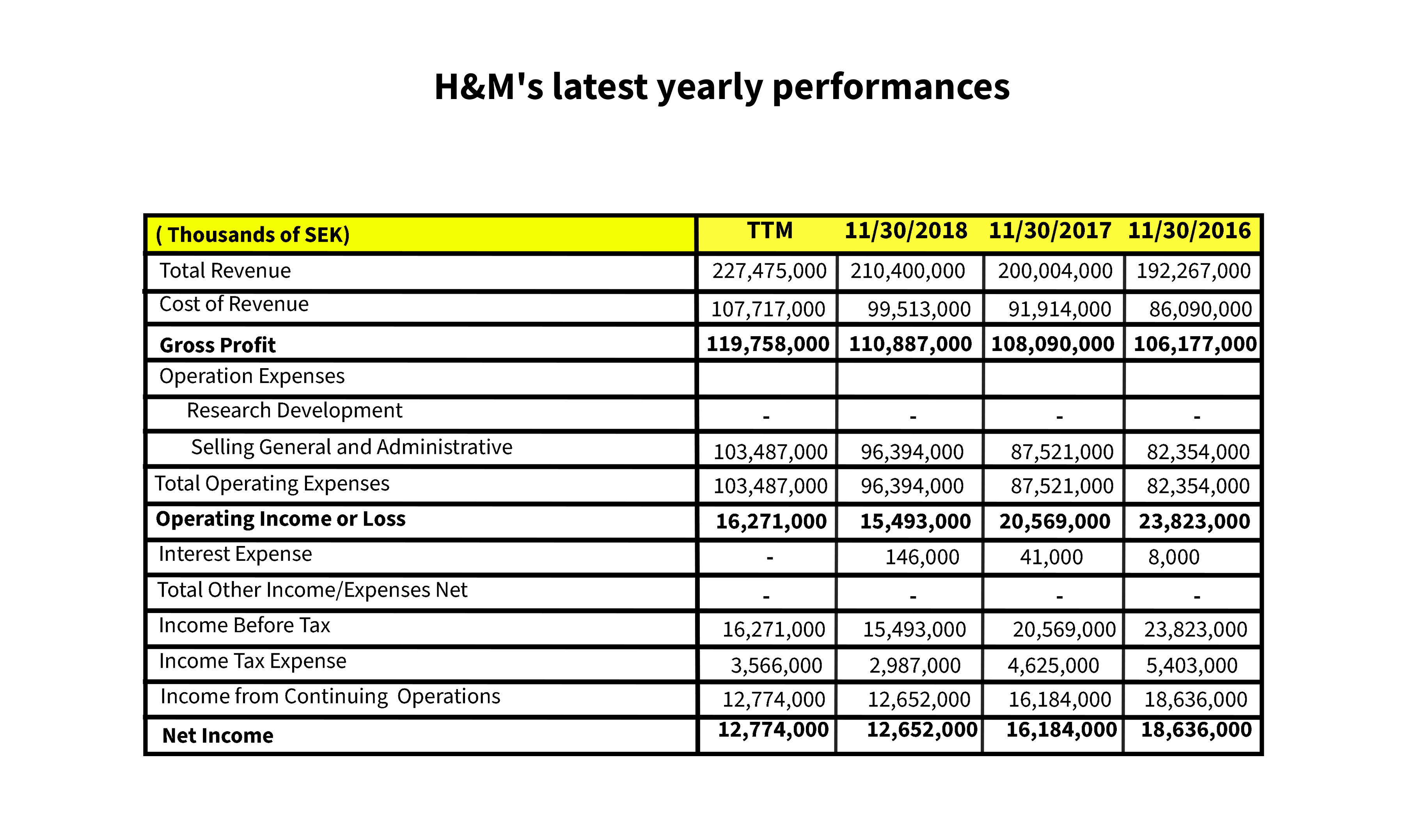

Here's what H&M's latest yearly performances look like:

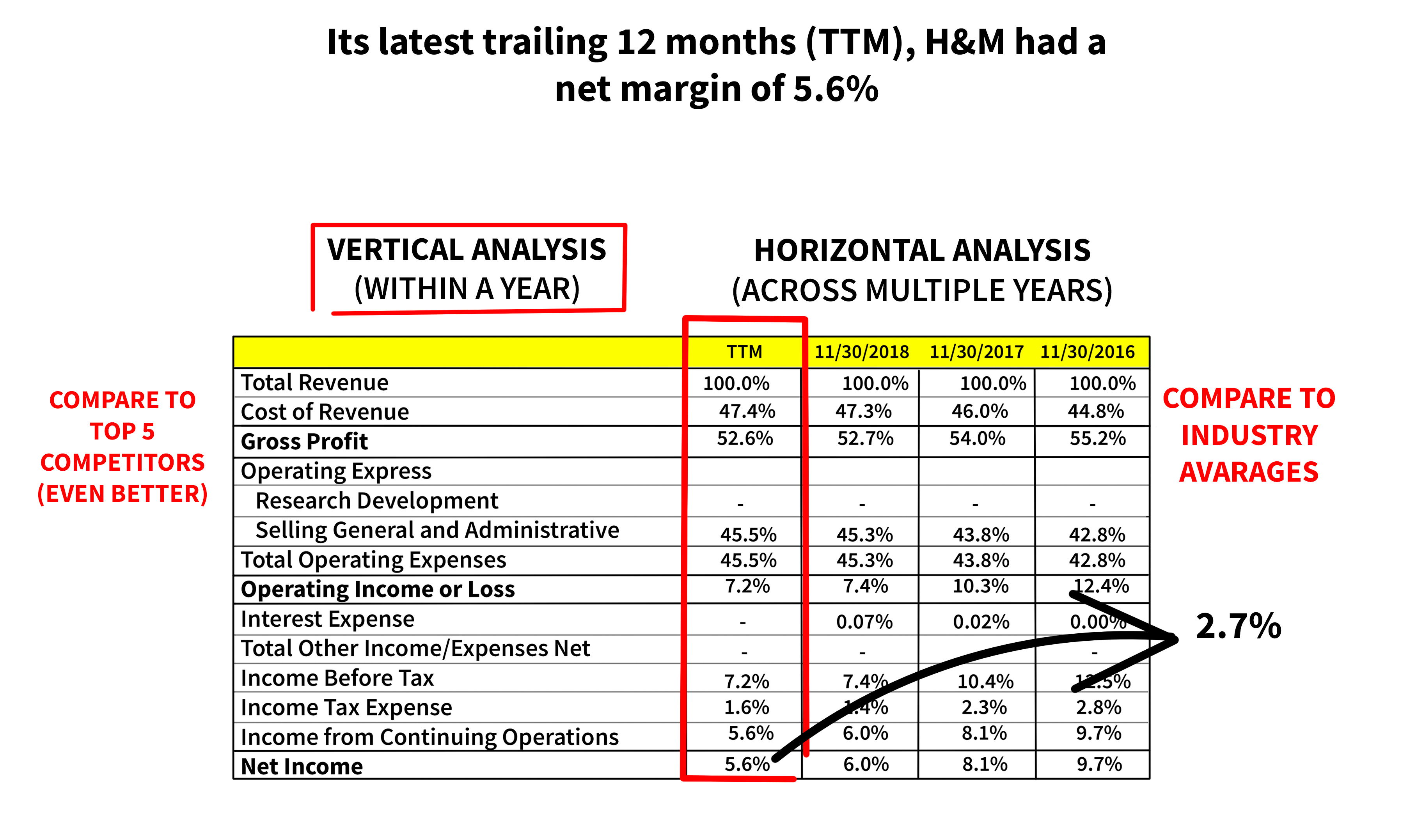

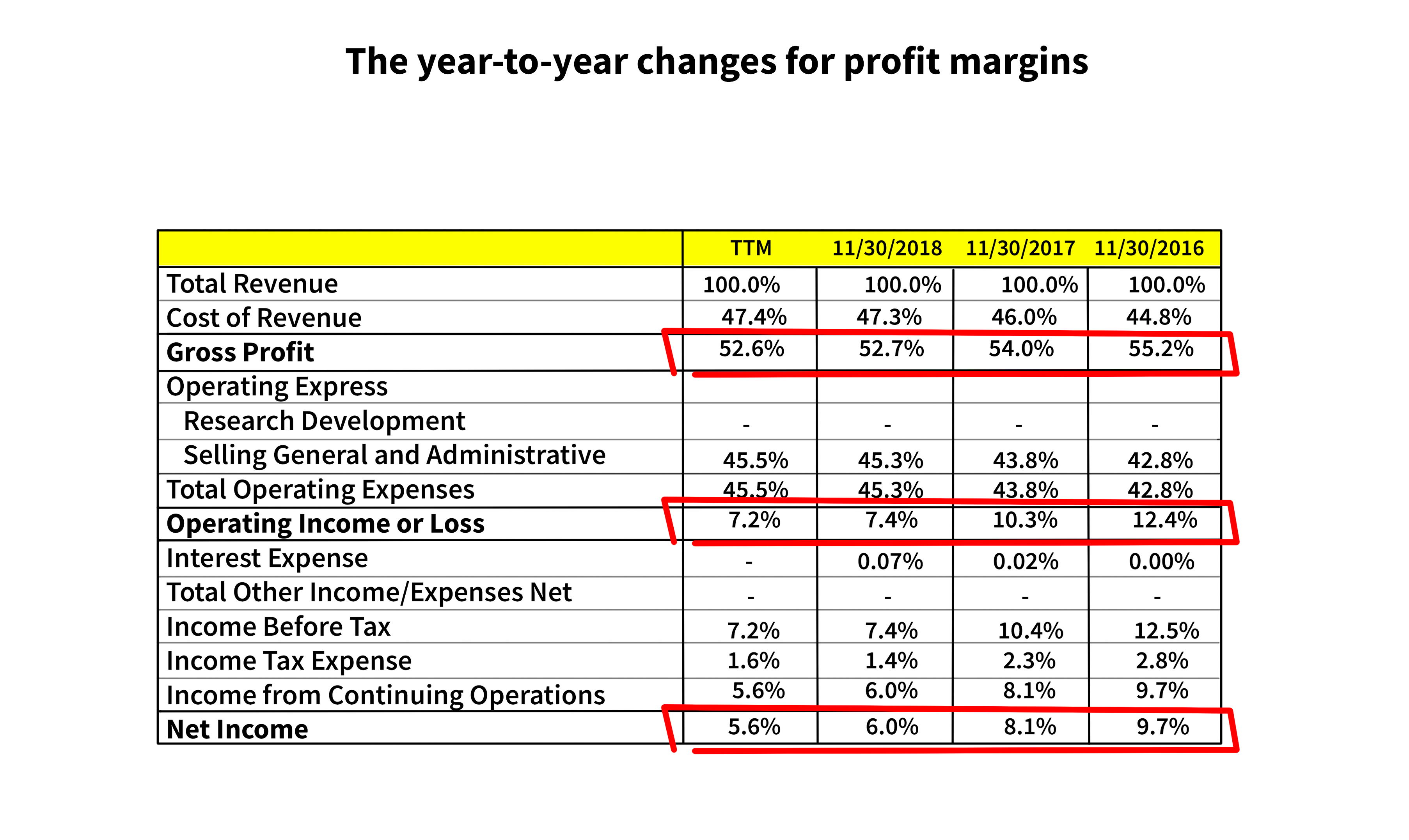

All these numbers may not say much at this point. When we do a vertical analysis, we express all the entries in the income statement as a percentage of the top line (the revenue) each year. This reveals a whole lot more, especially, if we compare it to numbers for the retail apparel industry in general. The industry data is gathered from zacks.com.

For example, in its latest trailing 12 months (TTM), H&M had a net margin of 5.6%, compared to the industry average of 2.7%. You can look for the top 5 competitors of a company, and then compare the vertical analysis between these.

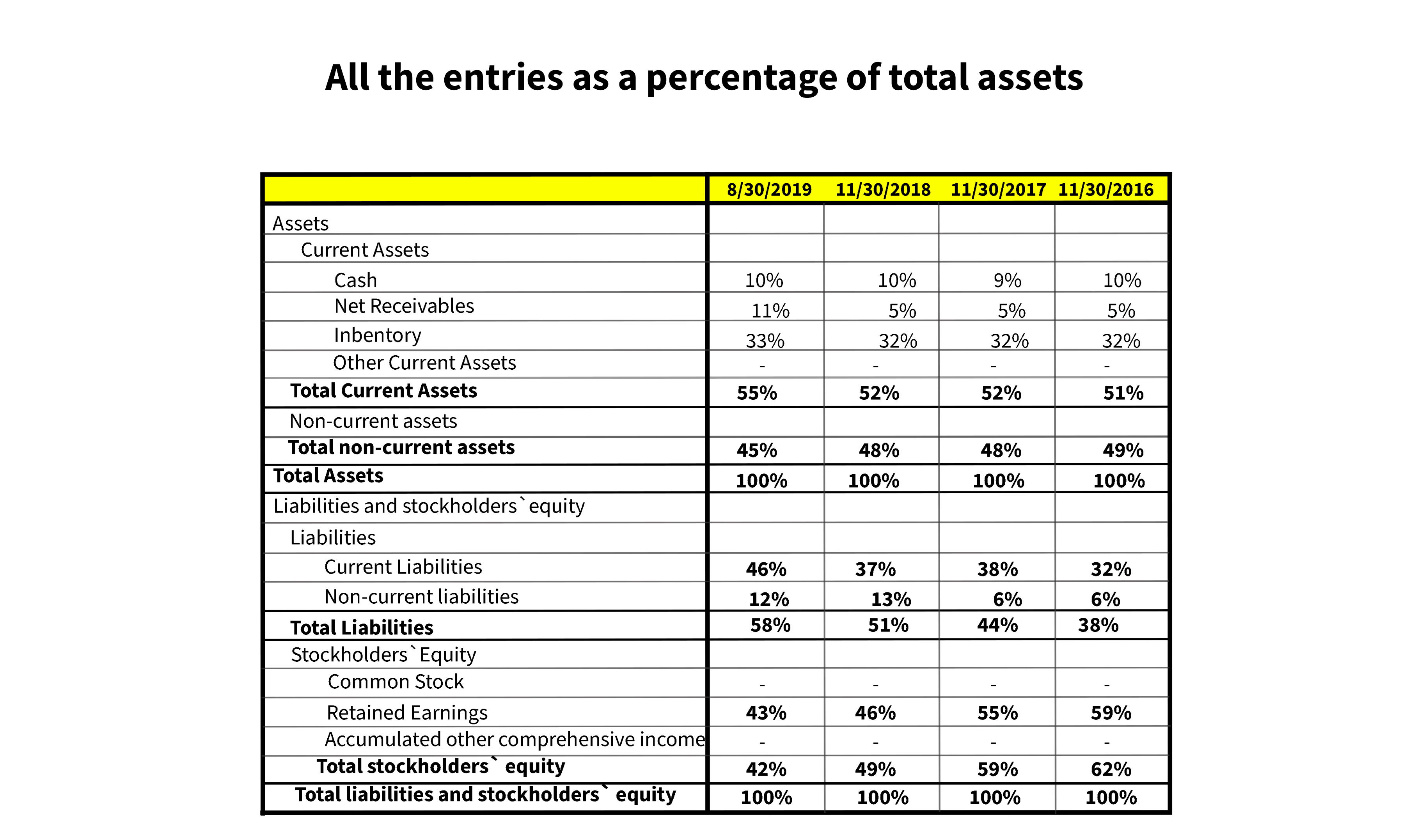

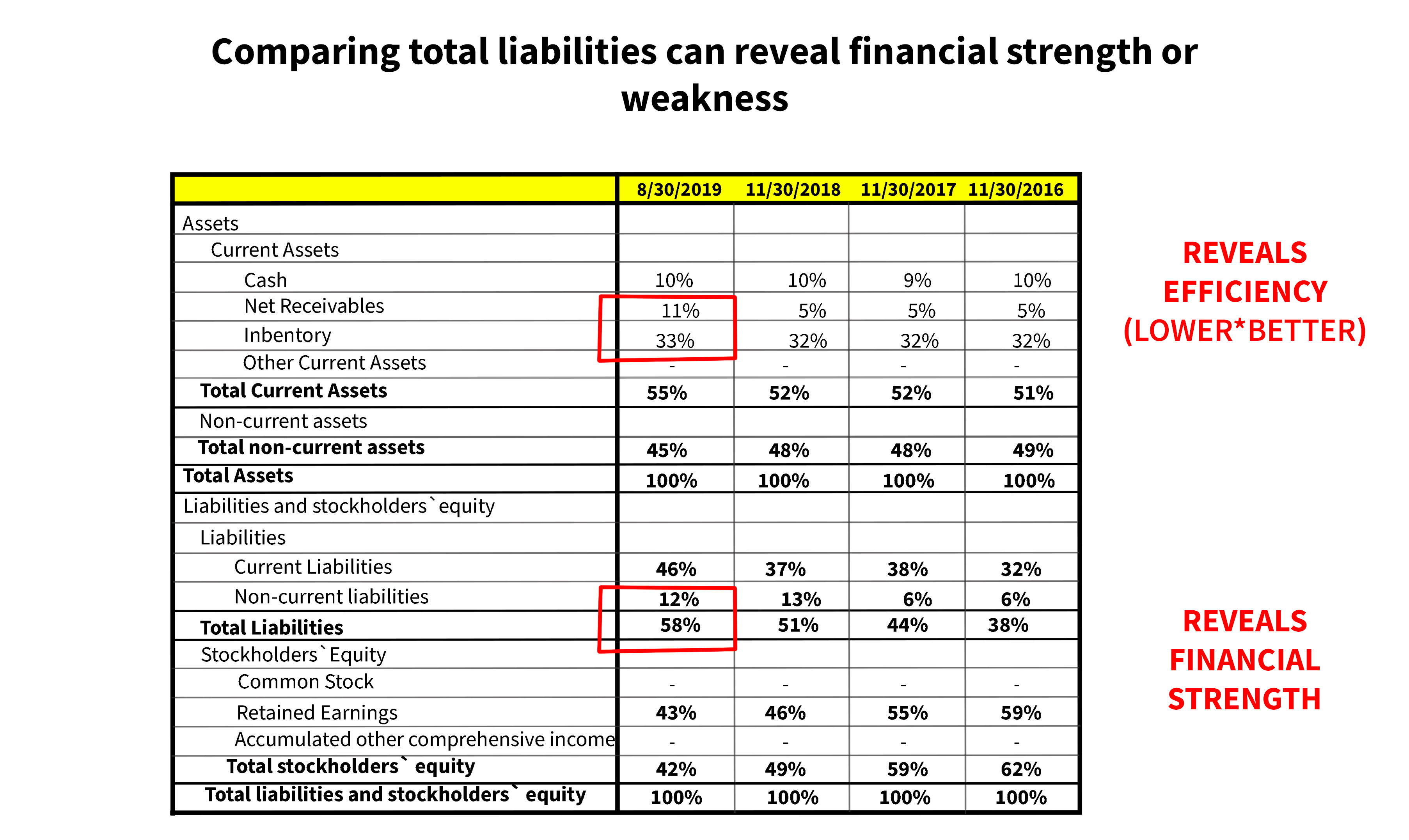

Once again, it doesn't say much in its current form, however, if we do a vertical analysis, we'll express all the entries as a percentage of total assets.

For example, comparing the inventory and net receivable entries to that of the top 5 competitors could reveal a whole lot about the efficiency of the H&M business. Well, it's actually even better to compare net receivables and inventory to sales from the income statement, but this will do for now. Comparing total liabilities can reveal financial strength or weakness.

Back to the income statements, to do the horizontal analysis and by keeping entries expressed as percentages of sales, we can see the year-to-year changes for profit margins. Unfortunately, for H&M, this doesn't look good on either gross, operating, or net levels. All the margins are deteriorating, and we should ask ourselves why this is happening before ever buying the stock.

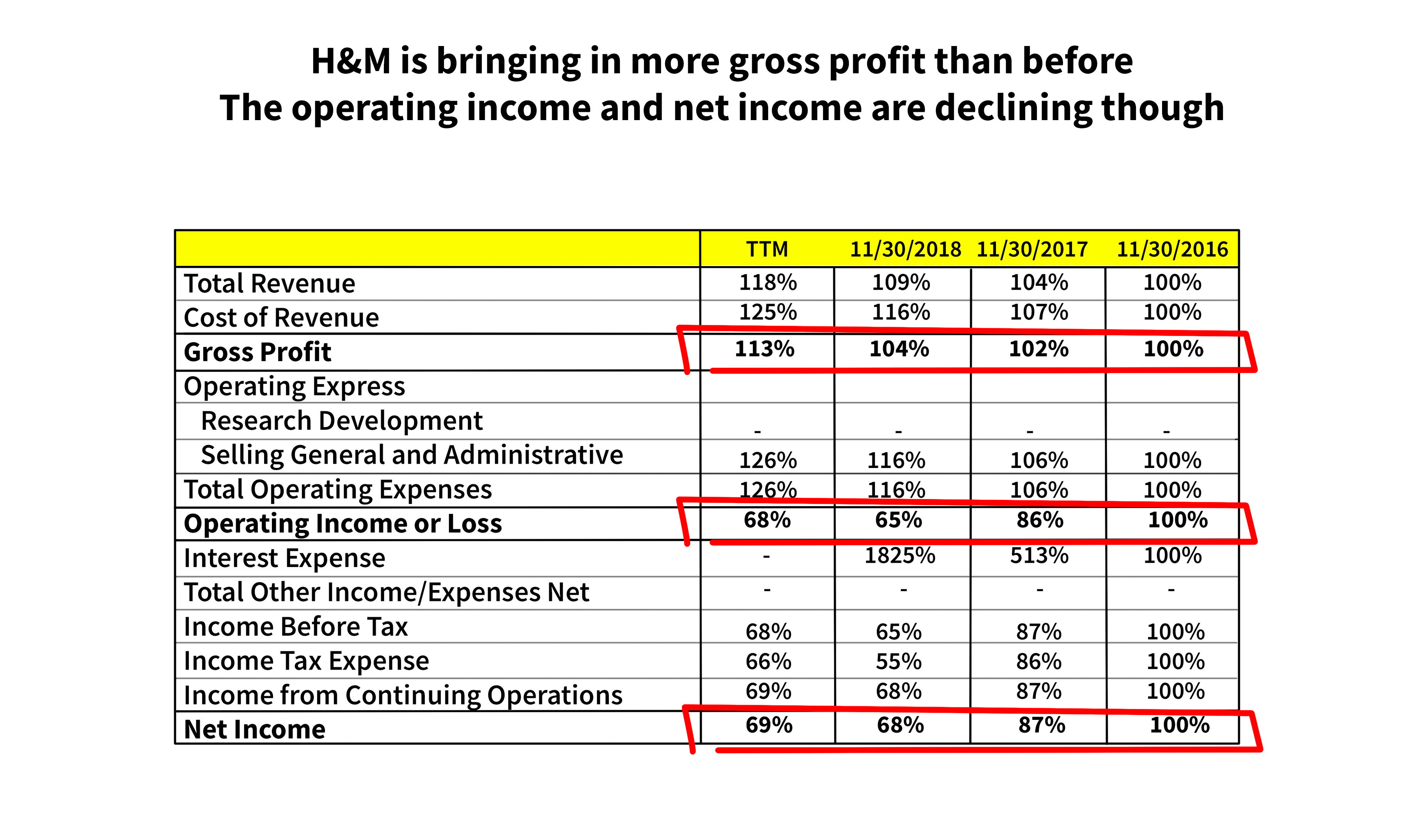

Moreover, we can see if the deterioration is just relative or if it, even worse, is happening in absolute numbers, by expressing all the entries as percentages of the entries from 2016. This reveals that, at least, H&M is bringing in more gross profit than before. The operating income and net income are declining though.

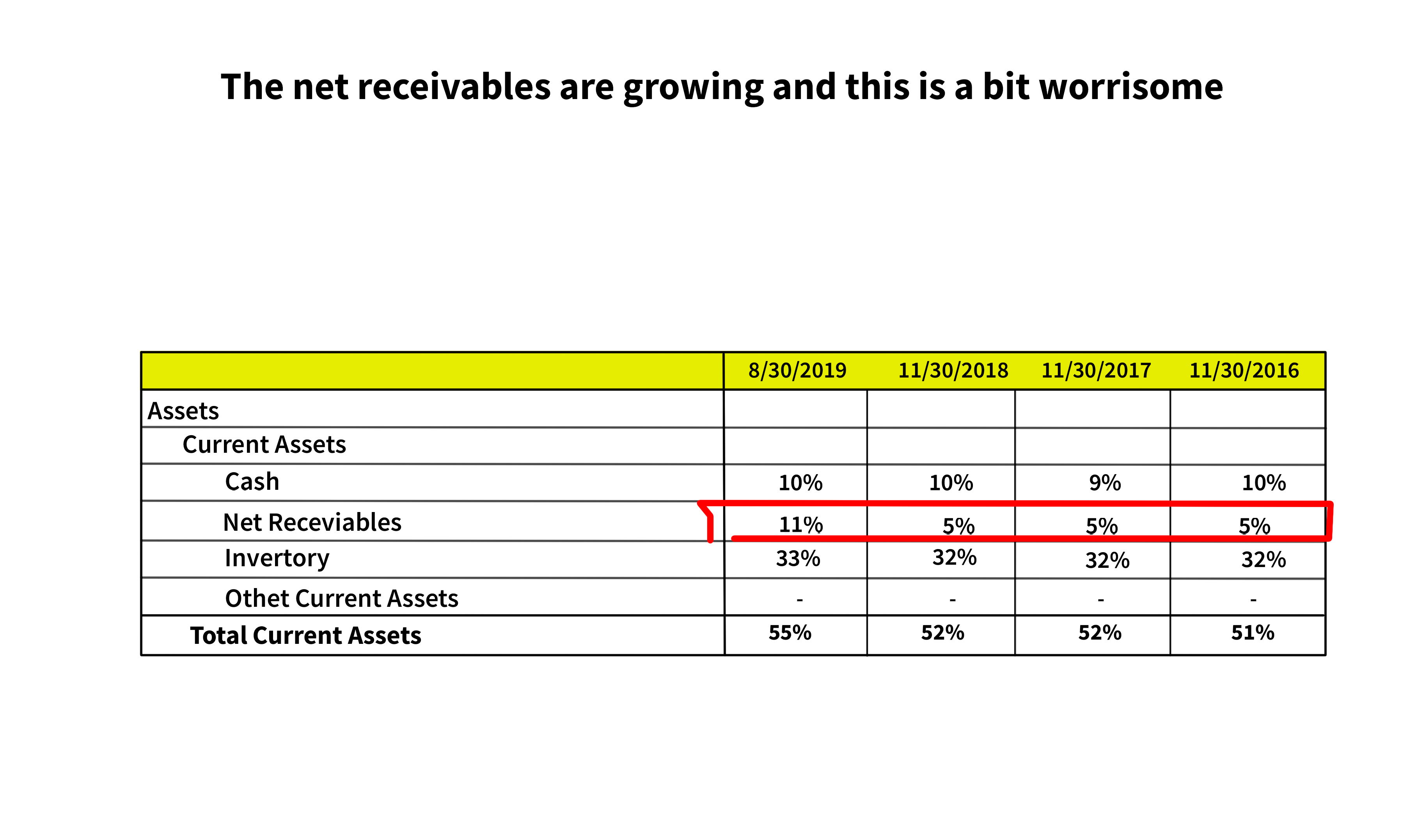

Finally, the horizontal analysis of the balance sheet should be done Expressed in relative terms. We can see that the net receivables are growing and this is a bit worrisome.

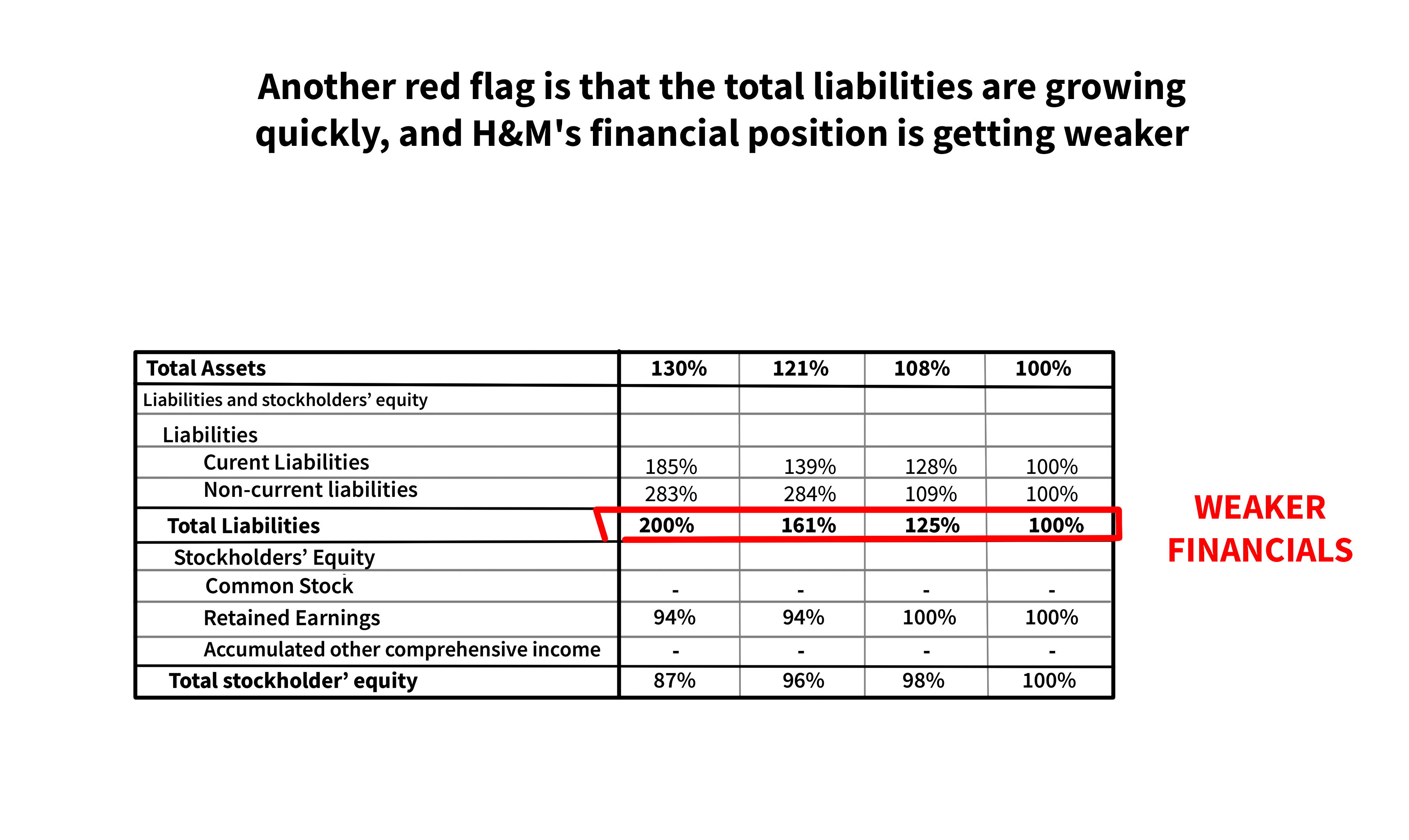

Is H&M being more generous towards its customers, offering better payment terms? Is this likely to have to continue? Is it a result of declining interest in the company's products? Another red flag is that the total liabilities are growing quickly, and H&M's financial position is getting weaker.

By expressing all entries as a percentage of the 2016 numbers, we can see if the results are also absolute. It actually reveals an even less appealing story. The net receivables have grown by 200%, and total liabilities by 100%. H&M may still be a great company to buy, but these factors should lower the price you're willing to pay for the stock.

Key Takeaways:

1. Financial fraud is committed to either boost current profitability or reduce current earnings.

2. Common situations in which financial fraud is more likely include companies making lots of acquisitions, having dumb incentives for managers, being private, recently going public, recently changing the business model, and having operational problems.

3. The top seven tricks used by businesses to deceive investors are: inaccurately or prematurely recorded revenues, false revenue, one-time gains, postponing current costs, incorrectly reducing or failing to record liabilities, putting off the receipt of existing revenues, and charging future costs to the current period as a special charge.

4. Before looking at the financial statement, consider the auditor's report, the proxy statement, footnotes, the president's letter, the MD&A, and the Form 8K.

5. Common-size analysis is a useful technique for investigating a company's financial statements.

6. Consider calling the CFO, head of Investor Relations, corporate controller, or treasurer with concerns.